The 39th GST Council Meeting was held on March 14, 2020, In which, the council agreed on the operationalization of Aadhaar authentication for new taxpayers. However, as per sources in the Finance Ministry, the implementation of the process was postponed amid lock-down caused by the coronavirus outbreak.

With a gap, finally, the implementation process of the same facility has started from August 21, 2020. Aadhar authentication for new registration has been brought into the light to improve the smoothness of doing business for genuine businesses. As per the ministry sources Aadhar will be authenticated within 3 working days for the person opting for Aadhar authentication for the new GST registration if no notice is issued.

Fill Form for GST Compliance Software

Latest Update

- The document verification for GST registration via Biometric-Based Aadhaar Authentication is now enabled for Assam taxpayers. View more

- New advisory guidelines for Aadhaar-Based Biometric Authentication and Document Verification for GST Registration of Jharkhand and the Andaman and Nicobar Islands. read more

- GSTN advisory for processing the GST registration as specified in Rule 8 of CGST Rules, 2017. Read more

- Now, the taxpayers of Maharashtra and Lakshadweep can verify GST registration applicants via Biometric-Based Aadhaar Authentication. View more

- Taxpayers in Tamil Nadu and Himachal Pradesh are now eligible for GST registration via biometric-based Aadhaar authentication and document verification. View more

- New Advisory on Biometric Aadhaar Authentication and Document Verification for Rajasthan GST Applicants. View more

- The GSTN department has enabled booking slots for new GST registration via biometric-based Aadhaar and document verification for taxpayers in Arunachal Pradesh, Chhattisgarh, Goa, and Mizoram. View more

- Arunachal Pradesh taxpayers can now verify their GST registration via biometric-based Aadhaar authentication. Read more

- A new advisory has been issued for taxpayers in Chhattisgarh, Goa, and Mizoram, permitting document verification for GST registration through a biometric-based process. View More

- A new advisory for Haryana, Manipur, Meghalaya, and Tripura. Taxpayers can now enable document verification for GST registration applicants via biometric-based Aadhaar authentication. Read more

- Biometric-based Aadhaar authentication and document verification for GST registration is now enabled for Madhya Pradesh taxpayers. View more

- An advisory has been issued regarding biometric Aadhaar authentication and document verification for GST registration applicants in Ladakh. Read More

- Document verification for GST registration based on Biometric-based Aadhaar authentication is now available at the GSNT portal for Kerala taxpayers

- Now, taxpayers in Odisha, Kerala, Nagaland, and Telangana can verify new GST registrations through Aadhaar authentication. View more

- A new advisory has been issued for Kerala, Nagaland, and Telangana regarding document verification based on biometric Aadhaar authentication. Read more

- A new advisory for Odisha taxpayers regarding the verification of documents and Biometric-Based Aadhaar Authentication for GST Registration is now enabled on the official portal. View more

- The Karnataka govt. has enabled special centres for GST registration verification via an Aadhaar Authentication. Read more

- GST registration applicants can now be verified through Biometric-Based Aadhaar Authentication, which is now available for taxpayers in Bihar, Delhi, Karnataka, and Punjab. View more

- Taxpayers in Dadra and Nagar Haveli, Daman and Diu, and Chandigarh are now enabled for biometric-based Aadhaar authentication and document verification for GST registration. View more

- A fresh new advisory for Authentication of Biometric Aadhaar and Document Verification of GSTN Registration Applicants for Uttarakhand state. read more

- 53rd GST Council Meeting Update: The GST Council has suggested implementing Aadhaar authentication for registration applicants across India using biometric methods. This will enhance the GST registration process and make it more difficult for people to make fake claims for input tax credits using bogus invoices.

- Many taxpayers have reported delays in registering despite successful Aadhar authentication under CGST Rules 8 and 9, 2017. For this clarification, the CBIC has released an advisory. Read more

If someone is not opting for the Aadhar authentication then GST registration would be granted only after physical verification of the place of business or documentary verification. However, it can take up to 21 working days if no notice is issued.

In the view of the pandemic, the sources in the ministry also stated that it has been provided that the Officer may if the circumstances so warrant opt for asking for additional documents in lieu of the pre-registration for physical verification of the premises.

Read Also: Amendment Process in GST Registration: Step by Step Guide

This measure is expected to be beneficial for genuine and honest taxpayers, and it will also keep fake and fraudulent actors away from GST.

GST Rule for Aadhaar Authentication While Registration

During the time of GST enrollment, every applicant could choose the Aadhaar authentication. The exceptions are the individual exempted by the central government beneath the CGST act or those who should mandatorily proceed with the Aadhaar authentication beneath section 25(6C) of the CGST Act, listed down in the next section.

