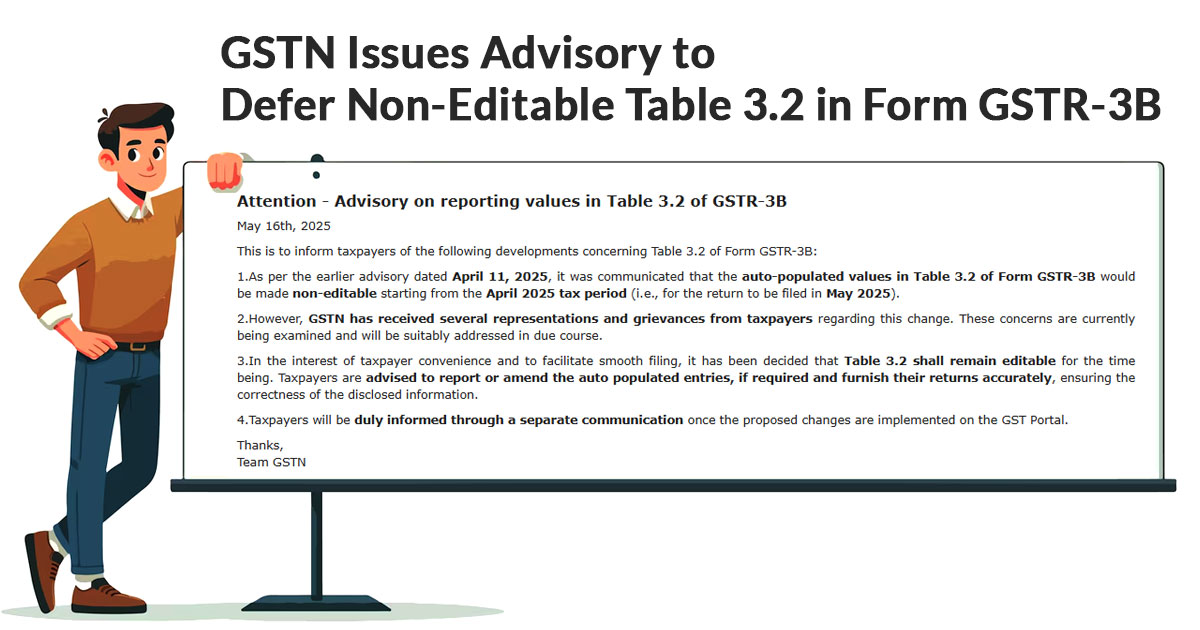

In a recent advisory, GSTN notified that Table 3.2 of Form GSTR-3B will remain editable for now, contrary to its before communication dated April 11, 2025, which suggested locking the table for the April 2025 return period.

The decision is in response to numerous complaints from taxpayers concerning the auto-populated, non-editable data fields. Consequently, GSTN is reviewing these concerns and will take action.

Table 3.2 Key Highlights

- Taxpayers must confirm and amend auto-filled entries, if required.

- Table 3.2 will continue to be editable to provide ease of return filing.

- The new implementation timeline will be reported under a particular communication.

The GSTN encourages taxpayers to ensure that their disclosures are accurate while taking advantage of the extended flexibility provided.

GSTR 3B Return Form

Every regular GST-registered taxpayer should furnish GSTR-3B, which is a monthly self-declaration return. It includes a summary of outward supplies (sales), inward supplies (purchases), input tax credit (ITC) claimed, and tax liability for the appropriate tax period.

GSTR-3B is a summarised return made for quicker compliance and timely tax filing, and is just the opposite of GSTR-1, which provides invoice-level details.

Even if there are no transactions during the month (a NIL return), the same return is to be filed. It is important to file the timely Form GSTR-3B as it allows the ITC claim and assists in avoiding the penalties and late fees. The form, over time, has witnessed rectifications like auto-population of data from GSTR-1 and GSTR-2B to lessen the manual errors and enhance precision.