The GSTR 3B form is a return form declared by the Indian government for the return filing only of GST implementation. You can read the entire help guide for filing the 3B form on the Indian government portal here: GSTR 3B Creation-Submission PDF, download GSTR 3B offline utility or download the 3B form in PDF format here.

The Ministry of Finance has updated the new feature of GSTR 3B filing via EVC mode. Get the full text of notification 38/2020

File GSTR 3B Return Via Gen GST Software, Get Demo!

- GSTR 3B Latest Updates

- GSTR 3B Return Due Date

- Interest and Penalty Charges

- General Queries on GSTR 3B Form

- Step to Filing GSTR 3B Form Online

- GSTR 3B Filing By Gen GST Software

Latest Updates in Form GSTR 3B

- A new advisory on interest calculation in GSTR-3B has been issued on the portal. Read more

- The GSTN advisory explains how these system enhancements ensure correct calculation and reporting. Read more

- The GSTN department has shared a new GSTR-3B advisory for reporting values in Table 3.2, along with important FAQs. View More

- The extended due date for filing GSTR-3B returns, applicable to both monthly and quarterly taxpayers, is October 25, 2025. Read Notification

- “CBIC has extended the due date for Mumbai (City), Mumbai (Sub-Urban), Thane, Raigad, and Palghar districts of Maharashtra till 27th August.” Read Notification

- From July 2025, GSTR-3B Filing to Be Locked; Modifications Permitted Only via GSTR-1A. View More

- The new advisory for GSTR-3B relates to reporting auto-populated values in Table 3.2. View More

- The GSTN portal has implemented updated reporting requirements for values in Table 3.2 of Form GSTR-3B. read more

- The GST Network has decided to postpone the strict rules regarding automatic calculations of tax liabilities in the GSTR-3B form. This means that businesses will have a bit more flexibility before these automatic figures become final. View more

- Issues related to negative values in Table 3.1 of GSTR-3B for outward supplies have been resolved by the GSTN department. View More

GSTR 3B Due Dates Revised On Categories of Taxpayers

The Government of India has earlier changed the GST filing due dates for the sake of betterment in the GSTN portal as well as the filing numbers. The taxpayers will now be required to file the GSTR 3B on 3 due dates as per the categories. These dates are well defined in the notification issued by the GOI (Government of India).

Now the taxpayers with an annual gross of Rs. 5 Cr or more (in the previous year) and from the whole country will be required to file the returns by the 27th of the concerned month without late fees applicability.

For the taxpayers with an annual gross of less than 5 Cr from defined 15 states i.e. 15 States/UTs, i.e., Chhattisgarh, Madhya Pradesh, Maharashtra, Gujarat, Daman and Diu, Dadra & Nagar Haveli, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Puducherry, Andaman and Nicobar Islands, Telangana and Andhra Pradesh are required to file returns by 22nd of the applicable month of every quater.

Finally, taxpayers from 22 States/UTs of Jammu and Kashmir, Ladakh, Arunachal Pradesh, Punjab, Himachal Pradesh, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha and annual gross less than 5 Cr in the previous year are obligated to file the returns by 24th of the month of every quarter.

Some of the Features of Return Form GSTR 3B

- Form 3B is to be filed mandatorily by all normally registered taxpayers

- Nil returns are to be filed in case of no business. GSTN portal offers a simple and fast procedure to file GSTR 3B returns. In the latest offering, the taxpayers who are filing nil returns are free from extensive filing details and will be forwarded to a simple return form with minimum details. No extra tiles and details are required for this new functionality.

- A summary of information about sale and purchase, available input tax credit, tax payable, and tax paid is to be furnished

- All input tax credits availed and utilized will be posted in the ITC ledger

- Unutilized ITC can be used in subsequent months

- While filing up form 3B, don’t forget to Save the partially filled form by clicking the save GSTR 3B button

- After pressing submit, no modification is possible therefore check the details carefully before pressing submit

- If form GST TRAN-1 is submitted Click the Check balance button to view the balance available for credit under the integrated tax, Central tax, State tax and Cess (including transitional credit)

- The finance ministry rolled out a special provision for the Form 3B return taxpayers by giving them accessibility to adjust and change the tax liability along with rectification in the monthly return of Form 3B.

- The decision has been taken in order to help the taxpayers claim the input tax credit on the correct basis while the penalty will be exempted from the procedure. In the latest CBEC statement, it is clear that “as the return in Form GSTR-3B does not contain provisions for reporting of differential figures for the past month(s), the said figures may be reported on net basis along with the values for the current month itself in appropriate tables.”

The Process of GSTR 3B Filing Simplified

GSTN-3B application has been finally simplified by the GSTN. It is now user-friendly, but there are several signs that it may be used after March month. Keeping in mind the problems faced by the public before, there are several changes done to modify the filing for easy use. This is a very important step as it makes the system less rigid and reduces the chances of inadvertent errors.

GSTN has made the following key changes in the GSTR-3B return filing form, said by the PWC partner:

Tax Payment: In the revised version of the form, the public can see whether the tax liability is being paid by cash or credit in tax liability, before submitting the form. But in the earlier filing, a taxpayer was required to submit the return to ascertain the tax liability amount. After submission, no changes were allowed.

Challan Generation: Now the challan gets prepared with the cash amount required to be paid after taking into account the balance available in the cash ledger and suggesting the utilization of ITC (Income Tax Credit) in the table, with a click of a button. Earlier, the challan had to be manually filled with the amount to be paid in cash. However, the taxpayers can make the edition in the credit amount to be utilized and not to use the credit amount filled by the system.

