XBRL is required by almost all corporate companies to furnish their compliance with the Ministry of Corporate Affairs.

As the XBRL format is widely used in corporate companies, it is an encrypted way to share the financial details of the business with the government and has been made possible with the help of software.

The XBRL filing has to be done on time, and here we have showcased the timeline and due dates to file the XBRL as per the demand of the MCA.

XBRL Filing Due Dates for FY 2024-25

| Name of E-form | Purpose of E-form | Due date of Filing | Due date for FY 2024-25 |

|---|---|---|---|

| Form AOC-4 (XBRL) | Filing of Annual Accounts in XBRL mode | 30 days from the conclusion of the AGM | 31st January 2026 (Revised) |

| Form AOC-4 (XBRL) for IND AS-based Financial Statement | Filing of Annual Accounts based on Indian Accounting Standards in XBRL mode | 30 days from the conclusion of the AGM | 31st January 2026 (Revised) |

| Form CRA-4 | Filing of Cost Audit Report | 30 days from the receipt of Cost Audit Report | 31st December 2025 (Revised) |

| Form AOC-4 (NBFC) IND and Form AOC-4 CFS (NBFC) IND | Filing of Annual Accounts based on Indian Accounting Standard for Non-Banking financial institutions NBFC | 30 days from the conclusion of the AGM | 31st January 2026 (Revised) |

Note:

- General Circular No. 08/2025 for MGT-7, MGT-7A, АОС-4, АОC-4 CFS, AOC-4 NBFC (Ind AS), AOC-4 CFS NBFC (Ind AS), AOC-4 (XBRL). Read Circular

- General Circular No. 07/2025 for MCA form CRA-4 (Cost Audit Report in XBRL format). Read Circular

The Concept of Penalty/Additional Fees

NOTE: The additional Fee for E-form AOC-4 (XBRL and non-XBRL) and Form MGT-7 after the due date is INR 100 per day, effective from July 1, 2018.

Penalty for other forms and Docs

| Period of Delays | Fees |

|---|---|

| Up to 30 days | 4 times the normal fees |

| More than 30 days and up to 60 days | 6 times the normal fees |

| More than 60 days and up to 90 days | 10 times the normal fees |

| More than 90 days and up to 180 days | 12 times the normal fees |

| More than 180 days and up to 270 days | 12 times of normal fees |

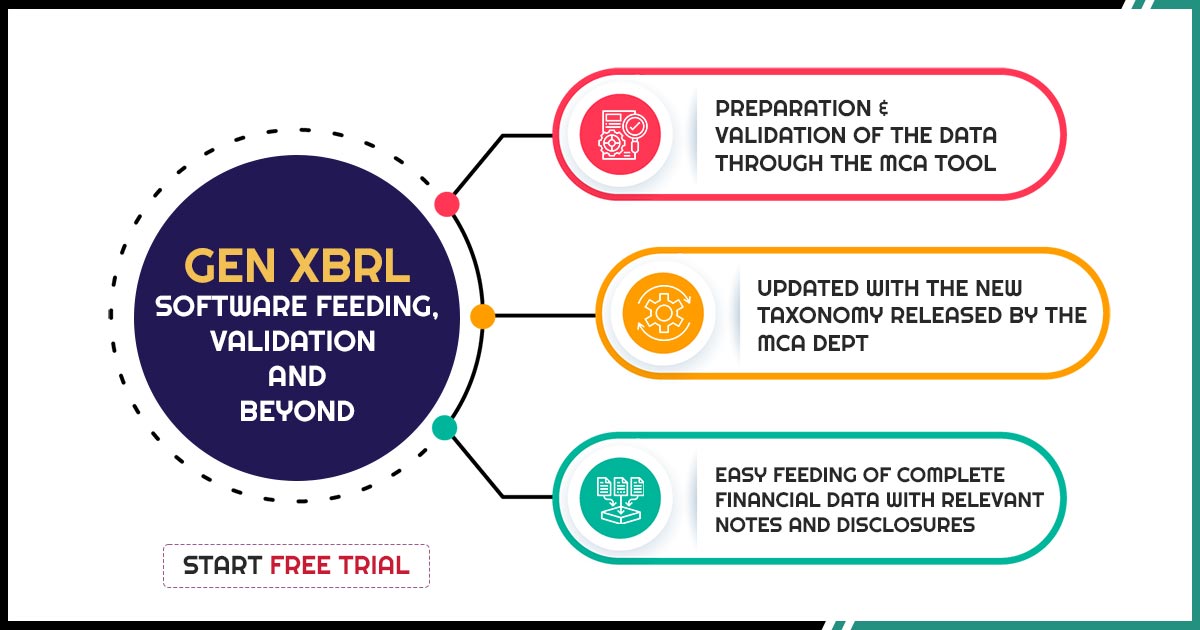

Recommended: Download Free Trial Version of XBRL Return Filing