In a case, the Income Tax Appellate Tribunal (ITAT) of Bangalore ordered improvement of the amended return filed via the taxpayer, remarking that misadvice via the tax auditors of the taxpayer directed him to pay the excess income tax.

The assessee Ramalingaiah, a semi-literate individual engaged in the business of tailoring and trading in textile fabrics, hails from an agricultural family with considerable agricultural income. The taxpayer had declared a gross total income of Rs. 2,45,000 for A.Y. 2016-17.

A notice dated November 30, 2017, has been issued by the Assessing Officer (AO) under section 142(1) of the Income Tax Act, 1961 (ITA), directing the appellant to prepare and file a true and correct return of income for A.Y. 2016-17 and A.Y. 2017-18.

As per the guidance of the auditor of the taxpayer, an amended return was filed dated 3rd January 2018, showing an income of Rs 3,29,560, and tax of Rs 10,820 was paid under acknowledgement number 354891220030118.

As of an error on the end of the auditor additional sums of Rs 3,89,850 on March 28, 2018, and Rs. 4,13,550 on July 2, 2018, were incorrectly deposited. Thereafter arises that these payments were directed for another client of the auditor, however were deposited inadvertently under the Permanent Account Number (PAN) of the appellant.

The auditor confirmed to the taxpayer that the excess amount shall be refunded after assessment. However the taxpayer does not have obtained any order under income tax section 143(1), and no additions or deletions were made to the returned income. The assessee was clueless that the auditor had failed to claim the refund of the excess amount in the revised return filed for A.Y. 2016-17, nor had the auditor filed Form 30 to claim the refund.

After some years when the refund was still not credited to the account of the taxpayer then the taxpayer asked for advice from another tax consultant. On verifying the records the new consultant recommended the taxpayer to apply for the rectification of the mistake since a refund does not get claimed in the regular or amended return filed.

As there was no provision to apply for rectification online for AY 2016-17, the taxpayer furnished a physical application on April 7, 2023, to the Income Tax Officer (ITO) in Mandya, asking for rectification of the mistake and issuance of a refund amounting to Rs. 4,13,550, Rs. 10,820, and Rs. 3,89,850.

An email was obtained by the taxpayer on May 2, 2023, notifying that the obtained return does not get accepted since it was filed post-expiry of 1 year from the finish of the Assessment year or before the finish of the assessment, whichever was earlier.

The email cited that the appellant has paid the self-assessed tax amounts of Rs 3,89,850 and Rs. 4,13,550 for A.Y. 2016-17, which were not claimed in the original or revised return, and hence, the refund cannot be allotted.

When the taxpayer received this email, they sought advice from their representative, who recommended filing an appeal against the rejection. Despite waiting for a formal order, none was served.

Upon visiting the income tax office in Mandya, the taxpayer was informed by the Income Tax Officer (ITO) that no formal order would be issued. Distressed by the rejection of the rectification application, the appellant filed an appeal before the Commissioner of Income Tax (Appeals) (CIT(A)) based on the letter dated May 2, 2023.

The appeal was rejected by the CIT(A) because it was filed after the deadline. The assessee then appealed to the ITAT. After reviewing the case, the bench of Beena Pillai and Laxmi Prasad Sahu suggested that the assessee should file a rectification application with the AO, and it should be considered without any time limitations.

The Tribunal acknowledges the bona fides of the taxpayer, who had been misled into depositing the taxes that were not within the income for the year under consideration. Stressing the norms that there would be no tax collected without the authority of law, the Tribunal asked AO to regard the rectification petition filed via the taxpayer.

Read Also: AO Failed to Specify Tax Penalty u/s 274 and 271(1)(c)

AO was additionally instructed to validate the returns furnished via the taxpayer and calculate the income as per the law. The taxpayer was asked to provide all the related proof to support the claim. It was also emphasized by the Tribunal that the plea furnished via the taxpayer must not be dismissed based on limitation and that the return must get processed as per the regulation.

Subsequently, the petition furnished via the appellant was permitted.

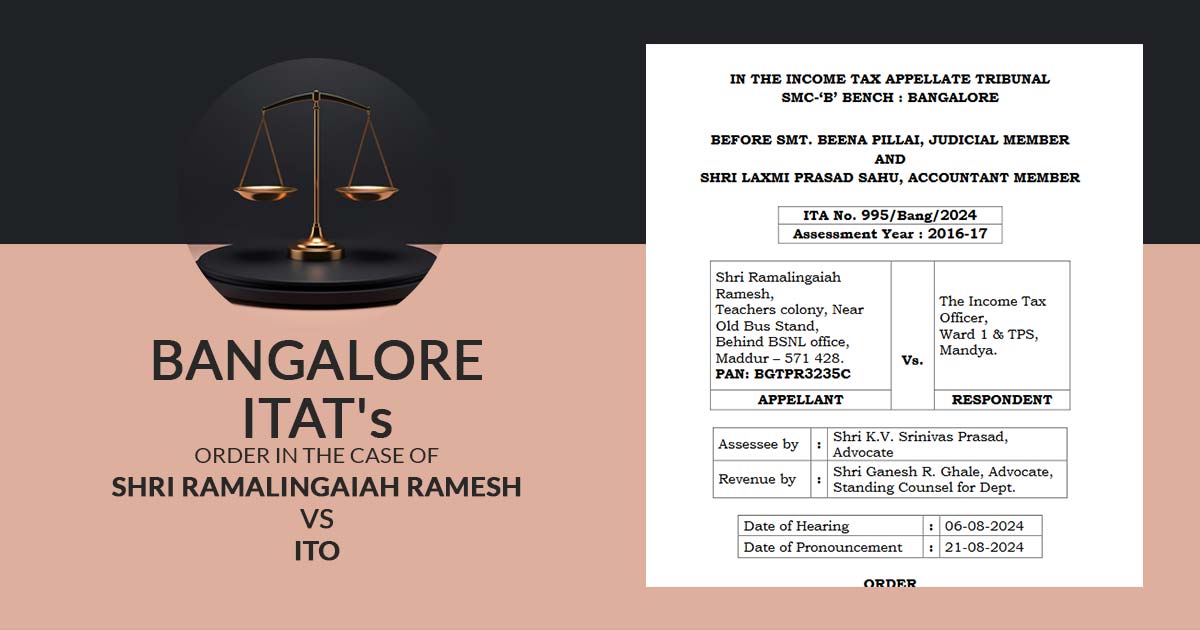

| Case Title | Shri Ramalingaiah Ramesh Vs ITO |

| Citation | ITA No. 995/Bang/2024 |

| Date | 21.08.2024 |

| Assessee by | Shri K.V. Srinivas Prasad |

| Revenue by | Shri Ganesh R. Ghale |

| Bangalore ITAT | Read Order |