What is ROC Filing?

Every company is required to file the Audited financial statement and annual return as per The Companies Act, 2013 within 30 days and 60 days respectively from the conclusion of the Annual General Meeting date. Filing of an Audited financial statement is governed under Sections 129 and 137 of The Companies Act, 2013 read with Rule 12 of the Company (Accounts) Rules, 2014 and annual return is governed under Section 92 of the Companies Act, 2013 read with Rule 11 of the Companies (Management and Administration) Rules, 2014.

The procedure of ROC filing the annual return and audited financial statement can be easily understood by the following process:

1. Hold another Board Meeting for approving the audited financial statements, Board Report, and Annual Return by the directors of the company, and recommend re-appointment of the retiring statutory auditors of the company and fixation of the remuneration if any.

Fix day, date, time and venue for annual general meeting, and authorise the issuance of the AGM notice.

2. Conduct the Annual General Meeting of the Company and pass the necessary resolutions, such as consideration and adoption of the audited financial statement together with the board report and auditor report. Please note that the financial statements are considered final only when the same is adopted by the shareholders at the General Meeting.

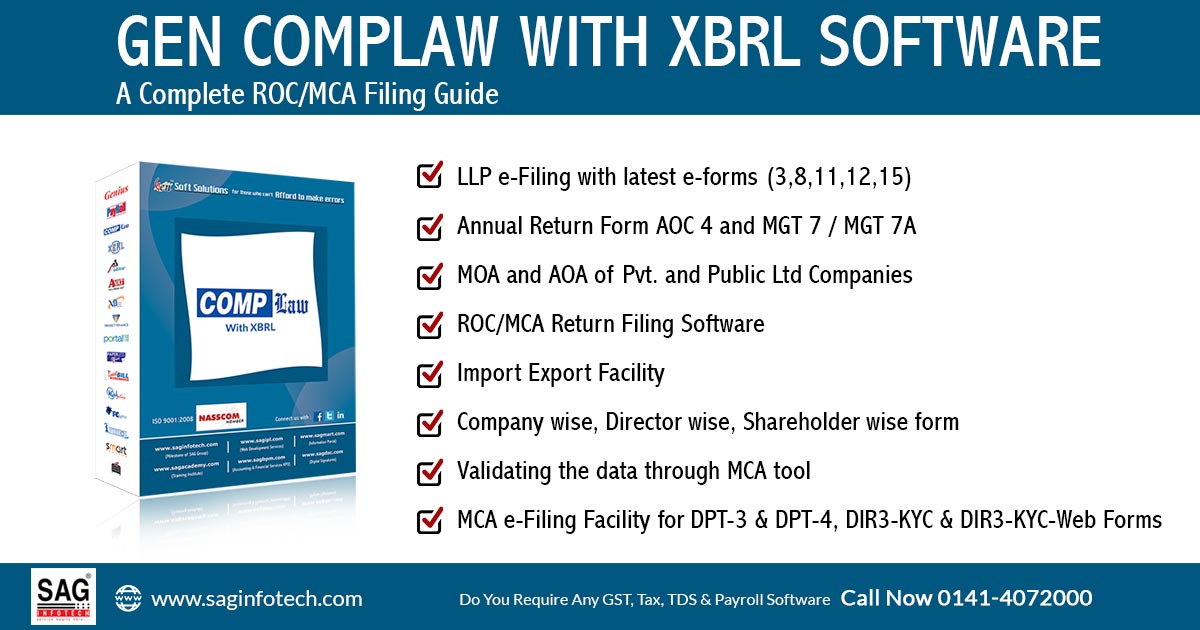

File ROC Returns Via Gen CompLaw Software, Get Demo!

Why ROC Filing is Important?

Compliance with the Law: Meeting the ROC filing obligations is essential for businesses to uphold their legal status. Not meeting the deadlines for submitting required documents can result in penalties, fines, or even the dissolution of the company. Adhering to these rules demonstrates a company’s dedication to transparent and accountable business operations.

Equitable Financial Reporting: ROC filing encompasses submitting financial statements like balance sheets, profit and loss accounts, and cash flow statements. These reports offer stakeholders such as investors, creditors, and government bodies a true and fair overview of the company’s financial performance. Clear financial reporting boosts investor trust and bolsters the company’s standing.

Blocking Legal Effects: Meeting ROC filing requirements shields companies from legal consequences stemming from non-compliance, safeguarding them against potential legal actions and fostering a seamless operational environment.

Availability of Business Financing and Loans: Before extending loans or funding, financial institutions and investors frequently seek access to a company’s financial statements and compliance records. ROC filing allows businesses to demonstrate their financial stability and creditworthiness, thereby enhancing their prospects of securing loans and drawing investments.