Download Facility of Draft Return: Earlier, there was not any downloading option to save details for offline re-checking. But now there is a new option available for public convenience where draft returns can be downloaded at any stage to verify the saved details offline.

Auto-fill of Tax Amount: This step is taken to save time and reduce the error as taxpayers now either have to fill CGST or SGCT/UTGCT, other tax amounts will be auto-filled manually.

All don’t have to Submit the GSTR 3B Return Form?

- (ISD) input service distributor

- Composition supplier

- TDS deductor

- TCS collector

- OIDAR (online information data access and retrieval)

Latest GSTR 3B Due Dates for February 2026

Annual Turnover of More Than INR 5 Cr in the Previous FY

| Period (Monthly) | Last Dates |

|---|---|

| February 2026 | 20th March 2026 |

| January 2026 | 20th February 2026 |

| December 2025 | 20th January 2026 |

| November 2025 | 20th December 2025 |

| October 2025 | 20th November 2025 |

| September 2025 | |

| August 2025 | 20th September 2025 |

| July 2025 | 20th August 2025 |

| June 2025 | 20th July 2025 |

| May 2025 | 20th June 2025 |

| April 2025 | 20th May 2025 |

| March 2025 | 20th April 2025 |

| February 2025 | 20th March 2025 |

| January 2025 | 20th February 2025 |

| December 2024 | 20th January 2025 | 22nd Jan 2025 (Revised) |

Annual Turnover up to INR 5 Cr in the Previous FY but Opted for Monthly Filing

| Period (Monthly) | Last Dates |

|---|---|

| February 2026 | 20th March 2026 |

| January 2026 | 20th February 2026 |

| December 2025 | 20th January 2026 |

| November 2025 | 20th December 2025 |

| October 2025 | 20th November 2025 |

| September 2025 | |

| August 2025 | 20th September 2025 |

| July 2025 | 20th August 2025 |

| June 2025 | 20th July 2025 |

| May 2025 | 20th June 2025 |

| April 2025 | 20th May 2025 |

| March 2025 | 20th April 2025 |

| February 2025 | 20th March 2025 |

| January 2025 | 20th February 2025 |

| December 2024 | 20th January 2025 | 22nd Jan 2025 (Revised) |

Annual Turnover Upto INR 5 Cr in Previous FY But Opted Quarterly Filing

- State 1 Group (Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, Daman & Diu and Dadra & Nagar Haveli, Puducherry, Andaman and Nicobar Islands, Lakshadweep)

- State 2 Group (Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Odisha, Jammu and Kashmir, Ladakh, Chandigarh, Delhi)

| Period (Quarterly) | Last Dates G-1 | Last Dates G-2 |

|---|---|---|

| Jan-March 2026 | 22nd April 2026 | 24th April 2026 |

| October – December 2025 | 22nd January 2026 | 24th January 2026 |

| July-Sep 2025 | ||

| April-June 2025 | 22nd July 2025 | 24th July 2025 |

| Jan-March 2025 | 22nd April 2025 | 24th April 2025 |

| October – December 2024 |

Penalty for Late Filing GSTR 3B with Interest on Delayed Payment

Those taxpayers, who do not pay their taxes on time as per the date scheduled by the GST Council, will have to pay an additional late fee amount at 18 percent per annum, depending on the number of days they delay the payment.

For example, If you fail to pay your tax liability on the due date, you will have to pay an additional 1000*18/100*1/365 = Rs. 0.49 per day as of late fee Where Rs. 1000 is the tax liability amount, 1 is the number of delayed days and 18 is the rate of interest (annual). See the official doc attached below for complete details of GST interest late fee and penalties https://cbec-gst.gov.in/CGST-bill-e.html

In case a taxpayer does not file his/her return within the due dates mentioned above, he shall have to pay a late fee of Rs. 50/day i.e. Rs. 25 per day in each CGST and SGST (in case of any tax liability) and Rs. 20/day i.e. Rs. 10/- day in each CGST and SGST (in case of Nil tax liability) subject to a maximum of Rs. 5000/-, from the due date to the date when the returns are actually filed.

Step-by-Step Procedure of Filing GSTR 3B Form Online

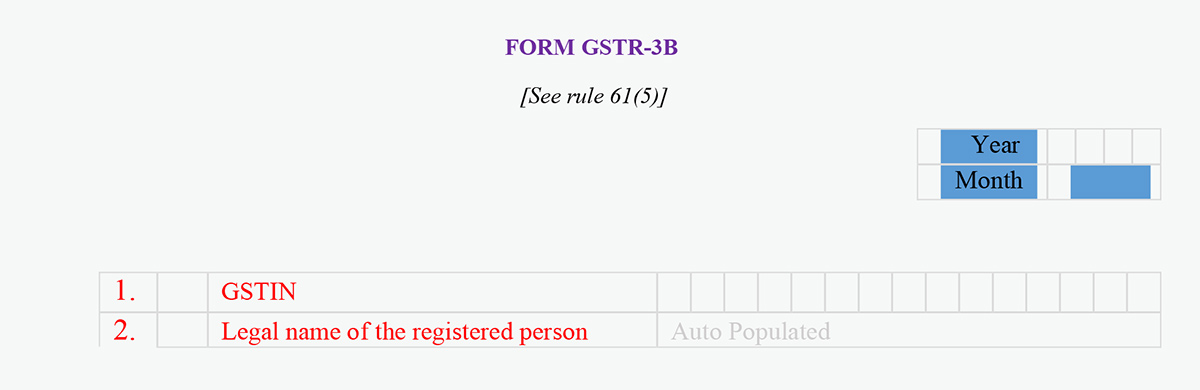

Steps 1 & 2: First of all the taxpayer will have to enter his GSTIN ID very precisely with no errors. And in the second point, is the legal of registered individuals.

