What is Form 16B?

The amount of money deducted as property TDS is essentially shown by Form 16B. In this instance, the buyer must essentially deduct the TDS from the property at the time of sale.

The amount deducted as TDS on the sale property that the buyer had deposited with the Income Tax Department is shown on Form 16B, which is a TDS certificate. When purchasing immovable property, the buyer must subtract TDS from the purchase price. The buyer’s obligation to pay the seller is reduced by 1% for TDS. The Income Tax Department must then receive that sum as a deposit.

The buyer must provide the seller with Form 16B after the money has been lodged with the Income Tax Department. This is evidence that the TDS was taken from the property and lodged with the government. The TDS certificate for salary deductions is Form 16, the TDS certificate for deductions from all other forms of payments is Form 16, and the TDS certificate for deductions from the sale of real estate is Form 16B.

Process to Download Form 16B on the TRACES

Users can download Form 16B from the TRACES website. The buyer may download Form 16B online after submitting challan-cum statement form 26QB with the necessary information and depositing the TDS. The buyer should receive this form.

Deadline for Filing TDS Form 26QB

Within 30 days of the end of the month in which the deduction is made, Form 26QB will be filed.

Step-by-Step Guide to Generate Form 16B TDS Certificate via Gen TDS Software

Step 1: First Install, ‘Gen TDS Return e-Filing Software‘ on your computer and laptop.

