XBRL is required by almost all corporate companies to furnish their compliance with the Ministry of Corporate Affairs.

As the XBRL format is widely used in corporate companies, it is an encrypted way to share the financial details of the business with the government and has been made possible with the help of software.

The XBRL filing has to be done on time, and here we have showcased the timeline and due dates to file the XBRL as per the demand of the MCA.

XBRL Filing Due Dates for FY 2025-26

| Name of E-form | Purpose of E-form | Due date of Filing | Due date for FY 2025-26 |

|---|---|---|---|

| Form AOC-4 (XBRL) | Filing of Annual Accounts in XBRL mode | 30 days from the conclusion of the AGM | 29 October 2026 (If AGM held on 30 September, 2026) |

| Form AOC-4 (XBRL) for IND AS-based Financial Statement | Filing of Annual Accounts based on Indian Accounting Standards in XBRL mode | 30 days from the conclusion of the AGM | 29 October 2026 (If AGM held on 30 September, 2026) |

| Form CRA-4 | Filing of Cost Audit Report | 30 days from the receipt of Cost Audit Report | 30 days from the receipt of Cost Audit Report |

| Form AOC-4 (NBFC) IND and Form AOC-4 CFS (NBFC) IND | Filing of Annual Accounts based on Indian Accounting Standard for Non-Banking financial institutions NBFC | 30 days from the conclusion of the AGM | 30 days from the conclusion of the AGM |

The Concept of Penalty/Additional Fees

NOTE: The additional Fee for E-form AOC-4 (XBRL and non-XBRL) and Form MGT-7 after the due date is INR 100 per day, effective from July 1, 2018.

Penalty for other forms and Docs

| Period of Delays | Fees |

|---|---|

| Up to 30 days | 4 times the normal fees |

| More than 30 days and up to 60 days | 6 times the normal fees |

| More than 60 days and up to 90 days | 10 times the normal fees |

| More than 90 days and up to 180 days | 12 times the normal fees |

| More than 180 days and up to 270 days | 12 times of normal fees |

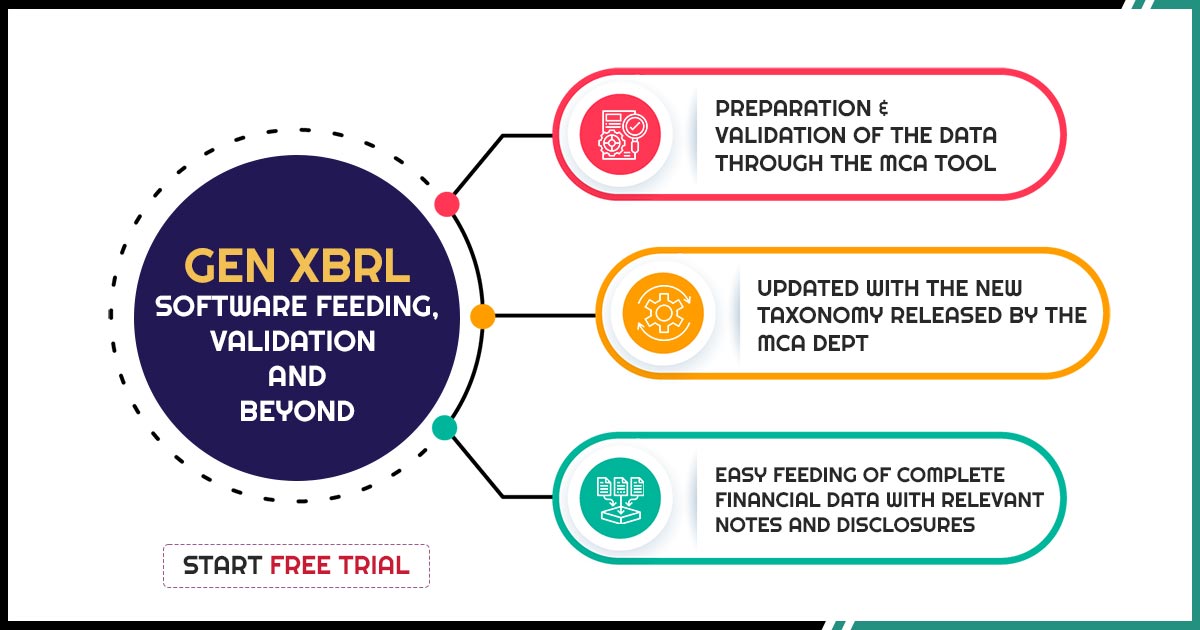

Recommended: Download Free Trial Version of XBRL Return Filing

God afternoon sir,

I was working in a private limited firm. I need to know what are all the documents that need to be furnished monthly, quarterly, half yearly, and annually. kindly mention with due dates.