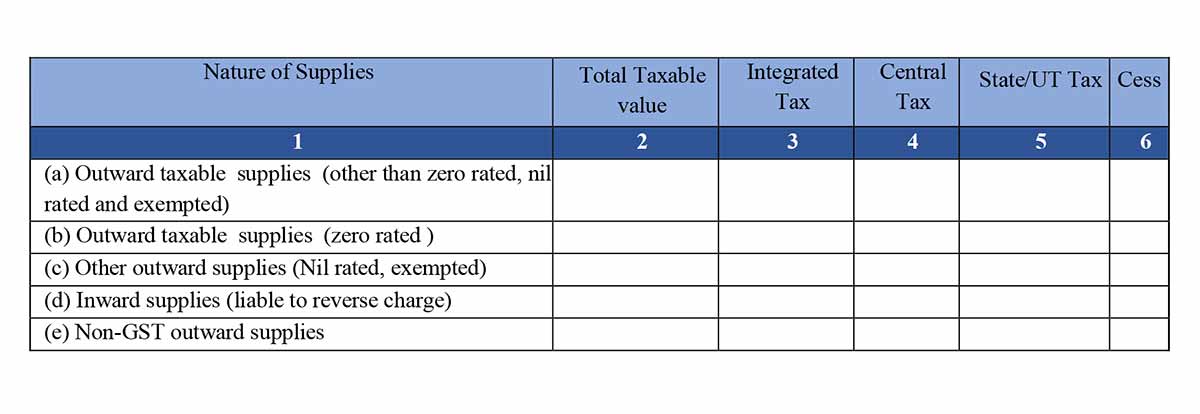

Step 3: Coming to the second box, including Details of Outward Supplies and inward supplies liable to reverse charge:

- Outward taxable supplies (other than zero-rated, nil-rated and exempted) – In this column, fill out all the general and non-taxable items which are sold by the business on a regular basis.

- Outward taxable supplies (zero-rated ) – In the column, only zero-rate tax items will be included, if any.

- Other outward supplies (Nil-rated, exempted) – In the column, only exempted tax items will be included, if any.

- Inward supplies (liable to reverse charge) – All the supplies of inward supplies must be mentioned here which are liable for the reverse charge.

- Non-GST outward supplies – Include all the non-GST outward supplies which are not covered by the GST tax scheme.

All the details must be filled in along with the Nature of Supplies, Total Taxable Value, Integrated Tax Central Tax, State/UT Tax, and Cess.

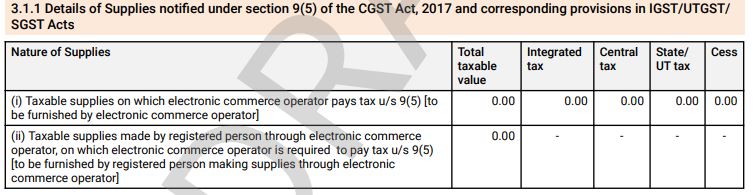

Step 3.1: Coming to the third box, Introducing new Table 3.1.1 in GSTR-3B for reporting supplies u/s 9(5) which consists of:

- Taxable supplies on which electronic commerce operator pays tax under Sub-section (5) of Section 9 [To be furnished by the electronic commerce operator]:- An ECO is required to report supplies made u/s 9(5) in Table 3.1.1(i) of GSTR-3B and shall not include such supplies in Table 3.1(a) of GSTR-3B. The applicable tax on such supplies shall be paid by ECO in Table 3.1.1(i) of GSTR-3B in cash. Only and not by ITC.

- Taxable supplies made by the registered person through electronic commerce operator, on which electronic commerce operator is required to pay tax under Sub-section (5) of Section 9 [To be furnished by the registered person making supplies through electronic commerce operator]:- A registered person who is making supplies of such services as specified u/s 9(5) through an ECO, shall report such supplies in Table 3.1.1(ii) and shall not include such supplies in Table 3.1(a) of GSTR-3B. The registered person is not required to pay tax on such supplies as the ECO is liable to pay tax on such supplies

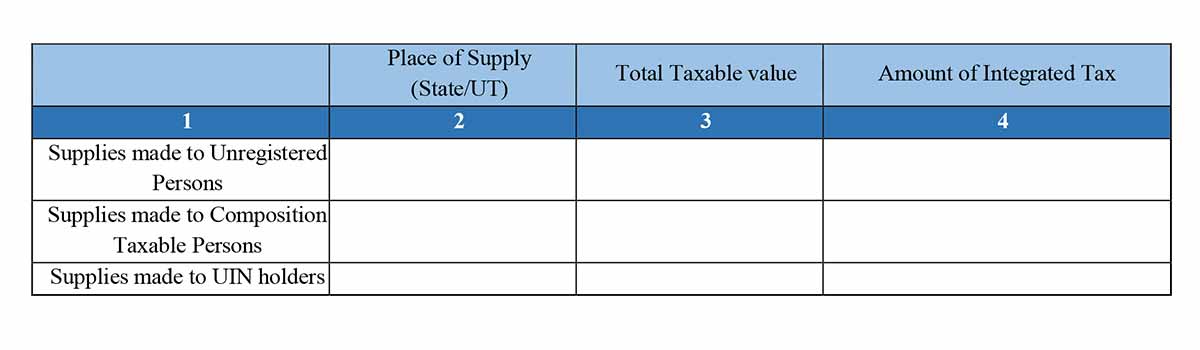

Step 3.2: Now the box, Of the supplies shown above, details of inter-State supplies made to unregistered persons, composition taxable persons, and UIN holders.

- Supplies made to Unregistered Persons – All the supplies details with the item name and HSN codes in the column which has been done to an unregistered dealer or individual.