Developing Trustworthiness: Consistently submitting financial statements to the ROC exhibits a company’s credibility and dependability. This, in effect, can entice potential clients, customers, and partners, nurturing business growth and facilitating expansion.

Key Components of Annual Filing

Every company has to attach some important documents while filing the ROC and including:

- Balance-Sheet: Form AOC-4 is to be filed by all companies while ROC filing

- Profit & Loss Account: Form AOC-4 is to be filed while ROC filing by all companies

- Annual Return: MGT 7 and MGT 7A to be filed by companies

- Cost Audit Report: Form CRA 4 to be filed by the companies

ROC Filing Due Date for Company

On the type and size of the company, the last dates for ROC filing vary. For example:

- AOC-4: Within 30 days From the Conclusion of AGM

- MGT-7/ MGT-7A: Within 60 Days From The Conclusion of AGM

E-Forms are Required to be Filed with ROC

| Name of E-form | Purpose of E-form | Attachments | Due date of filing | Applicability on Company |

|---|---|---|---|---|

| Form ADT-1 | Appointment of Auditor | Copy of the intimation sent by the company, such as Appointment Letter, a Copy of the written consent given by the auditor | Private Companies, Public Limited Companies, One Person Company | 15 days from the date of the AGM. |

| Form AOC-4 and Form AOC-4 CFS (in case of Consolidated financial statements) | Filing of Annual Accounts | Copy of financial statements duly authenticated as per section 134 (including auditors’ report and other documents), Supplementary or test audit report under section 143, Details of comments of CAG of India, Statement of the facts and reasons for not adopting the financial statement in the annual general meeting (AGM) Statement of the fact and reasons for not holding the AGM per the nature of Company and financial statements | 60 days from the date of the AGM. | Companies prescribed as per The Companies (Cost Records and Audit Rules), 2014 amended from time to time. |

| Form AOC-4 (XBRL) | Filing of Annual Accounts in XBRL mode | XBRL financial statements duly authenticated as per section 134 (including Board’s report, auditors’ report and other documents), XBRL document in respect Consolidated financial statement, Copy of financial statements duly authenticated as per section 134 (including auditors’ report and other documents) Supplementary or test audit report under section 143 if any Details of comments of CAG if India if any, XML document of financials of the Company | 30 days from the date of the AGM | Listed companies in India and their Indian subsidiaries (or) a public company With paid-up capital >= 5 crores (or) With turnover>=100 crores |

| Form MGT-7/MGT-7A | Filing of Annual Return | List of shareholders, debenture holders, MGT-8 | 60 days from the date of the AGM | Private Companies, Public Limited Companies, Listed Companies, One Person Company |

| Form CRA-4 | Filing of Cost Audit Report | XML document of Cost Audit report | 30 days from the date of the concerned Board Meeting | Private Company, Public Limited Companies, Listed Companies, One Person Company |

| Form MGT-14 | Filing of resolutions with MCA regarding approval of Board Report and Annual Accounts | A certified true copy of the resolution. | 30 days from the date of concerned Board Meeting | Public Companies and Listed Companies (Exempted for private companies) |

ROC E-filing Process on MCA (www.mca.gov.in)

AOC-4

AOC-4 Submitted in a revised version on the MCA V 3 portal. AOC-4 can be filed online as well as offline on the MCA V3 Portal. In the offline process, initially require basic information about the company after which the form can be downloaded in an Excel sheet to fill in detailed data and uploaded back.

AOC-4 Online Process

Login V3 Portal using your registered user ID and password, and after that, go to MCA Services ⏩ Company E filing ⏩ Annual Filings⏩ AOC-4 Financial Statement & other documents.

Enter general information about the company, such as Corporate Identity Number (CIN), Once entered, related data will be auto populated ⏩ to fill in details like Financial year to which it is pertain and other relevant particulars such as signatory details, details of the director IRP, RP, Liquidator who have signed the report ⏩ AGM details and after click the save button to further proceed.

Indicate whether a consolidated financial statement is required or not. If yes is selected in this field, then the user has to mandatorily file a linked form AOC-4 CFS along with AOC-4, click on the save button to proceed to the next section.

Enter all the financial data in the balance sheet section in the current year, and data in the previous year will be prefilled and in editable mode. If the user wants to edit previous year data, the user may provide a reason for such change.

Provide a detailed breakup of figures in the balance sheet of current year and in the previous year data will be prefilled and editable, and click on the save button to move forward. Fill in details regarding financial parameters and click the save button.