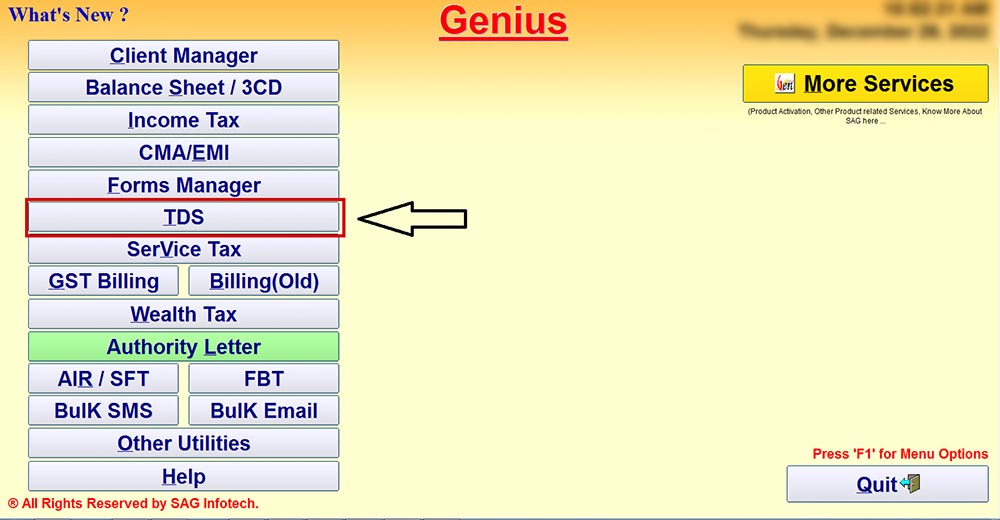

Step 2: Open the software and click on the TDS tab

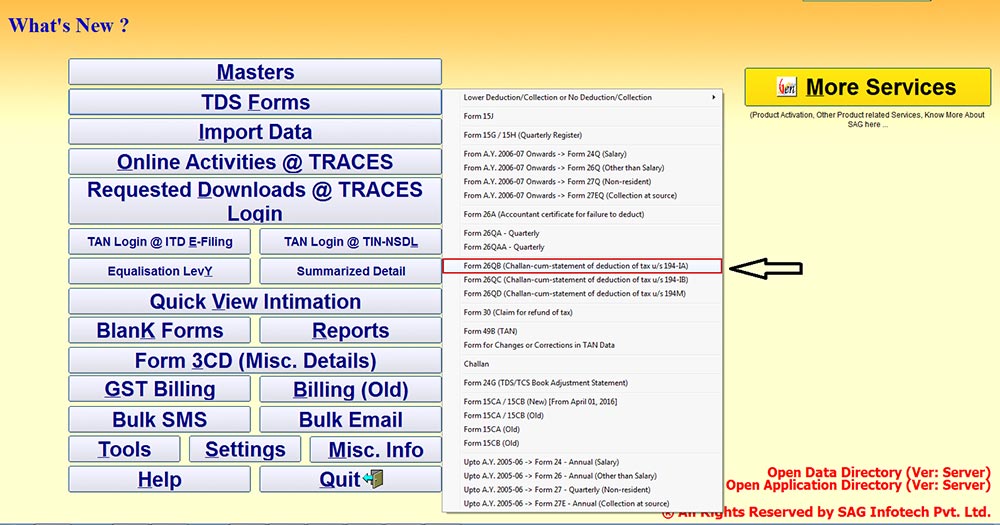

Step 3: Click on TDS Forms and then Go to tab Form 26QB

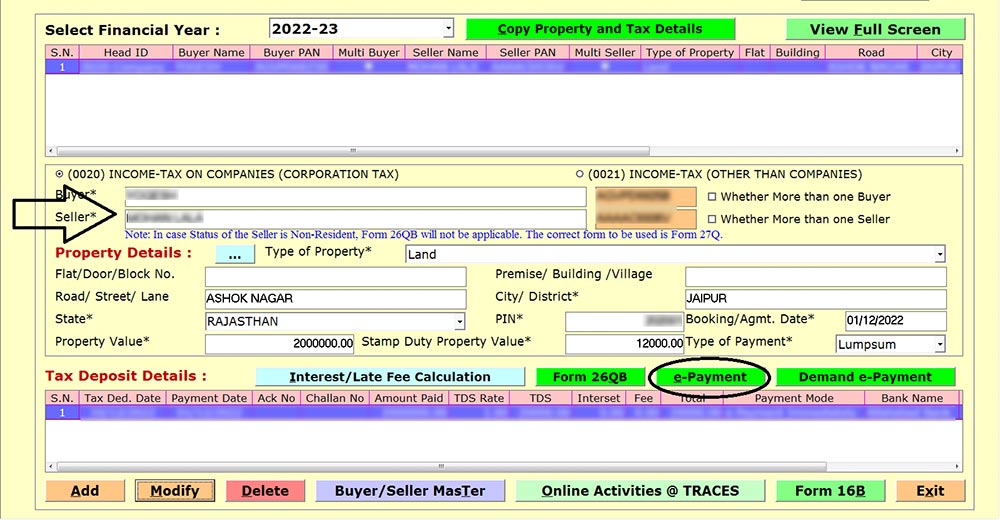

Step 4: Fill in the details like Buyer details, Seller Details, property value, type of payment etc and after that click on e-payment to file the Return.

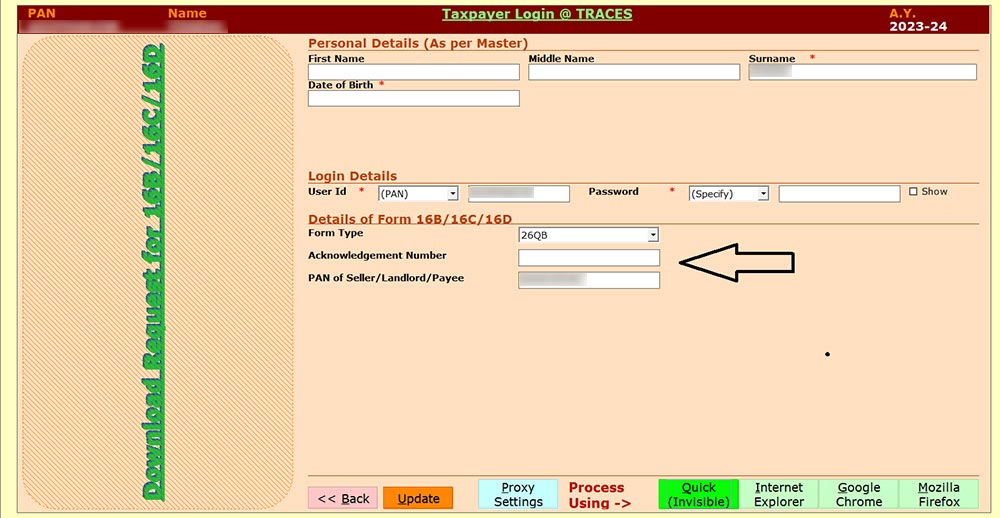

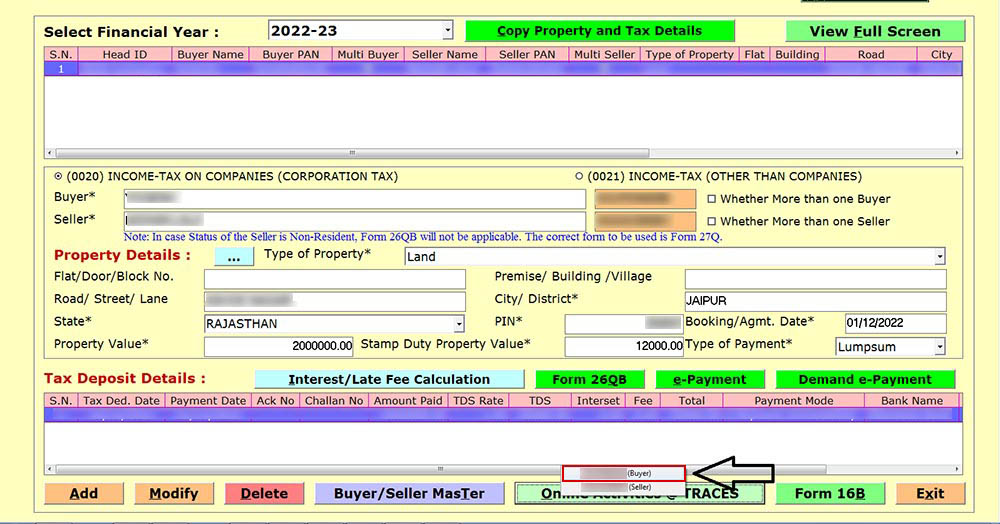

Step 5: After the filing of the Return Click on Online Activities @ Traces and then click on Buyer to request Form 16B.

Step 6: After that put, the Acknowledgement number of Return Filed and Click on Quick Invisible then the Request for Form 16B will get submitted and made available within one day of submitting the Request under the tab Requested Downloads.