- Supplies made to Composition Taxable Persons – All the supply details with the item name and HSN codes in the column which have been done to composition scheme dealer or individual.

- Supplies made to UIN holders – All the supplies details with the item name and HSN codes in the column which has been done to a UIN holder.

All the supplies must be entered with details of Place of Supply (State/UT), Total Taxable value, and Amount of Integrated Tax.

New Updation in GSTR 3B Return Table 3.1 (A): The GST Council in its 45th meeting held on 17th September 2021 suggested notifying “Restaurant Service” beneath section 9(5) of the CGST Act, 2017 including the additional services reported before these motor cabs, accommodation, and housekeeping services in which the tax on these supplies shall be paid by electronic commerce operator when these supplies made through it.

Notification No. 17/2021-Central Tax (Rate) and 17/2021-Integrated Tax (Rate) dated 18.11.2021 were allocated in this respect for intrastate and inter-state supply respectively.

As per the tax on supplies of the restaurant service given via e-commerce operators will be paid by the e-commerce operator with effect from the date 1st Jan 2022.

To follow the notification given, a new table 3.1(A) will be added in Form GSTR-3B for notifying the supplies made under section 9(5) of the CGST Act and corresponding provisions in IGST/SGST/UTGST Acts.

GSTR 3B Table 3.1(A) Format: 3.1(A) the information of Supplies reported under section 9(5) of the CGST Act, 2017 and corresponding provisions in IGST/UTGST/SGST Acts

| Nature of Supplies | Total taxable value | Integrated tax | Central tax | State/UT tax | cess |

|---|---|---|---|---|---|

| (i) Taxable supplies on which electronic commerce operator pays tax u/s 9(5) | |||||

| [To be furnished by electronic commerce operator] | |||||

| (ii) Taxable supplies made by a registered person through electronic commerce operator, on which electronic commerce operator is needed to file the tax u/s 9(5) | |||||

| [To be filed via registered person making supplies through electronic commerce operator] |

In row (i), the electronic commerce operators will be needed to notify the suppliers on which they are responsible to file the taxes.

The added information would be the sum to the liability beneath excluding the reverse charge in Table 6.1. The liabilities notified would need to be paid by means of cash.

From the supplies reported in Table 3.1 (A) (i), the break of the inter-state supplies, POS wise on the supplies made to the unregistered individuals, composition taxable individuals, and UIN holders are needed to be notified inside table 3.2

In Row (ii), the enrolled individual who makes the supplies via electronic commerce operators would be needed to report the supplies which are made through them via electronic commerce operators.

The values auto-drafted in Table 3.1(a) and Table 3.1(c) from GSTR-1 comprise the supplies which are made via electronic commerce operators.

An Electronic Commerce Operator liable to pay taxes should reduce such supplies from Table 3.1(a) and report it in Table 3.1(A)(i).

The supplies made by the individual on which the electronic commerce operator is responsible for furnishing the taxes must be reduced these supplies in table 3.1(c) and notified in table 3.1(A)(ii).

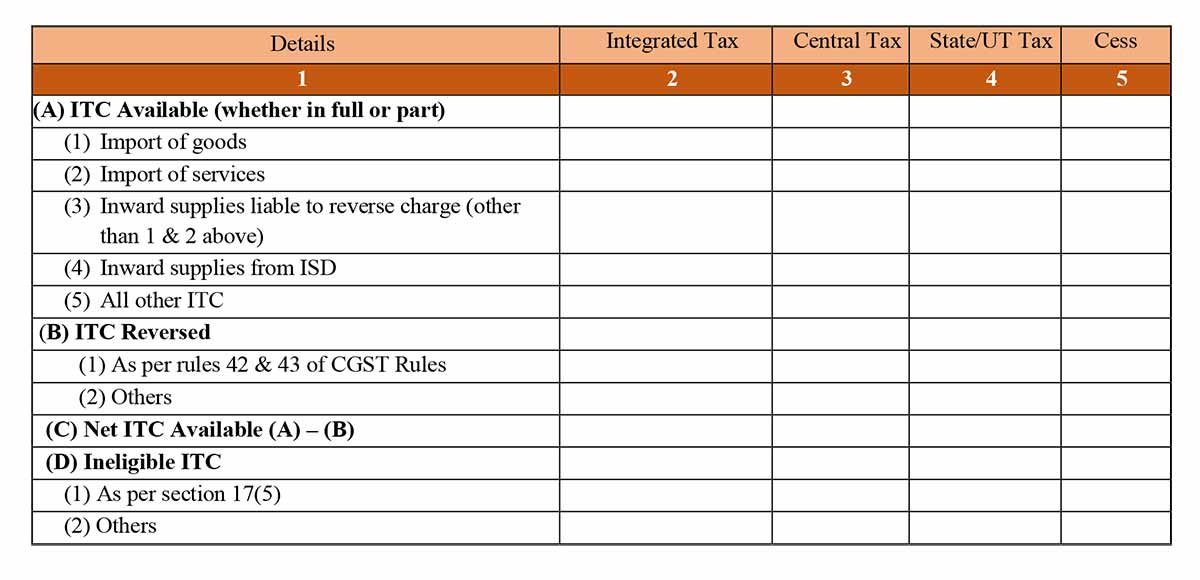

Step 4: Now, the 4th box is of Eligible ITC containing all the input tax credit demand from the taxes paid:

- Import of goods

- Import of services

- Inward supplies are liable to reverse charge (other than 1 & 2 above)

- Inward supplies from ISD

- All other ITC

(B) ITC Reversed

- As per rules 42 & 43 of CGST Rules

- Others

(C) Net ITC Available (A) – (B)

been(D) Ineligible ITC

- As per section 17(5)

- Others

The required details must be filled up with Details of individual taxes to be paid accordingly, Integrated Tax, Central Tax and State/UT Tax Cess.

