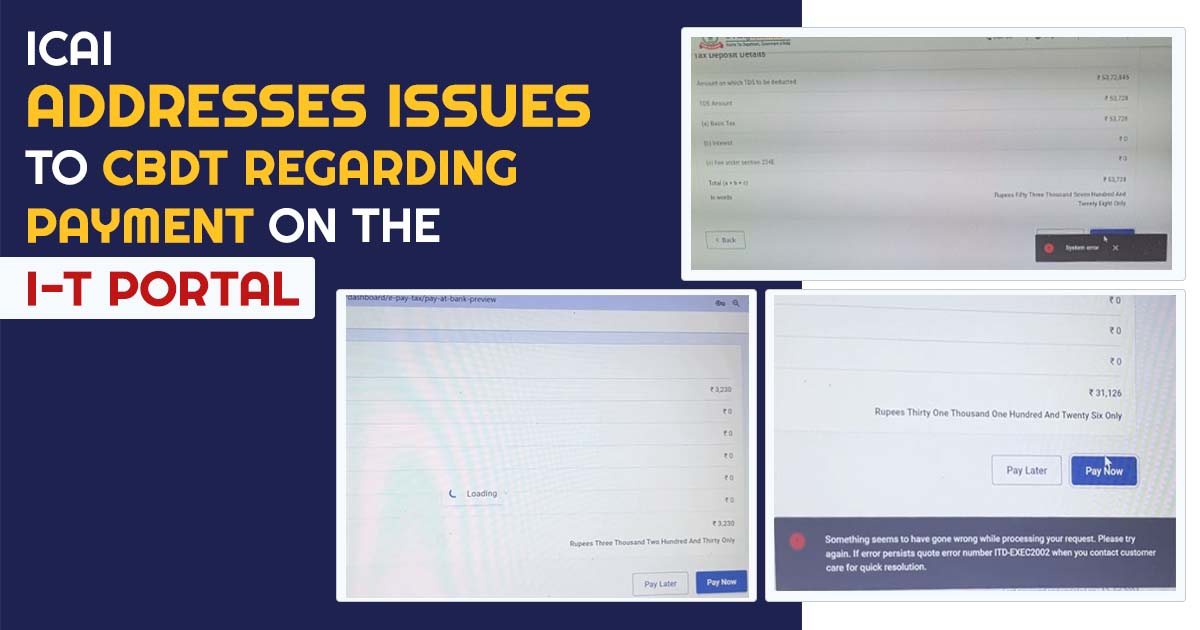

At present the income tax portal is undergoing issues related to payment which prevents the assessees, CAs, and tax filers from finishing their transactions. Filers are prompted with error messages when trying to make any payments. ICAI has addressed the problems of the CBDT.

Representations have been sent by the ICAI before the finance ministry involving issues with the Income Tax Portal. Further, another representation was sent emphasizing payment issues.

In its representation, the ICAI remarked: “In this regard, we would like to bring to your notice once again of the technical glitches in filing returns and making payment of taxes- Unavailable service (on account of temporary overloading or under maintenance), failure to make challan payment, error messages appearing while making payment are some of the issues being faced by the taxpayers while filing returns/making payment of taxes”.

The ICAI has suggested that with the deadline u/s 139(1) of the Income-tax Act, 1961 for filing returns for the A.Y. 2024-25 approaching for individuals, HUFs, and firms not subject to a tax audit, it is crucial to address and fix the technical errors in the income-tax e-filing portal. The same will enable assessees to file their returns and pay taxes easily within the deadline.

A CA has published in ‘X’ account tagging the income tax India that “Pathetic state of income tax portal..!!! #IncomeTax @IncomeTaxIndia loading this since 30 min..!!!” He shared the video where he stuck with the payment issues. The income tax department answered with the solution of clearing browser caches, which does not work for numerous problems.

The question arises who faces the results of such issues in the income tax portal – The government or the common people? The highest tax-paying demographic in the country is the middle class and many CAs have a backlog of ITRs on their desks. As the income tax return filing due date is set for 31st July the issues of the portal cause problems of financial losses. Who will be liable for that? The taxpayers need to pay their dues irrespectively, but missing the due date shall result in late fees.

The taxpayers might seem to face the issues as the finance ministry has not announced any extensions or relief schemes. It is been anticipated that the last date to file the ITRs will get extended or that late fees will be exempted. However, the financial load would fall more on the common people compared to the government.

With zero exceptions filing the taxes is crucial. Hence even when the payments get late the treasury of the government will eventually be filled. If the government does not grant any extension then the taxpayers will be required to pay the taxes including the late fees. Immediate attention is needed on the income tax portal from the ministry or the technical team.

Speculation is there that such issues have been made deliberately to ensure the taxpayers file late fees, thereby raising the revenue. Lastly, it is the common people who shall bear the load of such issues as the government obtains its revenue irrespective of the performance of the portal.

Read Also: Free Download Income Tax Return E-Filing Software FY 2023-24

The government along with the technical team is required to take sincere action to solve such problems immediately. There must be an initiative to improve the software for easier ITR filing. Such issues impact the money and the working hours of many people and quick action is required.