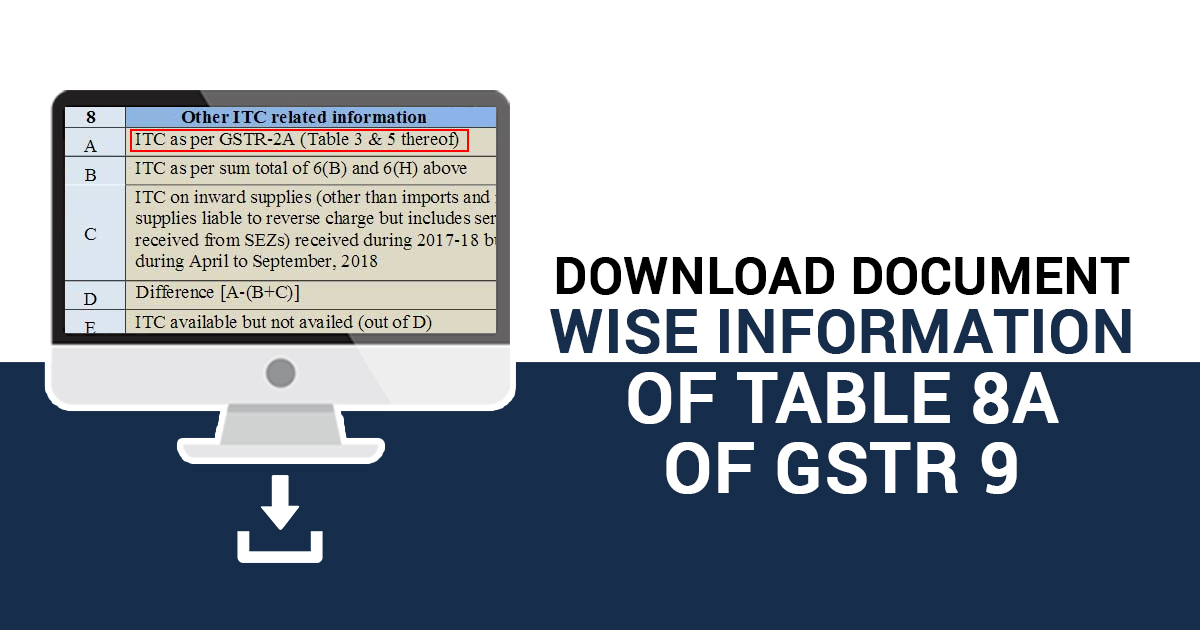

On August 17, Goods and Services Tax Network authorities released an update and notified about a new facility that has been provided on the GST portal to the taxpayers. With this facility, taxpayers can download document wise details of Table 8A of Form GSTR-9

As per the released update. The details will be downloaded in excel format and it will be packed in .zip file. The document wise details of Table 8A of Form GSTR-9 can be downloaded through a new option ‘Document wise Details of Table 8A’ which will be available on the GSTR-9 dashboard, from FY 2018-19 onwards.

Read Also: Latest Official Updates Under GST by Indian Government

This new function will help the taxpayers in reconciling the values appearing in Table 8A of Form GSTR 9, thus facilitating filling the Form GSTR 9. The new facility will be helpful for all the taxpayers to consolidate the values displayed in Table 8A of the GSTR 9 Form, thus it will make the filing of Form GSTR 9 a bit easier.

The excel will have details of issues like values of Input Tax Credit (ITC)

If you don’t know already, the details in Table 8A of Form GSTR 9 get auto-filled by fetching details from documents in filed either from Form GSTR-1 or GSTR-5 Form of the supplier. But it needs to be kept in mind that documents and details visible in GSTR-2A (Table 3 & 5) will not be available in Table 8A of Form GSTR 9 because uploaded or submitted documents in Form GSTR 1

Taxpayers can download the excel file by navigating to Services > Returns > Annual Return > Form GSTR-9 (PREPARE ONLINE) > DOWNLOAD TABLE 8A DOCUMENT DETAILS.

The excel file will have details of GSTIN, Trade Name or Legal Name of the supplier, the period (month) of document featured in GSTR-2A of the recipient, After it, the sheet will have details of B2B

Along with all these, it will also consist of details from Form GSTR-1/GSTR-5 filed till 31st October of the following year. If amendments have been made, only the latest value will be fetched. With all these, it will also show the status of “ITC available for Table 8A” with the response “Yes” or “No”. In case of unavailability of ITC a column named ‘Reason for Non-accounting’ will be also available in it.

Two more things that need to be mentioned here are, first, the excel files will be downloaded in .zip file and if the number of documents is large then it will be downloaded in multiple parts. And the second one is that the details saved or submitted in Form GSTR-1/5 will appear in Form GSTR-2A, but it will not be included in the downloaded excel file.