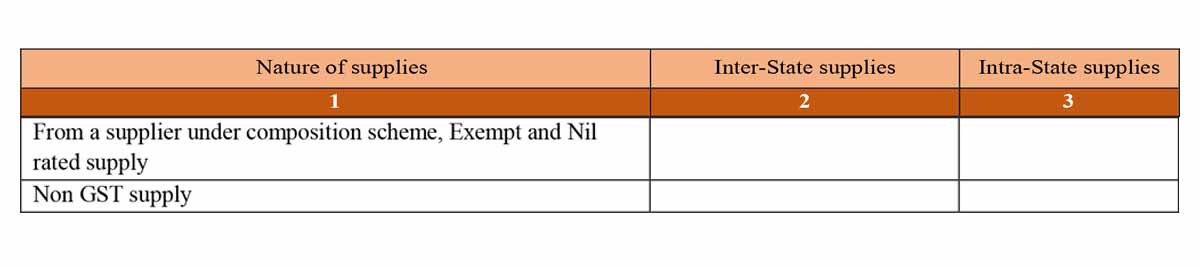

Step 5: Now coming to box 5, it includes Values of exempt, nil-rated and non-GST inward supplies:

- From a supplier under the composition scheme, Exempt and Nil-rated supply – Include all the purchases made by unregistered dealers and composition dealers in the list.

- Non-GST supply – Include all the non-GST applicable items and products of a similar category.

The taxpayer has to include all the relevant details of Nature of supplies, Inter-State & Intra-State , and its calculations.

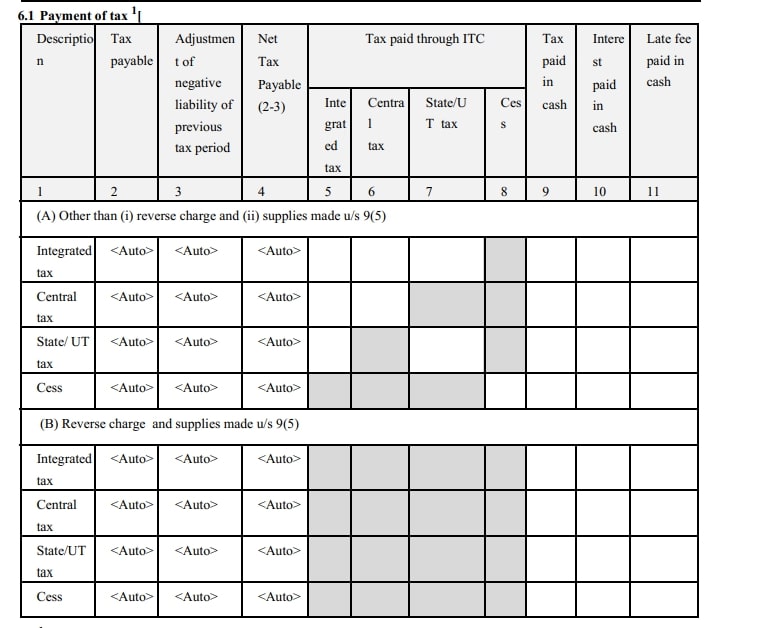

Step 6.1: Now comes the important box for the payment of taxes, which includes a number of significant data which has to be filled up with accurate details:

- Integrated Tax

- Central Tax

- State/UT Tax Cess

The details must be Tax payable, Tax paid- (TDS./TCS) Tax/Cess paid in cash, Interest Rate Paid through ITC – (Integrated Tax Central Tax State/UT Tax Cess)

Note: Columns which are filled in black colour must not be filled up.

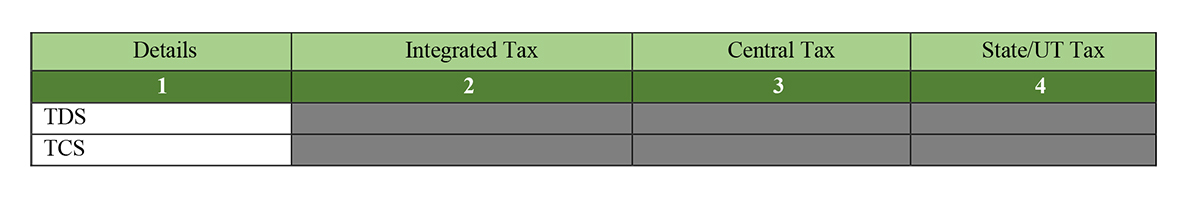

Step 6.2: In the next box, comes the details of the TDS/TCS Credit

A proper format in which it has been mentioned all the TDS and TCS deducted for all the tax scenario including Integrated Tax, Central Tax, and State/UT Tax.

Overall the Government has chosen to implement the GSTR 3B form in the starting phase of GST return filing for an easy and convenient taxpaying experience for the dealers.

Verification

General Queries on GSTR 3B Form

Q.1 – What is the Difference Between GSTR 3 & GSTR 3B?

GSTR 3 which was previously issued by the GST council was further replaced by the GSTR 3B which is a consolidated monthly return filing form for the payment of the net liabilities (output tax – input tax) i.e. GSTR 3B form is a consolidated return form whereas GSTR 3 is a detailed form including sale/purchase details of the month.

Q.2 – How to Show Credit Note in GST Rreturn 3B Form?

For showing the credit note in the form GSTR 3B, one can deduct or net-off the amount of credit note from total outward taxable supplies. GSTR 3B is only showing an aggregate total amount.

