If a taxable person has received a show-cause notice in Form GST REG-23 then he/she must have to file a reply in defence using Form GST REG-24 within a period of seven working days. Today you will get proper information about the receiving of notice by a taxable person and filing replies in Form GST REG-24. We are covering the Coverage of Form GST REG-24 and possible results after the filing of response in Form GST REG-24.

Latest Update

- The judgment said that show cause notice can’t be feted SCN allocated on the particular company.

Accepting of SCNs & Response in GST REG-24 Form

Following is the flow of action in which the taxable person will receive notice in Form GST REG-23:

- At first, the GST registration of the taxable person will be canceled by the proper officer on his own motion.

- When the taxable person will know about the cancellation of GST registration by the proper officer then he/she will be aggrieved.

- Then, the taxable person will file a revocation application against cancellation of registration using Form GST REG-21.

- If the revocation application filed by the taxable person failed to satisfy the Proper Officer, then the proper officer can issue a notice in Form GST REG-23.

- The notice will contain all the valid reasons the Proper Officer found and on the basis of the same rejected the revocation application.

- After receiving and aggrieved by the rejection reasons stated in Form GST REG-23 by Proper Officer the taxable person can file a counter reply using the Form GST REG-24.

It is notable that, the taxable person has to file a counter reply in Form GST REG-24 within a period of seven working days from the date of service of the notice in Form GST REG-23.

Summary of GST Registration 24 Form

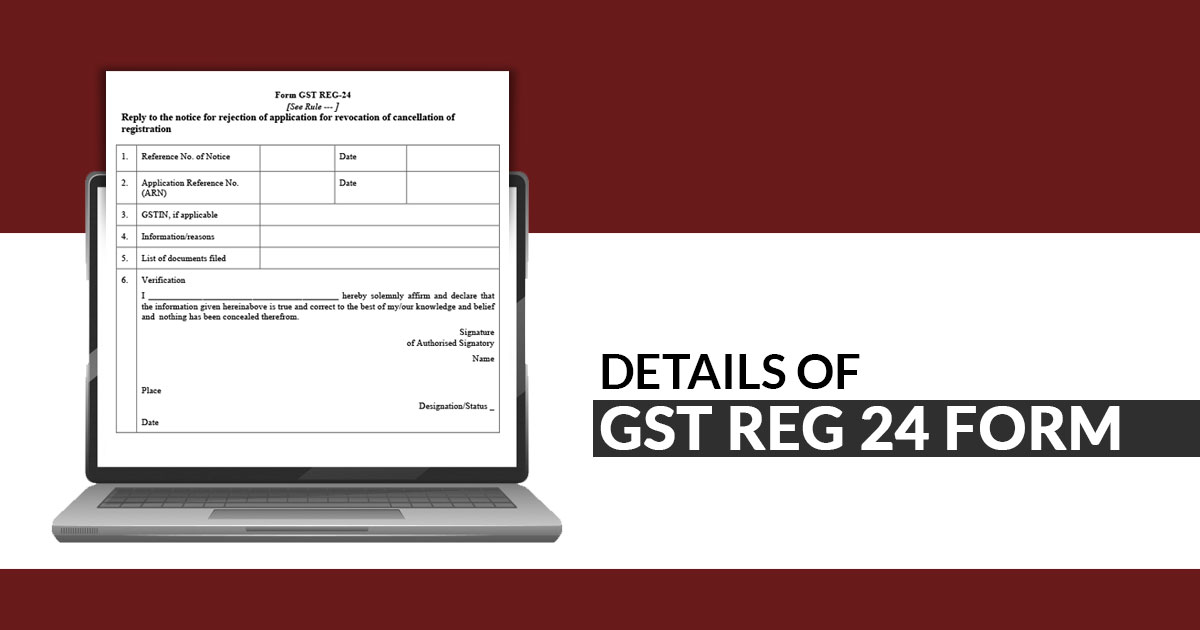

Form GST REG-24 contains the following information/details-

- Reference Number and Date of the Notice.

- Reference Number and Date of the Application.

- GSTIN (If applicable)

- Details of Information: Reasons for the revocation is demanded by the taxable person.

- List of attached/filed documents.

Issue Post Furnish of GST REG-24 Form

The Proper Officer will properly verify the reasons or information provided by the assessee in Form GST REG-24. After verification, if Proper Officer is satisfied, then the officer will pass an order revoking the cancellation of GST registration. But if the proper officer is not satisfied then he/she will reject the assessee’s application for revocation of cancellation of GST registration.

That’s pretty much on the Filing of reply under GST in Form GST REG-24, the response provided by the taxpayer in this form is very important and the proper officer’s decision will be based on it. So make sure to fill in proper details and reasons in Form GST REG-24.