The Delhi bench of the Income Tax Appellate Tribunal ( ITAT ) in a ruling removed the penalty u/s 270A of the Income Tax Act, 1961, quoting that the income difference was due to the wrong recording of the written down value (WDV) of the auditor in the tax audit report and noted that ‘to err is human’ claiming that a bona fide error must not serve as the foundation to levy a penalty.

The respondent/ taxpayer, Mahashian Di Hatti Pvt. Ltd furnished a return declaring a total income of ₹383,45,50,210. The matter was designated for scrutiny under the Computer-Assisted Scrutiny Selection (CASS). In the assessment proceedings, the Assessing Officer (AO) recognized a discrepancy of Rs 1, 63,21,921 between the opening written down value (WDV) reported in the Income Tax Return (ITR) for the Assessment Year (AY) 2017-18 and the closing WDV for AY 2016-17.

The AO contended the taxpayer with this discrepancy u/s 142(1) of the Income Tax Act. In answer, the taxpayer admitted the mistake, remarking that the opening WDV for AY 2017-18 had accidentally been recorded based on the book value of the asset instead of the closing WDV for AY 2016-17.

Thereafter the taxpayer offered the excess depreciation claimed for taxation. Consequently, the assessment was completed u/s 143(3) on 12/12/2019, with a total income assessment of ₹385, 08,72,140/- after adding ₹1,63,21,921/- to the returned income. The AO initiated penalty proceedings u/s 271A of the Act for underreporting income due to the misreporting of ₹1,63,21,921.

The AO in the penalty proceedings, rejected the explanation furnished by the taxpayer and, by order on 02.09.2021, charged a penalty of ₹1,13,76,592, equivalent to 200% of the tax payable on ₹56,88,296.

The taxpayer appealed the penalty before the First Appellate Authority, which, by order on 29.01.2024, deleted the penalty. Therefore, the Revenue appealed the decision before the Tribunal.

Taxpayer representative Mr Vinod Kumar Bindal repeated the submissions made to the lower authorities. He elaborated that the difference between the assessed and returned income emerges as a clerical mistake in recording the opening WDV of the assets.

The emerged error as the WDV was inadvertently opted from the book value in the audited annual accounts prepared under the Companies Act, instead of WDV under the Income Tax Act, as cited in the tax audit report u/s 44AB.

The accounts and the tax audit report were both submitted with the income tax return. After realizing the error, the taxpayer promptly informed the Assessing Officer (AO) of the correction in a letter dated 29/11/2019, well before the completion of the assessment proceedings.

Bindal highlighted that there was no change in the value of assets purchased in the year and that the error was simply a clerical oversight. He pointed out that the taxpayer had already deposited advance income tax on the evaluated income, even after the addition.

A refund of Rs 1.88 crores has been granted to the taxpayer under the assessment order showing that no malintent in underreporting the income u/s 270A of the act. The levying penalty is there due to the reason that the taxpayer does not furnish the revised return u/s 139(4) of the Income Tax Act. Bindal supported the First Appellate Authority’s decision to delete the penalty.

The Tribunal including Judicial Member Kul Bharat and Accountant Member Brajesh Kumar Singh, analyse the case. The bench remarked that the difference between the evaluated and returned income was due to the bona fide clerical error in recording the WDV.

It was remarked by them that the first appellate authority has discussed the issue thoroughly in the impugned order and laid on the Jurisdictional High Court decision in the matter of Prem Brothers Infrastructure LLP vs. NFAC to justify the deletion of the penalty.

It was concluded by the bench that ‘to err is human’ and that a bona fide error must not be the reason for levying a penalty. Provided the case fact that the Tribunal confirmed the decision of the First Appellate Authority to delete the penalty, and the evenue’s backgrounds for appeal were dismissed.

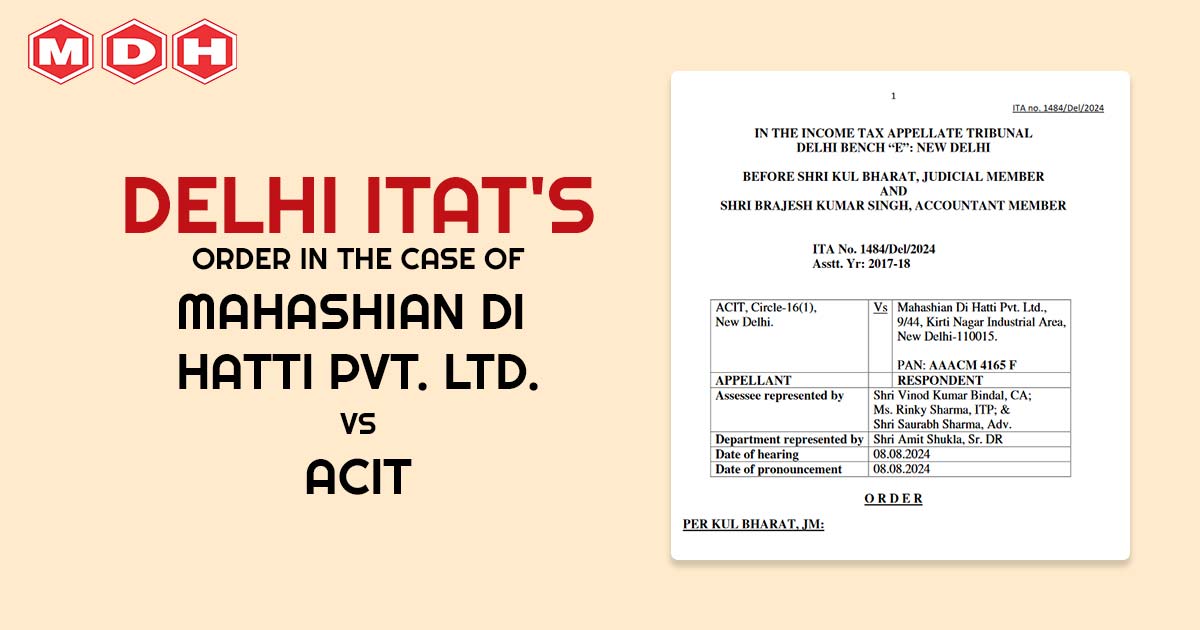

| Case Title | Mahashian Di Hatti Pvt. Ltd. Vs ACIT |

| Citation | ITA No. 1484/Del/2024 |

| Date | 08.08.2024 |

| Counsel For Appellant | Shri Vinod Kumar Bindal, Ms Rinky Sharma, Shri Saurabh Sharma |

| Counsel For Respondent | Shri Amit Shukla, Sr. DR |

| Delhi ITAT | Read Order |