Q.3 – ITC Reversal in GSTR 3B Return Form?

ITC reversal can be shown in the GSTR 3B on tab 4 B (1) “As per rule 42 & 43 of CGST/SGST rules” and 4 B (2) “Other”.

Q.4 – How to Rectify GST Return 3B?

Previously there was a reset tab in GSTR 3B and now it has been removed by the GSTN portal, hence once the GST return 3B gets filed, it cannot be rectified now.

Q.5 – What is ITC in GSTR 3B?

The input tax credit is that amount of the tax which you have already paid on input and now will be deducted from the total amount of tax you need to pay on output. For instance When you purchase a product or service then you pay taxes on every purchase to a registered dealer and the same way you collect taxes when you sell , then the tax you paid initially on purchases will be adjusted against the taxes you collected i.e output tax (tax on sales) and balance liability of tax (tax on sales minus tax on purchase)will have to be paid to the government. This process refers to the utilization of input tax credit. So, in short, you can say Input Tax Credit is the initially paid tax on purchases or inputs.

Q.6 – How to Pay Taxes While Filing Form GSTR 3B?

One can pay taxes while filing GSTR 3B by Logging in and Navigating to GSTR-3B – Monthly Return page. Then fill up the details in Section – 3.1 i.e. Tax on outward and reverse charge inward supplies and Section – 3.2 i.e. Inter-state supplies. After that Enter ITC Details in Section – 4 i.e. Eligible ITC.

Q.7 – How Do I Check My GSTR 3B Status?

The steps to check GSTR 3B form status are as follows:

- Step 1: Access GST Portal via https://gst.gov.in

- Step 2: In the main menu, click on Track Application Status under Services

- Step 3: Enter the ARN Number. Enter the ARN number in the field provided and complete the captcha casual taxable person

- Step 4: Now view Status

Q.8 – What is the Difference Between Form GSTR 3B & GSTR 2A?

Form GSTR – 3B is a month-based summary return filed by the taxpayer by the 20th of the next month to declare their summary GST liabilities for the tax period and the completion of these liabilities in time.

Form GSTR – 2A is an auto-populated form generated in the recipient’s login, carrying all the outward supplies (Form GSTR – 1) declared by his suppliers, from whom goods and/or services have been procured by the receiver taxpayer, in a respective tax period.

A normal taxpayer needs to file GSTR-1, 2, & 3 returns for every tax period. When the due dates for filing of GSTR-1 and GSTR-2 get postponed then GSTR-3B has to be filed. And there is any mismatch between the system generated 3B and initially filed 3B then the taxpayer is compelled to pay additional tax, liability and other dues.

Form GSTR -2A is auto-populated from the Form GSTR-1/5, Form GSTR-6 (ISD), Form GSTR-7 (TDS), and Form GSTR-8 (TCS).It is generated for a recipient when the Form GSTR-1/5, 6, 7 (Tax Deductor) & 8 (Tax Collector) is filed by the supplier taxpayer. The details can be viewed by the recipient and can be updated as and when supplier taxpayer add or alter any details in their respective Form GSTR, for the given tax period. Form GSTR-2A of a tax period is available for view only.

Q.9 – Can I File a GSTR 3B Without Paying the Tax?

As per section 27 (3) of GST Law, GST return will be valid only if the full tax is paid by the registered taxpayer and only the valid return would certify the taxpayer to claim an input tax credit (ITC). In other words, the supplier has to pay the entire self-assessed tax and file his return to be eligible for ITC.GST returns are treated as void if filed without making GST tax payment against such GST returns. Section 28 does not allow ITC on invalid return and defines such taxable person as unqualified for utilizing such credits before clearing his self-assessed tax liability.

Q.10 – Is There any Provision for the Rectification of Errors in GSTR 3B Return?

However, there is no concept of revised return available in GST, whether for Form GSTR-3B or your regular return which means one can not modify the data after the submission of return in the GST Portal. Yet some errors can be rectified:

- The Form GSTR-3B is just an interim return and the actual return for July is to be filed in Form GSTR-1, Form GSTR-2 and Form GSTR-3 by 10 October; 31 October; and by 10 November 2017 (revised dates) respectively. Hence, any correction in GSTR-3B can be duly reported via Form GSTR-1 and Form GSTR-2.

- Any alterations regarding outward supplies are to report in Form GSTR-1 when the supplies are incorrectly filled FORM GSTR-3B.

- While any corrections regarding inward supplies need to be reported in Form GSTR-2 like when the ITC, tax liability of inward supplies liable for the reverse charge; or any other details of inward supplies are submitted erroneous in the Form GSTR-3B.

- Based on the correct details reported in the Form GSTR-1 and Form GSTR-2, the revised tax liability and eligible ITC will be displayed in your e-ledger and these details will get auto-populated in Form GSTR-3 of July 2017.

- Because of the absence of the revised return concept the data can only be rectified as long as the GST form is in save status before the submission, but cannot be modified after the final submission of return.

In GSTR3B, if igst value was decreased by mistake (from the prefilled value) in All other ITC field under Eligible ITC (4A (5)) then how we can correct it when 3b has already been filed.

You can correct it by adjusting the same from next month

Dear sir,

If recovery officer has utilised half of tax liability from taxpayer ledger for non filing of return GSTR 3b (i.e after the expiry of 30 days of issuance of ASMT 13)…then what will be the next step.??Either taxpayer will pay rest of the tax and file nil return OR he will file return and pay taxes as per self assessment and file for refund that has already been utilised by recovery officer..???

Pls explain

You need to pay the balance tax via DRC-03, for more detail kindly contact the GST practitioner

Dear Sir,

While filing GSTR-3B, I have not provided liabilities for Oct-2020, but entered ITC and filed GSTR-3B. There are two issues here:

1) first the ITC is not claimed against the liability and

2) second the liability is also not reported at all.