Please refer blog regarding due dates of annual compliances.

Recent changes in Company act and IND AS have specified new requirements in Asset Valuation methodology and Eligibility criteria for Registration of Valuers in various Asset categories. Mandatory Coursework, the passing of Valuer’s Examination (conducted by IBBI), and Continuous Education Program have been specified for getting Registration as a VALUER under Company Act.

Bench-Mark team has Qualified and Experienced Registered Valuers in all the THREE categories to offer Comprehensive services required by Businesses, Industry, and Government Organisations.

I have purchased GEN XBRl software and due to some reasons have failed to update the same for the financial year 2017-18 onwards, if I will update the software for the year 2018-19 will I be able to do XBRL for the year 2017-18, kindly help

Yes, you can be able to do XBRL filing for FY 2017-18.

I have filed AOC 4 XBRL along with the consolidated financials. i.e. the option no 8 “Whether consolidated Financial Statements are also being filed” was selected as YES. So is filing of AOC 4 CFS mandatory for this company OR it is mandatory only when AOC 4 or AOC 4 XBRL is filed without consolidated financials. I am asking coz the form AOC 4 CFS is throwing message of invalid SRN when SRN of AOC 4 XBRL is filled.

Also, do let me know a link to the pricing of your software for XBRL?

Thanks….

In case of XBRL applicability, company’s financial instance (XML file of standalone and consolidated) shall be filed as an attachment of E-form AOC-4 XBRL. You don’t need file E-form AOC-4 CFS.

You can check the price at the following link:

https://saginfotech.com/GenCompanye-filerXBRL.aspx

There is a simple question which is needed to confirm. Please solve this query asap.

A company whose turnover till March 2017 is below 5 crores and in April 2017 its turnover is more than 5 crore. Is the company required to file the XBRL in the financial year 2016-2017

We are confused regarding the filing of XBRL in case of a company named GLOBAL STONES PRIVATE LIMITED. The paid-up capital of the company for the year 2016-17 is 42,936,200 and the reserves and surplus of the company are 143,599,99. Also, the turnover is 686,158,790.

As per our understanding we only consider paid up up capital for the purpose of XBRL filing and the company has paid up less than 5 crores till March 2017. The paid-up capital of the company in October 2017 is more than 5 crore. In this case, the company is required to file the XBRl for the financial year 2016-2017.

Vide Notification dated 9th September 2015, Ministry of Corporate Affairs has notified “Companies (Filing of documents and forms in Extensible Business Reporting Language) Rules, 2015”. As per the same, companies falling in the following categories will have to file their Financial Statements under section 137 of the Companies Act, 2013 using the Extensible Business Reporting Language (XBRL) taxonomy for financial year commencing on or after 1st April 2014:-

v. all companies listed on any Stock Exchange(s) in India and their Indian subsidiaries; or

vi. all companies having paid up capital of Rupees five crore and above; or,

vii. all companies having a turnover of Rupees one hundred crore and above; or,

viii. all companies which were hitherto covered under the Companies (Filing of Documents and Forms

in Extensible Business Reporting Language) Rules, 2011:

However, companies in Banking, Insurance, Power Sector and Non-Banking Financial Companies are exempted

from XBRL filing.

Please advise on due dates for AOC-4 IND AS based Taxonomy for FY 2016-17. Is the final Taxonomy available? Is your software ready for IND AS taxonomy?

Till date IND AS taxonomy has not been finalized by the MCA, so when MCA will provide the final taxonomy for IND AS, we will provide the same through an update. Also, there is no update/notification from MCA regarding the extension of filing due date.

For the financial year 2016-17, due date of AGM is 29.09.2017 as 30.09.2017 is a national holiday, Dusshera, last date of filing of AOC 4 is 28.10.2017

Is due date for filing AOC 4 XBRL extended upto 30.10.2017 even if AGM is held on 28.07.2017. Normally it is to be filed within 30 days of AGM. I m not able to find any circular for extension? The software is also not ready for the same… So how the same are being filed by the listed companies which have already done with AGM in May 17 itself?

Thanks….

There is no circular till yet regarding extension for due date of annual filing from MCA, the date 30/10/2017 is showing the last date of filing if the AGM will be conducted on last date i.e.30.09.2017 and also the taxonomy based on IND AS is not finalised by the MCA.

So is your software ready for FY16-17 XBRL filing (non IND AS)?

Do you believe the due date will be extended for both IND AS and other XBRL filings?

Yes, you can do FY 16-17 XBRL filing (non IND AS) and please contact at MCA helpdesk to know about due date extension of XBRL filing.

one Financial Statement of FY 2016-17 is available with me for filing but the XBRL software is not available for FY 2016-17. so when the software will be available for FY 2016-17.