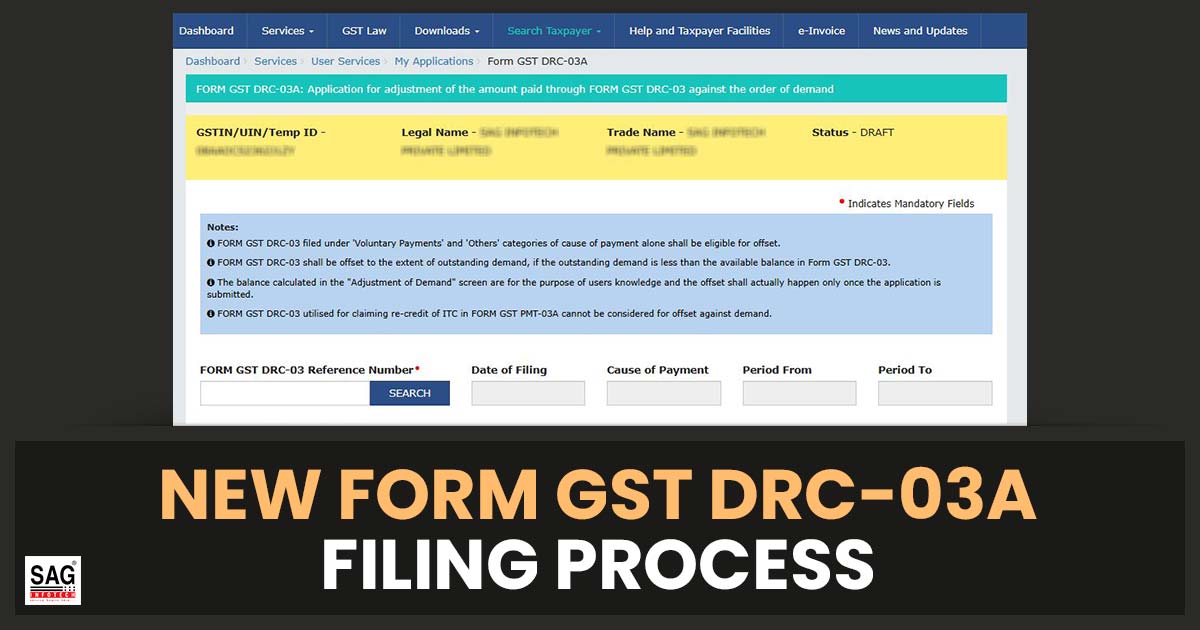

An important advisory has been issued by the Goods and Services Tax Network (GSTN) on the updated introduced Form GST DRC-03A. It was introduced for demand adjustments in the electronic obligation register for the assessee.

What is the New GST DRC-03A Form?

The amendment has arrived in answer to the instances where the assessees used Form DRC-03 rather than the designated “Payment towards demand” option on the GST portal to settle the amounts under DRC 07, DRC 08, MOV 09, MOV 11, or APL 04. The same practice stayed certain payments unlinked to the related demand orders, creating discrepancies in the electronic liability register.

The government to solve the same has furnished Notification No. 12/2024 dated July 10, 2024, officially introducing Form GST DRC-03A.

Form GST DRC-03A is available on the GST portal which permits the assessees to link the payments made via the DRC-03 to the pertinent demand order assuring the effective adjustments in their obligated ledger.

The Purpose of the New GST DRC-03A Form

The form applies to the DRC-03 payments marked as either “Voluntary” or “Others”. the taxpayers to use DRC-03A should enter the ARN (Application Reference Number) of the DRC-03 including the related demand order number on the portal. The same data allows the system to auto-populate information from both the DRC-03 form along with the demand order.

GST FORM DRC-03A Online Filing Process

Step 1: Log in to the portal à tap on Services à User Services à My Applications à form GST DRC-03A.