Kindly, let me know how to proceed? Can we reverse the ITC filed in Oct-2020 and use that ITC in Nov-2020? And also file the liability of Oct-2020 along with Nov-2020 liability.

Thank you for your support.

While I am filling GSTR 3B return for the month of Oct 2020 one error message was displaying there: Interest to be paid on tax liabilities both for supplies attracting reverse charge as well as other than reverse charge”. But I have already mentioned the tax amount. I could not understand the error message.

Table 3.2 included exempted inter-state supplies?

No

I have raise bills for the month of August 20 to unregistered person but goods return for the month of September 2020. Now I going to filing GSTR 3B for the month of Sep 20. but I am not able to update the negative amount in table 3.2. Please suggested to me how to show in GSTR3B.

This facility is not available on the portal right now, so you cannot put values in negative.

3.1 table error filed and submitted and didn’t filed evc for July 2020. how to rectify July 2020

Since there no facility to Reset the same, Hence you have to rectify the same in the next period

I am a GTA service provider and all services under the RCM basis. So in 3B freight collected from parties shown under which column.

In GSTR-3B you can show the same in 3.1 (a), in Total Taxable Value only,

Hello,

we are registered in Maharashtra. and our property is in UP and we have given on rent for residential purpose. and we are issuing a bill of supply for the same.

my query is where to show the amount either,

(3) Other outward supplies (Nil rated, exempted) 3.1.C

(1) Supplies made to Unregistered Persons 3.2

Pls reply as soon as possible

Sir, Since you are issuing Bill of Supply it is used only for Exempted sales, in this case, you should show it in 3.1.C

IS IT MANDATORY OF FILING GSTR 3A IN EVERY MONTH?

how to file GSTR 3B of real estate developers, in case they opted for 5% without ITC on residential real estate property (other than affordable)

You can file GSTR 3B in a normal manner.

Hi, Is this GST applicable on Government fees for a new trademark application? We’ve not been charged any GST in the invoice. Only the fees. Is this under reverse charge? Or is this exempt?

Thanks!

No GST impact will be there.

In Gstr 3b eligible ITC (a) ITC available includes an opening balance of last month also?

No. Only ITC availed in the current month has to be mentioned here.

We are showing the RCM Bills in GSTR 1 B2B as Reverse Charge Column Checked, But on GSTR3B how to show the RCM amount. Still, now we showing the RCM Bills in GSTR1 only as Reverse charge Column checked. Not in GSTR3B. Kindly advise.

If you are also providing non-RCM supplies, then you can show total sales i.e. RCM and non-RCM sales value in outward supplies column and under taxes head you only need to show taxes paid on non-RCM supplies.

All supplies are under RCM and therefore tax is zero. Now, Where to reflect in GSTR 3B?

Hi Aravind,

I had the same query in my GSTR 3B return filing process, do we need to disclose anything in GSTR3B if all supplies rendered fall under RCM only. Please advise

In GSTR-3B all inward supplies liable to Reverse Charge need to be disclosed.

I filled nil transaction GST 3b return in the feb.2019 period on 20/03/2019. in jan.2019 I purchased construction material cement from a registered dealer, after deduction of GST 10000/-. I want to take claim of ITC in tab eligible ITC. because the supplier has not uploaded their return till April 2019. now rs, 10000/- GST shows in electronic credit ledger. May I did wrong entry in return? kindly help me

You can take the ITC of Jan month now but do check whether the ITC on the said transaction is eligible to avail or not.

sir, all questions answered by you is super. I have one clarification. In GSTR-3B, my consultant wrongly entered the taxable amount instead of tax amount in IGST field. I want to write off the same amount. kindly tell me what can i do?

As rectification in GSTR-3B is not possible, you should file correct data in GSTR-1. In case of any query from the department, you may provide clarification.

Want clarification about column 5 of GSTR 3B. inward supplies from unregistered dealer below 5000 per day regarding business expenses. Is it mandatory to mention it in column 5 of gstr 3b.

I had reported excess taxable value in gstr-3b June 2020 and paid tax liability correctly and showed all details correctly in gstr-1 also how can I rectify this problem in further months

You can apply for a refund of excess amount of tax paid

I AM GST TAXPAYER. HOW TO CLAIM INPUT IN BOE SEZ MATERIALS. KINDLY TELL ME PROCESS IN GST PORTAL

You can claim input while filing GSTR-3B

I am a registered dealer. Paid CGST & SGST on raw materials. My query:

– Is the ITC eligible to be claimed?

– Where to be shown in 3B?

What if I decide not to claim ITC? Do I need to disclose this in my monthly 3B?

Ans. Yes, ITC is eligible to be claimed. You have to show the same ineligible ITC tile of GSTR-3B in the row “All other ITC”.

If you decide not to claim ITC then at least show it in GSTR-3B but do not claim it while offsetting liability.

SIR,

Would like to update you that we are mfg industry and we have an interstate supply. We do collect IGST @12% towards ‘Transport charges’ & ‘Insurance charges’ as well

Please revert us that where we need to show those (outward supply) transport & insurance charges while filing the GSTR 3B return

You have to shown them in outward taxable supplies tab in row 1 outward taxable supplies(other than Nil rated, exempted).

SIR, I WANT TO ASK THAT IF I MADE ANY PURCHASE THAT IS EXEMPTED FROM A REGULAR REGISTERED DEALER, THEN DO I HAVE TO SHOW IT IN GST3B? AND IF YES THEN WHERE DO I HAVE TO SHOW IT?