The rule to opt-in or not for Aadhaar authentication is subjected to apply for the applications made on or post to the date 21st August 2020. But between 1st April 2020 and 20th August 2020, all the applicants who submit the enrollment application beneath GST need to proceed with the Aadhaar authentication to receive the enrollment.

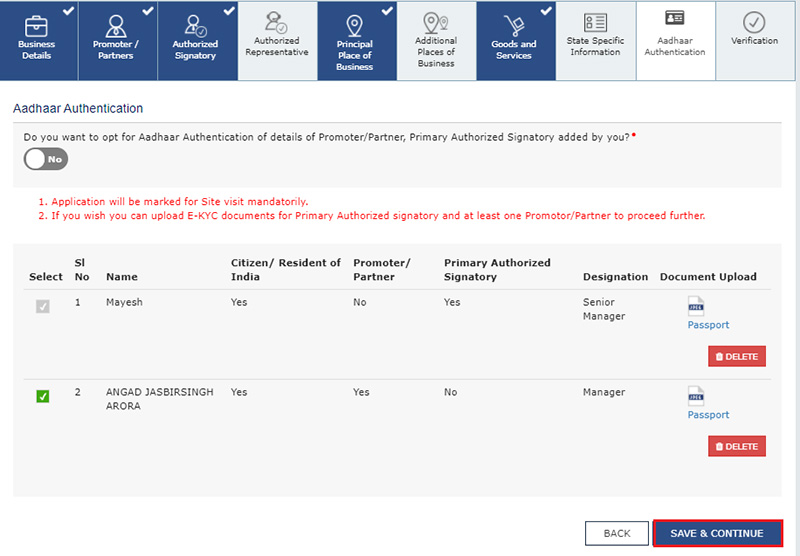

The applicants who opt for it should submit their Aadhaar number as well as the application for enrollment beneath GST. Post to this, they are required to e-verify that on the GST portal through the authentication link sent on the mobile number and the email-id associated with the Aadhaar. The same comprises the OTP that should be inserted on the portal and it gets e-validated. The Aadhaar authentication of the main authorized signatory and at least one promoter or partner is needed.

Note that for the cases of company/LLP/foreign company/AOP/Society/ Trust/Club, Aadhaar authentication of only the primary authorized signatory will be fine.

Post to that, whenever an assessee furnishes his returns or uses any services on the GST portal, an OTP would be sent on the mobile number and the email id, which is associated with the Aadhaar number. Only post to entering the OTP an assessee would move further to furnish the return.

When individual losses to do an Aadhaar authentication when chosen or have chosen for that, move to file the application without the Aadhaar authentication steps mentioned above. The enrollment would be given only post to the physical verification has been done of the principal place of business via the GST officer. The office would rather check the e-KYC documents of the main authorized signatory and any one of the promoters or partners received permission from the officer, not under the rank of the Joint commissioner and in writing.

Towards these cases, a notice in form GST REG-3 in 21 working days from the date of submitting the application. The submission date of the application is earlier than the below two:

- Date of Aadhaar authentication

- Date after counting 15 days from the submission of Part B of Form GST REG-01, being the registration application.

The taxpayer should answer in 7 working days from the receipt date of notice in form GST REG-4. Once he answers, the officer should validate in the subsequent 7 working days to approve the grant of enrollment. When the answer is not obtained in 7 working days from the applicant or he does not agree with the obtained reply, then the GST officer could refuse the grant of enrollment in REG-05. When the officer is unable to act in the mentioned period, the enrollment is considered to be allotted.

Before that, the enrollment will be provided on the grounds of the physical verification of the principal place of business 60 days from the application date.

When there is no allocation of an Aadhaar number to the specific person who applies for the enrollment beneath the GST, then another means of identification is made available to him such as physical verification of the place of the business under the CGST rules.

Obligatory Cases of Aadhaar Authentication While GST Registration

Under section 25(6C) of the CGST Act, the Aadhaar authentication is essential for the mentioned class of individuals under Rule 8 of the CGST act so as to become qualified for the GST enrollment:

- Authorized signatory of all kinds

- Managing/authorized partners of a partnership firm

- Karta of a Hindu Undivided Family

Exceptions

The exception is if a person is not an Indian citizen or he is a person other than the one prescribed below:

- Individual

- Authorised signatory of all types

- Managing/authorised partners of a partnership firm

- Karta of a Hindu Undivided Family

Application of GST Registration Cases Via Officer

The application is considered to be approved via officer if the officer losses to choose the action in the provided duration given with respect to the mentioned cases:

| Case | Timeline |

|---|---|

| The individual who has finished the Aadhaar authentication or the individual is privileged from the Aadhaar authentication need. | Three working days from the date of application submission. |

| An individual who has chosen but losses to complete the Aadhaar authentication | 21 working days from the submission date of application to furnish the notice in form REG-3 |

| Person would not choose for Aadhar authentication | 21 working days from the date of submitting an application |

| The individual who has chosen but looses to complete Aadhaar authentication, notice is provided in form GST REG-3 and the individual has answered in REG-4. | 7 working days from the receipt of the response, the information, or the needed documents. |

Step-by-Step Procedure for GST Registration Via Aadhaar Authentication

- Open a browser and head-up to www.gst.gov.in.

- Here either click on REGISTER NOW link or navigate to Services > Registration > New Registration option.

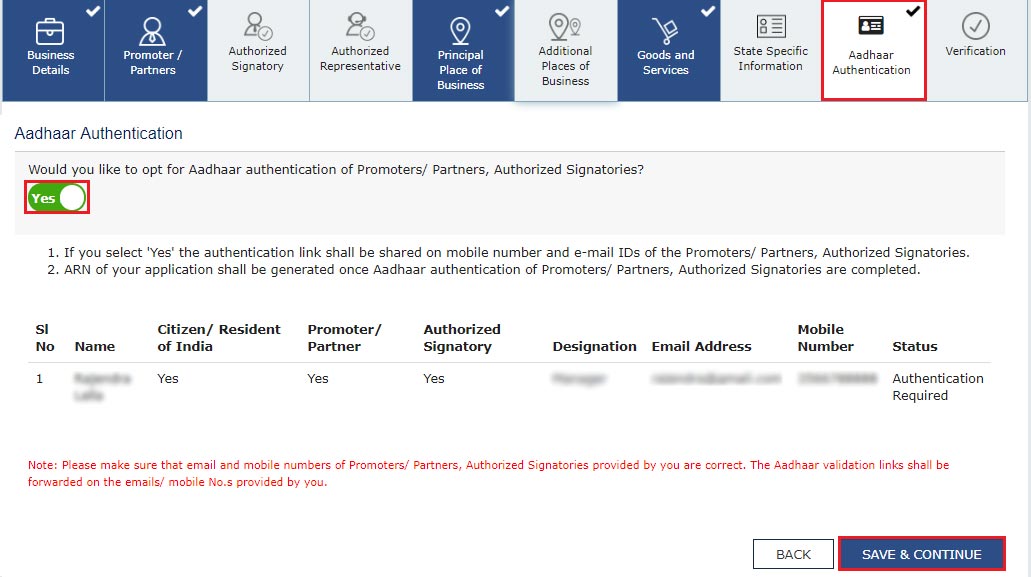

- During the usual procedure of GST Registration opt for Aadhaar authentication, by clicking on the Aadhar Authentication Tab.

- Here the applicant will get an option to select if you wish to authenticate Aadhaar or not.

- You can select YES or NO for Aadhaar Authentication, as per your choice.

- If you clicked on YES, an authentication link will be sent on the registered mobile number and e-mail IDs of the Promoters/ Partners and Authorized Signatories.

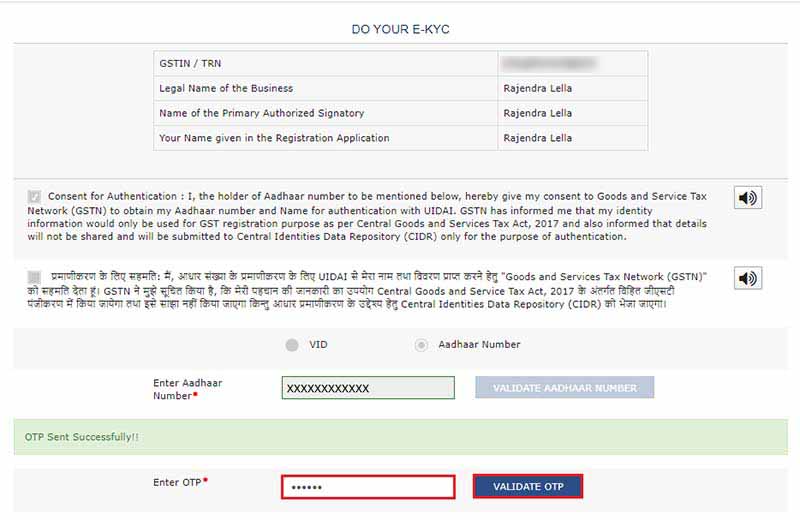

- Upon clicking on the link, a declaration will appear on the screen, here you have to enter your Aadhaar number and then click on “validate”.