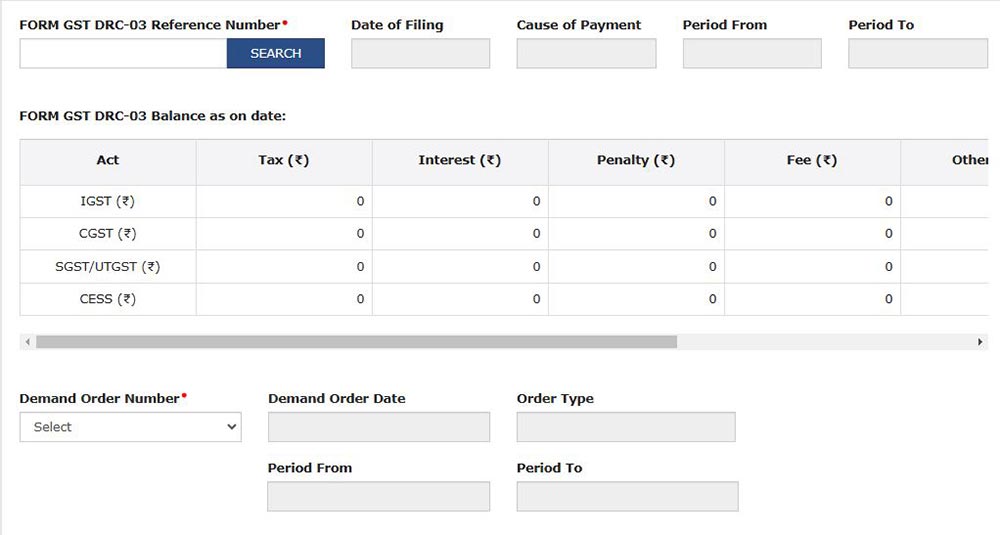

Step 2: Enter the form GST DRC-03 number and tap on the Search button. The below-mentioned details corresponding to DRC-03 will be visible:

- Date of Filing

- Cause of Payment

- Period form & To

- Form GST DRC-03 balance as of date

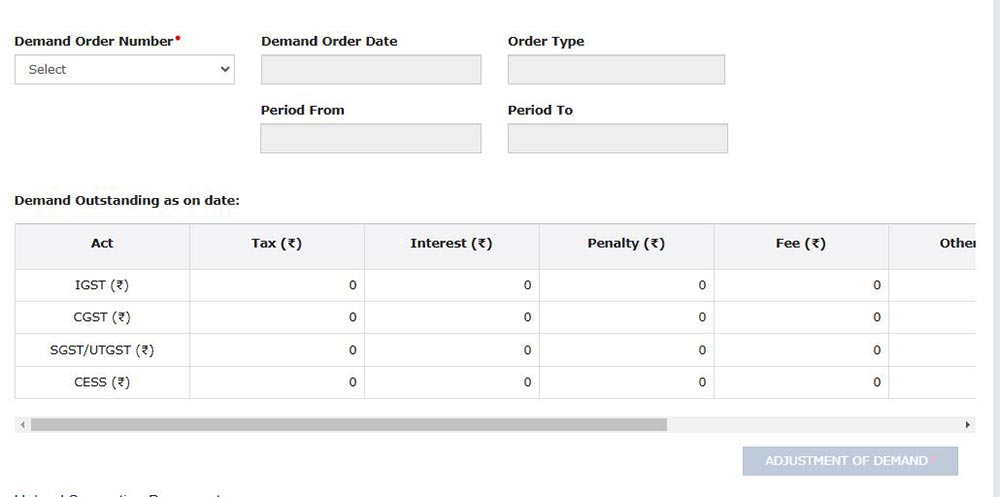

Step 3: Choose the demand order no from the drop-down box. It shall show all the left demands against which the payment has not been accomplished. Choose the pertinent demand order no. from the drop-down box. Below mentioned are the details that shall be shown on selection-

- Demand Order Date

- Order Type

- Period From & To

- Demand Outstanding as of date

Step 4: Taxpayers to tap on the tab “Adjustment of Demand”. A new page shall be opened and the below tables will be shown on the page. The assessees would required to enter or edit the details:

- Table A Outstanding Demand

- Table B1 (DRC 03 – Amount paid through Cash: Balance Available)

- Table B2 (DRC 03 – Amount to be adjusted: Cash)

- Table B3 (DRC-03: Balance post adjustment- Cash)

- Table C(1) (DRC 03 – Amount paid through Credit: Balance Available) Table C(2) DRC 03 – Amount to be Adjusted: Credit

- Table C(3) DRC-03 Balance post Adjustment: Credit

- Table D. Outstanding Demand post Adjustment

Step 5: The information cited in Tables A, B, C & D is required to be verified by the taxpayer. Tap on the validate button after verification.