Fill information in respect of the profit and loss account. Provide a detailed breakup of figures in the profit and loss account of the current year and in the previous year, data will be prefilled and editable.

User indicates whether any transaction has been entered between the related parties if yes is selected, then the user mandatorily file the Linked form AOC-2 along with AOC-4.

In case the user selects Section 135 or & Report for unspent CSR amount &, and the form is filed for the Financial Year 2024-25 onwards, linked filing for CSR-2 form shall be automatically enabled.

Attach all mandatory and optional documents and get it digitally signed, after signing, submit the form once the AOC-4 is submitted, the portal automatically enables linked forms such as AOC-4 CFS, AOC-2, CSR-2, Extract of auditor reports, extract of board reports, fill and submit these linked forms.

MGT-7/7A Online Process

Log in V3 Portal using your registered user ID, and after that, access MCA Services ⏩ Company E filing ⏩ Annual Filings⏩ access MGT-7 Annual Return other than OPC and small companies.

Enter company information using CIN, once entered, related data will be auto populated ⏩ Provide Latitude and Longitude details as on the filing date and as on the financial year end date ⏩ attach a photograph of the registered office of the company showing the external building and name prominently visible.

Provide other details as required by the form, ⏩ provide the details of Holding, Subsidiary and associate (including Joint Venture) through excel functionality via the specified template only. Download the Excel template, provide the details of Holding, Subsidiary and associate (including Joint Venture) and after saving the details there in upload the same.

Provide details regarding share capital, Debenture and other securities of the

Company Details of shares/Debentures Transfers since the closure date of the last financial year (or in the case of the first return at any time since the incorporation of the company) this field shall be displayed if NIL checkbox is not selected. These transfer details shall be provided through Excel functionality via the specified template

Attach the List of shareholders, debenture holders via an Excel template and optional documents and get it digitally signed. After signing, submit the form.

ROC Filing Method

The procedure of ROC filing concerns distinct essential steps:

- Compiling Records: Companies are obligated to gather all pertinent documents, including financial statements, balance sheets, profit and loss accounts, and compliance records.

- Verifying and establishing Up Accounts: The financial records need meticulous examination and validation to guarantee precision and adherence to accounting regulations.

- Filing Particular Forms: Businesses are required to complete particular forms assigned by the Registrar of Companies, which encompass details regarding the company’s activities, financials, and adherence status.

- Fee Payment: Companies need to pay the set filing fees, including document submission.

- Verification and Certification: A practising professional, such as a Chartered Accountant or Company Secretary, verifies and certifies the submitted documents.

- Submit Required Documents and Form: The completed forms and financial documents should be submitted on the portal of the MCA (Ministry of Corporate Affairs).

Difficulties with ROC Filing

Even though ROC filing holds immense importance, companies frequently face several challenges, including:

- Being Aware of Complexity: The intricate legal and financial terminology often confuses business proprietors, resulting in filing mistakes.

- Missing Due Date: Internal mismanagement or unawareness can cause companies to overlook filing deadlines.

- Error in Data: Presenting inaccurate information in filings can invite legal consequences and damage the company’s image.

- Penalties linked with Non-Compliance: Disregarding ROC filing regulations can lead to substantial penalties, impacting the company’s financial stability.

- Adapting a new form process may require time and training.

General Points to be Kept in Mind While Doing the Annual ROC Filing

- The notice of the Board Meeting should be sent to all the directors before 7 days and an acknowledgement for the same should be taken.

- As per Section 134 of the Companies Act, 2013 the financial statement, including consolidated financial statement, if any, shall be signed on behalf of the Board at least by the chairperson of the company where he is authorized by the Board or by two directors out of which one shall be the managing director and the Chief Executive Officer if he is a director in the company, the Chief Financial Officer and the company secretary of the company, wherever they are appointed, or in the case of a One Person Company, only by one director.

- As per Section 101 of the Companies Act, 2013, a clear 21-day notice for the general meeting shall be given to all the members, legal representatives of any deceased person, the auditor, and every director of the company by physical or electronic mode. The notice should also contain the location map of the venue of the general meeting as per Secretarial Standards and should be placed on the website, if any.

- The company shall prepare its books of accounts and keep them at its registered office. If the company chooses to place at any other place, then the company will have to file AOC-5 by passing a board resolution.

Conclusion: From the above, we can conclude that all the Companies registered under the Act will have to file their Audited financial statement and annual returns as per the provisions of the Companies Act, 2013 through the MCA V3 portal within the prescribed time period.

The new AOC-4 AND mgt-7/7A forms are designed to make annual filing more transparent, streamlined, user user-friendly.