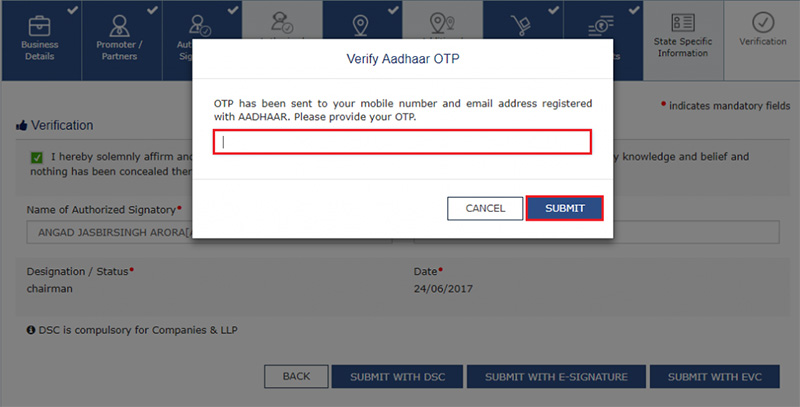

- After cross-checking the details in the registration form and the UIDAI, an OTP will be sent on their email and registered mobile number. You have to enter the OTP in the box visible at the validation screen. After it, a confirmation message will appear.

- For Successful Authentication, taxpayers need to ensure that they have updated registered mobile numbers and email in Aadhar.

- OTP for Aadhaar authentication will be sent on the mobile number and e-mail address registered with Aadhaar. Mobile number and email can be verified at https://resident.uidai.gov.in/verify.

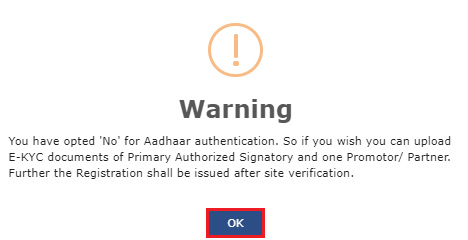

- If you choose NO for the Aadhar Authentication, then the GST registration application will be sent to the jurisdictional tax authority. And they will perform the further steps which include documentary and/or physical site verification before approving the registration.

- If no action has been taken by the Tax Authority within 21 days then the GST registration application will be considered as approved.

Recommended: Easy to Know Aadhaar Virtual ID & How to Generate via UIDAI Portal?

Complete Process for Existing Taxpayers’ Aadhaar Authentication

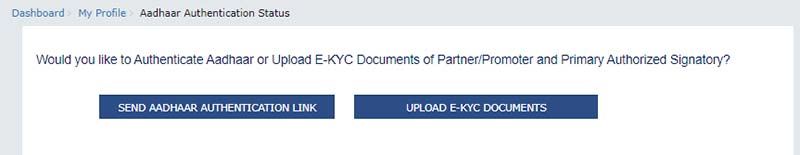

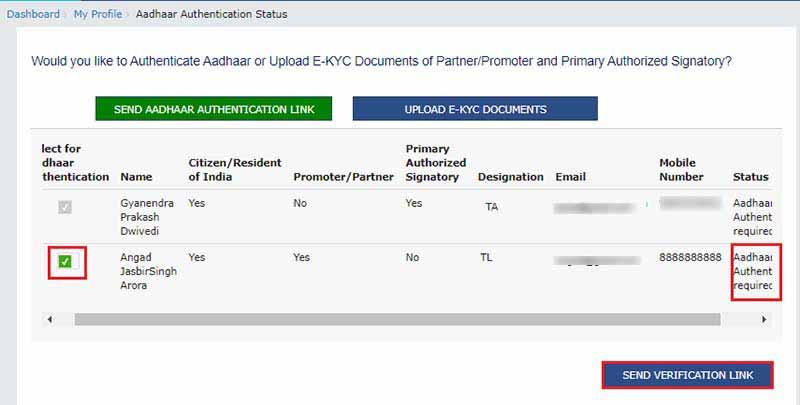

Step 1: Log in to the GST portal. Navigate to the “MY PROFILE” page. Proceed to Aadhaar Authentication Status. Two options emerge.

