For some services, linking your PAN card with your Aadhaar would have been essential just like filing your ITR. 30th June 2023 is the due date to link PAN with Aadhaar according to the notification. Before that, the due date was March 31, 2023.

But the fine shall be obligated to be paid for the case when the PAN along with the Aadhaar are linked post 30th June 2023. If the linking is been executed after the extended due date then a penalty of Rs 1000 shall be levied.

What are the Consequences of Not Linking a PAN Card with an Aadhaar?

According to the Ministry of Finance’s notification, your Permanent Account Number (PAN) will expire if you don’t link it to your Aadhaar.

Who is Exempted from Linking PAN and Aadhaar?

Citizens of the states of Assam, Jammu, Kashmir, and Meghalaya are free from associating their PAN with Aadhar, as is anyone over the age of 80 and non-residents of India according to the Income Tax Act of 1961.

How Much Time Will Take to Link Aadhaar and PAN?

It takes roughly ten days to update the information on the ITD database once all the necessary processes to integrate Aadhar with PAN have been taken.

Why Should Taxpayers Choose Genius Return Filing Software?

Among the tax professionals in India, Genius would be counted as the most productive tax return filing software that is used to file the returns from the assessment year 2001-02. The software furnishes unlimited client return filing of income tax, TDS, AIR/SFT, and others with its updated process of taxation.

The Genius would secure the total 6 modules that include GEN BAL (Balance Sheet), GEN IT (Income Tax), GEN CMA, GEN FORM MANAGER, GEN TDS (Tax Deducted at Source), and AIR/SFT. The fact that Genius tax return software has so many features, including Backup, Restore, and Password Settings, places it overall among the top tax software available in India.

Without having to go to the income tax department website, our highly regarded tax return software also allows for income and TDS e-payments. The Genius tax software includes creating new forms as well as filing income tax returns, e-TDS (Tax Deducted at Source), Bal, and Form Manager, which has all relevant Company Law drafts.

Genius Software to Check the Status of Multiple PAN-Aadhaar Card

We have provided two examples below to illustrate how Genius Software verifies the status of PAN-Aadhaar cards in bulk:

Case 1: PAN-Aadhaar Card Linking Using Login

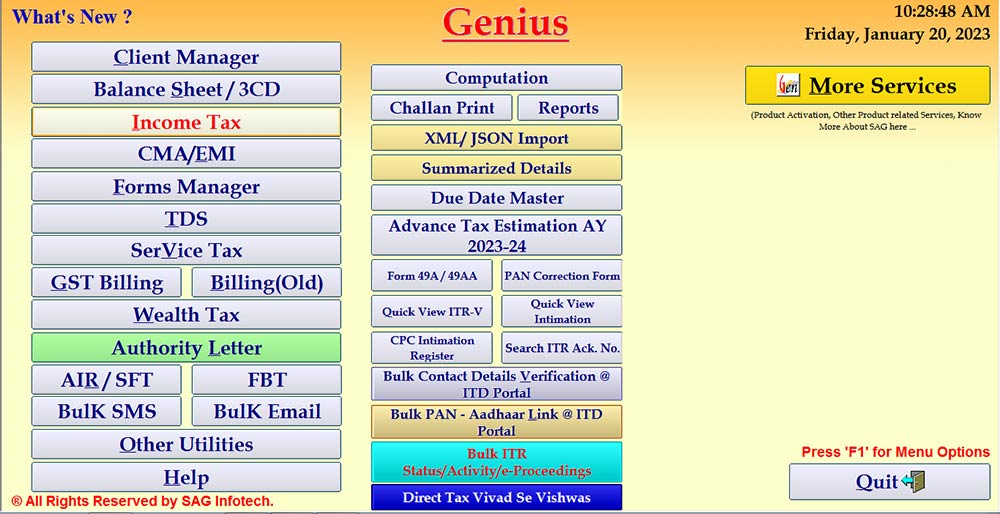

Step 1:- Open the Genius Software and then go to the Income Tax tab and then click on Bulk PAN-Aadhaar Link @ ITD Portal.