Yes, you have to show such purchase in inward supplies tab in the row from a supplier having an exempt supply.

I am talking about TCS. I checked on GSTR 2a. It is showing TCS FROM MakeMyTrip. Now I am confused about what to do … how to file TCS on GSTR 3B and how to claim this? if anyone has the answer please reply

You can claim such TCS credit as ITC by filing GSTR-3b mentioning such data under Table 4 (A) 5 i.e all other ITC heading.

HOW TO RCM SERVICES PROVIDED BY INDIVIDUAL TO BANK, GST PAID BY BANK, IN GSTR 3B? SHOULD I SHOW THE INVOICE VALUE IN GSTR-3B AND LEAVE BLANKS IS CGST & SGST?

If you are only providing RCM services and not any other taxable services then in GSTR-3B showing the only taxable value of RCM services shall not be possible as tax fields can be blank or 0. In such a case you can’t file neither invoice/taxable value of RCM services in GSTR-3B

Then, How to file GSTR 3B? Should I file nil GSTR 3B? or Show RCM Outward Services in GSTR 3B?

You cannot show only RCM outward services without filing tax amount in such a case filing nil GSTR-3B is the only option available.

Thank you for your reply. Now, How to Show RMC outward supplies in GSTR 1?

In GSTR-1 Rcm outward supplies to be shown as normal supplies in respective heads only selecting RCM field as yes.

PLEASE TELL HOW TO FILE GSTR 3B OF SECURITY SERVICE ORGANISATION (FIRM) FOR THE PERIOD JAN 2019. THE ENTIRE TAXABLE SERVICE IS UNDER RCM WEF 01.01.2019.

The amount must be mentioned in table 3.1 under the head “outward taxable supplies” and the tax column should be left blank.

While keeping Tax column blank the error displaying that “When the taxable value is declared, Tax amounts cannot be zero.” I am trying to file the return for security service (proprietor) Please suggest what can I do for the same.

If you are exclusively providing RCM services you have to file nil GSTR-3B, as dept has put a validation on tax column that it cannot be left blank.

Where to show RCM outward supplies, as I am a supplier of GTA services my receiver has to pay the tax liability, But where I have shown my outward supplies in GSTR – 3B?

thanks

abhinav

The amount must be mentioned in table 3.1 under the head “outward taxable supplies” and the tax column should be left blank. You cannot show only RCM outward services without filing tax amount in such a case filing nil GSTR-3B is the only option available.

Hi,

Stuck at same issue, i too had only rcm outward supplies. It populated correctly from GSTR1, but i mistakenly edited and saved, it’s not going back to system generated data. Can we enter the amount as 0.10 in tax field, it has no effect on payment of tax. Or will reset GSTR3B works in this case ??

How can we rectify Financial Year 2017-18 sale value & Tax not disclosed in GSTR 3B but disclosed in GSTR1? Can we add that value and tax in GSTR3B of the financial year 2018-19 and pay Tax. Please give me a Solution.

Yes, same can be added in F/Y 2018-19 of GSTR-3B

OUTWARD SUPPLIES IN GSTR 3B. PROVIDING SERVICE TO BANK GST PAYING UNDER RCM BY BANK WHERE THE SERVICE PROVIDER HAVE TO SHOW TAXABLE VALUE IN GSTR-3B

In case the only service provided is of RCM and nothing else no where data to be shown in GSTR-3B and in case there is any other outward service apart from RCM then sown both taxable value of RCM and non-RCM service in column 3.1(a).

We are merchant exporter. We have exported goods under LUT (without payment of IGST). While filing GSTR-3B, in Table 3.1(b),

– what amount needs to be mentioned in the column “Integrated Tax”?

– what would be “Total taxable value”?

In case export is without payment of tax no amount need to file in column “IGST”. The only taxable value needs to be entered.

SIR,

STAR DYES & INTERMEDIATES.

WE HAVE MADE MISTAKE IN FILLING GSTR3B &GSTR1 IN JUL 2017 AND OUR EXPORT DATA IS NOT BEING TRANSMITTED TO ICEGATE FOR IGST REFUND.

BUT IN CURRENT MONTH JUNE-2018 WE HAVE FILLED EVERYTHING OK GSTR3B/GSTR1/TABLE 6A THEN ALSO OUR DATA IS NOT BEING TRANSMITTED TO ICEGATE FOR IGST REFUND.

CAN U PLEASE GUIDE

Contact department’s helpdesk for assistance.

Sir, I am having unregistered interstate sales so is it mandatory to fill that in GSTR 3B table 3.2 also?

Yes, you have to file table 3.2

In GSTR-3B for June 2018, I’ve shown Inward Supplies (liable to reverse charge) in 3.1 and also claimed ITC under point 4 (A) (3) -Eligible ITC. However, under Offset Liability I am not being allowed to claim ITC on reverse charge. It was allowed till May 2018 GSTR-3B. Why is it? Please guide

Contact department for assistance.

As per Dep’t. I have to pay the Reverse Charge GST this month and claim ITC against the same in next monthly return.

How to correct the wrongly entered GSTR 3B?

No option is given to revising the return as of now.

Sir,

I have an error in the invoices have not been transmitted to ICE GATE AS cumulative total of IGST amount in table 3.1 (b) of all GSTR 3B filed so far is less than the cumulative total of IGST amount in Table 6 A and 9A of all Gstr 1 filed so far

Contact to GSTN helpdesk.

Hai Sir,

My Question is if we purchase from the registered dealer some items in cash, but we have to give him our GST No. so while filing GST return where to show this kind of purchase?

This is the purchase transaction between registered dealers. Hence this type of transaction is part of GSTR-2 which is temporarily suspended by GST portal