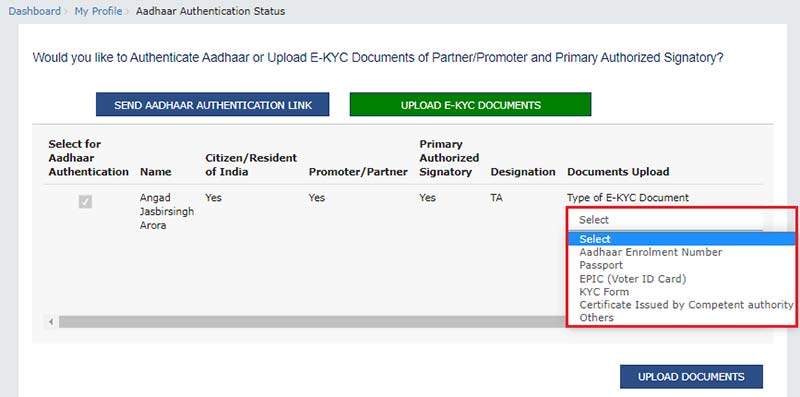

Step 2: Select one of the two options- Send an Aadhaar authentication link or upload e-KYC documents.

If the former opts, then tap on the links obtained on the email id and mobile number of the signatory and the specific promoter or partner, and finish the OTP verification.

If the latter opts, the documents would be approved or canceled by the tax officer. The assessee would acknowledge e-KYC authenticated and not Aadhaar authenticated.

GST Registration Facility Via Aadhar Authentication

As per the received information, for faster approval of the GST registration, all Indian Citizens can use this facility. It is not required for tax collectors, tax deductors, Online Information Database Access and Retrieval services (OIDARs), Taxpayers having a Unique Identification Number, and Non-resident taxpayers. You can get more details on the news and update section of GST Portal.

As sources informed, Whether a person chooses Aadhar Authentication or not, the officers have to act within the predefined time period Which are 3 days for persons opting for Aadhar authentication and 21 days for a person not opting for Aadhar authentication? After this predefined time, if the application neither accepted nor rejected, then the application will be considered approved.

FAQs on Aadhaar Authentication for GST Registration

Q.1 – Who and which taxpayers are required for Aadhaar authentication?

All the regular assessees and composition assessees are mandated to obtain the Aadhhar authenticated for a new GST registration.

Q.2 – Where shall I receive the OTP while using the authentication link for Aadhaar authentication?

On your mobile number and E-mail ID linked with your Aadhaar on the UIDAI Portal, you will receive a common OTP for its authentication.

Note- On the mobile number and e-mail IDs of the selected primary authorized signatories, as cited in the registration application you will obtain an authentication link.

Q.3 – What was the purpose of introducing Aadhaar authentication?

As per the company secretary Dinkar Sharma, Partner, Jotwani Associates, the government has furnished the same advisory in answer to the rising subjects of bogus GST registrations. With the passage of time there has been a rise in the matters of bogus GST registrations that have been used frequently to make a network of bogus businesses or to claim the input tax credits without legitimate transactions. The same makes the tax system integrity weaker and directed to the revenue leakage and makes unjust competition for the legitimate assessees.

The government to address the same has introduced a system in which the applicants for the GST registration in particular states are required to experience the biometric-based Aadhaar authentication. It has been executed in a phased manner in the States of Haryana, Manipur, Meghalaya, and Tripura.

This ensures that the individual who are applying for the GST registration is correct individual since Aadhaar furnishes a stronger and unique form of identity verification that links to the person’s biometric data like fingerprints and iris scans.

The motive of the initiative is to make the GST registration process secure, and transparent in averting fraud.

Q.4 – In what way it assists assessees?

Sharma said that the Aadhaar biometric authentication proposes distinct advantages to assessees both the convenience and security

- Surged security and reduced fraud: The government through linking GST registrations with Aadhaar can avert the making of bogus businesses. The biometric authentication assures that the individual applying for the GST registration is who they declare to be. The same lessens the chance of bogus activities such as fake companies and the misuse of the GST system to claim bogus ITCs.

- Facilitation of registration process- The Aadhaar system permits for the faster and more efficient verification of the applicants. The requirement for manual document verification and physical checks is lessening directing to quicker approval times for legitimate businesses who are looking for GST registration. It is advantageous for businesses that require a registration process.

- Faith and clarity in the system: Since the Aadhaar-based authentication system makes the integrity strangers for the registration process it assists in legitimate businesses who are confident in the GST system fairness. When the fraud gets reduced then the honest businesses can compete on a level playing field in which the tax evaders are not taking advantage of the unjust benefits.

- Decreased compliance load: By furnishing a single government-issued identification (Aadhaar) the process of verification becomes easier for the assessees. Businesses rather than documents and verification processes use a single form of identity to prove their legitimacy for making the process effective.

For the assessees the advantage is a secure and transparent system in which the chance of fraud is lower and the process of registration and compliance is facilitated making it simpler to perform the business while assuring fair treatment for all.