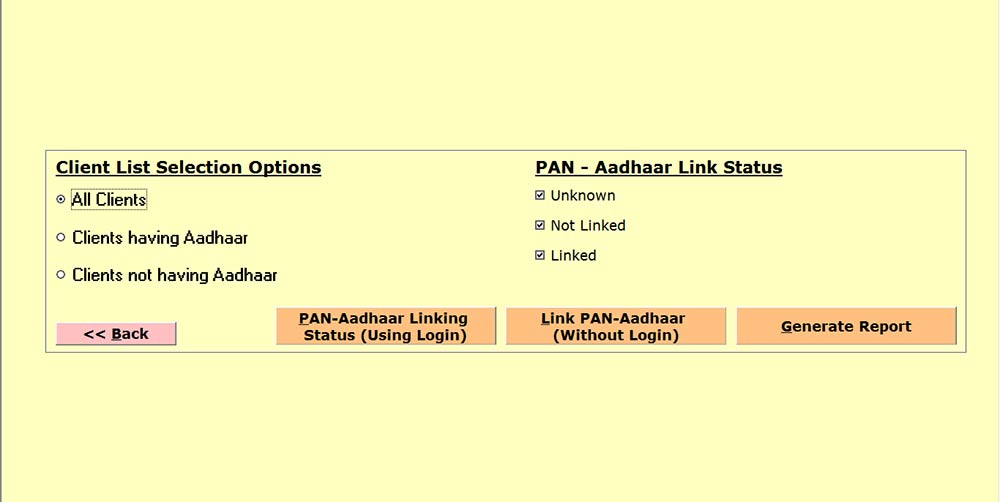

Step 2:- Go to PAN-Aadhaar Linking Status(Using Login).

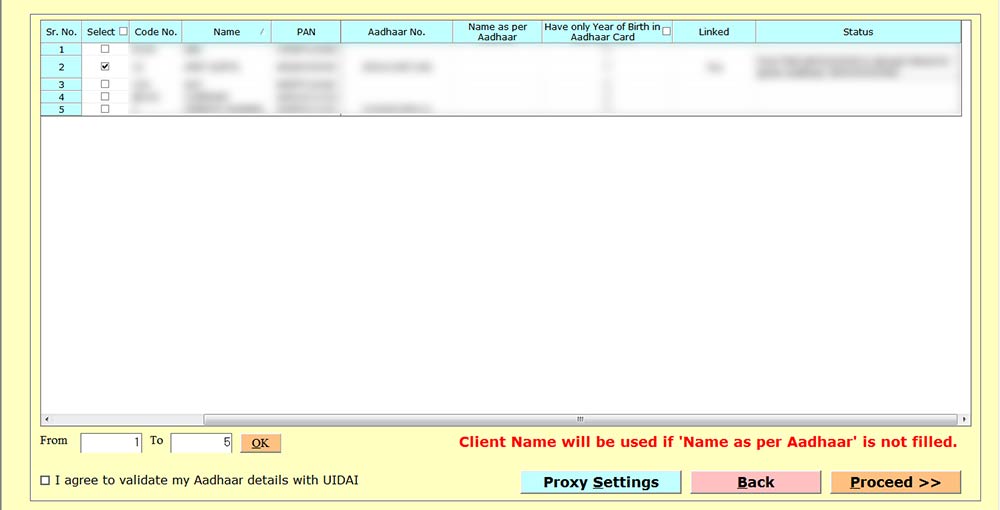

Step 3:- Select the Client and Click on the Proceed Button.

Step 4:- After clicking on Proceed Button the Software will show the Status of whether the PAN is Linked to the Aadhaar Number.

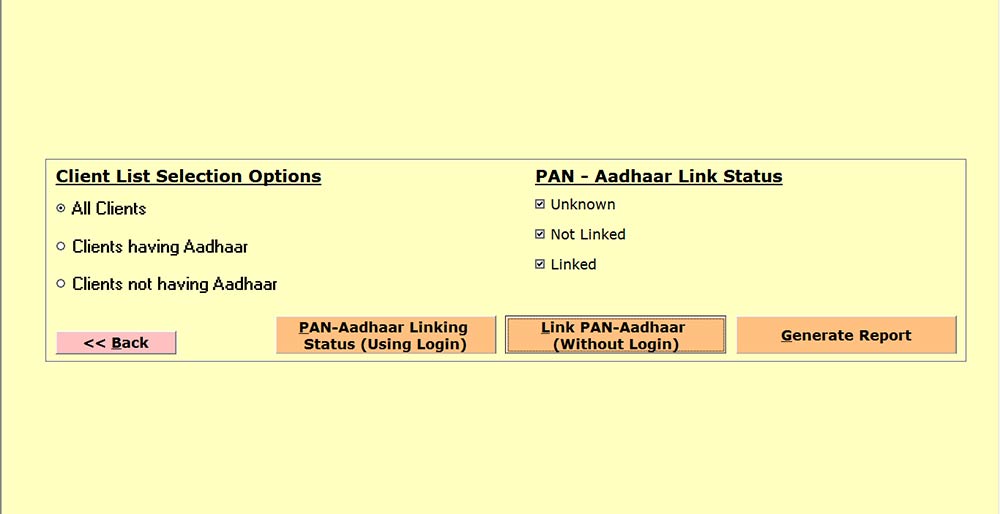

Case 2: PAN-Aadhaar Card Linking Using Without Login

Step 1:- Another option available in the Software is the Linking of PAN-Aadhaar (without Login). Click on the tab Link PAN-Aadhaar (without Login).

Step 2:- Select the Client and click on the proceed button.

Step 3:- After that, the Software will show the status as Linked.