ROC Filing FAQs

Q.1 What is ROC Filing, and why is it mandatory for my company?

ROC filing entails the submission of necessary paperwork and financial declarations to the Registrar of Companies. It is a compulsory obligation for every company that is registered under the Companies Act to adhere to regulatory obligations. By completing ROC filing, businesses ensure adherence to legal requirements, promote transparency, and establish accountability.

Q.2 Which documents are necessary for ROC filing?

Typically, financial declarations such as balance sheets, profit and loss accounts, compliance records, and specific forms prescribed by the Registrar of Companies are required for ROC filing.

Q.3 What are the deadlines for ROC filing?

The deadlines for ROC filing differ based on the company’s type and size. Private limited companies have 30 days, public limited companies have 60 days, one-person companies have 60 days, and small companies have 90 days to complete their ROC filing from the Annual General Meeting (AGM).

Q.4 What are the consequences of missing the ROC filing deadline?

Failure to meet the ROC filing deadline can result in penalties, fines, or even potential dissolution of the company. Adhering to the prescribed due dates is crucial to avoid any legal repercussions.

Q.5 What advantages does ROC filing provide to my business?

Many benefits can be availed through ROC Filing including:

- Ensuring Legal Compliance: It guarantees that your business follows the regulations outlined in the Companies Act

- Transparent Financial Reporting: It provides stakeholders with accurate financial information, fostering trust and credibility

- Access to Business Loans and Funding: By demonstrating financial stability, it attracts potential investors and facilitates obtaining business loans

- Building Credibility: It instills trust among clients, customers, and partners, contributing to business growth

Q.6 Can I file ROC documents, or does it require professional assistance?

Yes, you can file ROC documents independently, approaching a professional like a Chartered Accountant or Company Secretary, will ensure accuracy and compliance with accounting laws.

Q.7 What are the issues often faced while ROC filing?

- Lack of Understanding: Complex legal and financial terminology may lead to errors during filing

- Missing Deadlines: Internal mismanagement or lack of awareness can cause companies to overlook filing deadlines

- Incorrect Information: Furnishing inaccurate information can result in legal consequences

- Non-Compliance Charges: Failure to comply with ROC filing regulations can incur substantial penalties

Q.8 How frequently is it required to file ROC documents?

ROC documents, including annual returns and financial statements, must be filed on an annual basis according to the specified deadlines based on your company’s type.

Q.9 Can the ROC filing process be done through online mode?

Indeed, it is possible to file ROC documents online through the Ministry of Corporate Affairs (MCA) portal.

Q.10 Is ROC filing obligatory for companies of all types?

Yes, ROC filing is a mandatory requirement for all companies registered under the Companies Act, irrespective of their size or type.

Q.11 How to process a hassle-free ROC filing for my business?

To ensure a seamless ROC filing process, consider the following steps:

- Begin preparations well in advance and gather all the necessary documents

- Engage with the services of professionals to ensure accurate and timely filings

- Regularly update your financial records to facilitate a smooth filing process

Q.12 Does ROC filing differ across industries?

ROC filing requirements generally follow a standardized approach for companies registered under the Companies Act, irrespective of the industry. However, specific industries may have additional compliance obligations based on their operational characteristics.

Q.13 Can I correct or revise ROC filings if errors are discovered?

If errors are identified, you can rectify or revise your ROC filings by applying for rectification to the Registrar of Companies. However, it is advisable to conduct thorough document verification before filing to prevent errors.

Q.14 How to monitor the status of my ROC filing?

You can monitor the progress of your ROC filing by accessing the MCA portal and monitoring the concerned section for updates and notifications.

Q.15 Is ROC filing suitable for startups and small businesses?

ROC filing is relevant for startups and small businesses, similar to any other registered entity. It plays a critical role in ensuring that these businesses comply with the law and maintain transparency in their financial operations. Regardless of their size, all companies need to fulfill their ROC filing obligations to stay legally compliant and maintain financial transparency.

Our company name is Maharashtra State Oil Seeds commercial & industrial Corporation Ltd incorporated on 30th March 1974. we didn’t do RCO Annual return from FY 2016. could you please guide me how to file ROC?

Dear Team

My person who is handling Roc matter is out of country i need your help i have knowledge of all forms which is prepared by me but when i login under v3 it takes me my workspace i do not have that detail how to file returns advise

Please update or revise or edit your this full article according to the latest or current v3 Mca portal.

one of my client company’s share capital i.e authorized & paid-up capital was increased after 31.03.2020 than which amount should mention in form MGT- 7?

and calculation turnover and net worth mention in the CSR column and other columns. It’s any different?