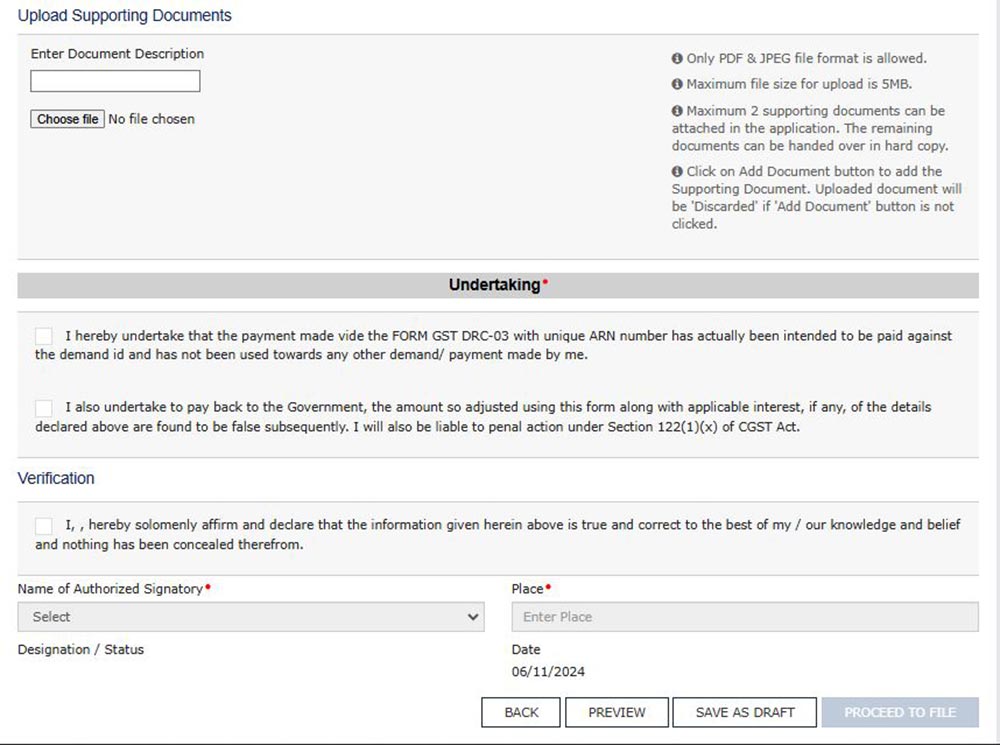

Any supporting document (if needed) can also be uploaded by the taxpayer. Following that the assessee is required to sign the undertaking and verification.

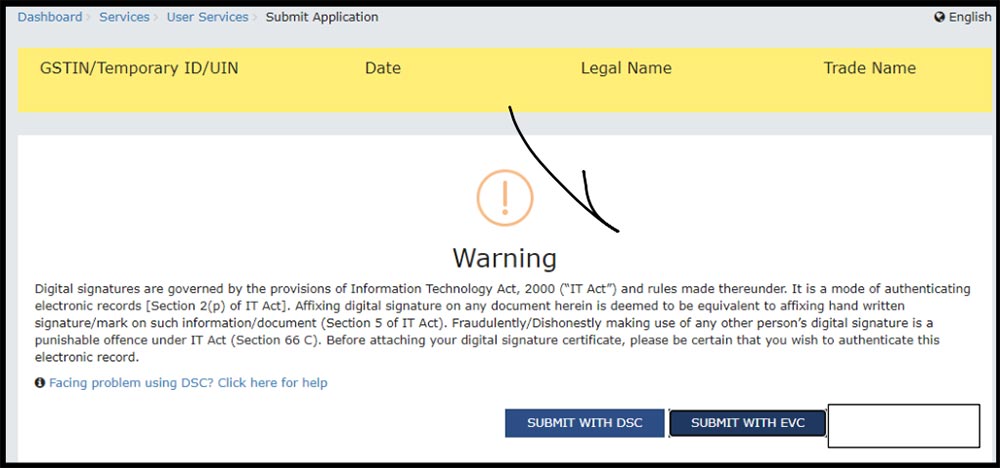

Step 6: Thereafter the taxpayer can Preview or Save Draft or Proceed to file. Post tapping on the Proceed to File button, the following page will be displayed and taxpayers can submit the form using DSC (Digital Signature Certificate)/EVC.

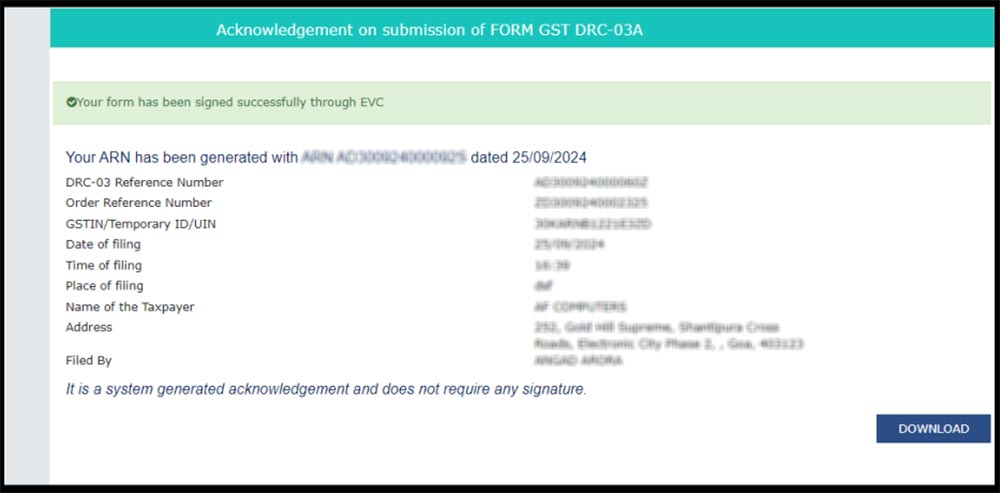

Step 7: Acknowledgment shall be issued on the successful submission.

Step 8: Under the provided information in the DRC-09A Form, the related entries will be published into the ledger. Indeed, a single DRC-03 could be utilized to adjust the payments against multiple demand orders and vice-versa.

Step 9: The taxpayer if faced with technical issues can raise a support ticket via the Grievance Redressal Portal: https://selfservice.gstsystem.in.