The Central Information Commission ( CIC ) noted that the GST returns information could not be filed u/s 158(1) of the Central Goods and Services Tax Act ( CGST Act ), 2017. It was cited that the General Laws could not override the special law with the Non-Obstante Clause carrying the Supreme Court’s decision in the case Chandra Prakash Tiwari v. Shakuntala Shukla.

CIC addressed an RTO application furnished via the appellant dated January 31, 2023, asking for the GST payment information for Vadamalayan Hospital in Madurai from 2007 to 2022. The GSTIN of the hospital was specified in the request.

On February 8, 2023, the Central Public Information Officer (CPIO) citing that the urged data was not available in their office instructed the appellant to contact the CPIO of the Assistant/Deputy Commissioner of CGST and Central Excise, Madurai II Division, for additional assistance.

The appellant aggrieved from the answer filed a First Appeal on April 7, 2023, but did not obtain a resolution. Therefore the appellant presented the case before CIC via a second appeal.

In the hearing, both parties were present through video conference. It was claimed by the appellant that the data was not furnished via the respondent, while the CPIO elaborated that identical data has been asked in another RTI application dated February 28, 2023, which stresses that GST was executed from July 1, 2017, making the previous request from 2007 unfeasible. CPIO mentioned section 158(1) of the CGST Act, 2017, which precludes the GST return information disclosure.

Post analyzing the facts of both parties, the commission carried the position of the respondent. The CIC directed a Delhi High Court ruling (W.P.(C) 340/2023) that distinguished between the Right to Information Act, 2005, as a general law and Section 138 of the Income Tax Act, 1961, as a special provision concerning the disclosure of information related to the taxpayer. It was specified under distinction that the special law shall take precedence over the general law for the matter of conflict.

The ruling of the Delhi High Court stresses that the particular process for revealing the data for the third parties under the Income Tax Act should be fulfilled and the same need could not be transferred to the other authority under the general RTI act, CIC marked.

Vinod Kumar Tiwari, the Information Commissioner, determined that the refusal to provide the information was warranted according to the CGST Act, and the appellant has the option to seek the information directly through the relevant CGST Act channels.

Read Also: Delhi HC Quashes GST Cancellation Order Due to Lack of Specifics in Show Cause Notice

Therefore the commission discovered that the respondent had furnished an answer and no additional interruption was required. Hence affirming the limits of the data disclosure under the pertinent tax statutory the appeal was disposed of.

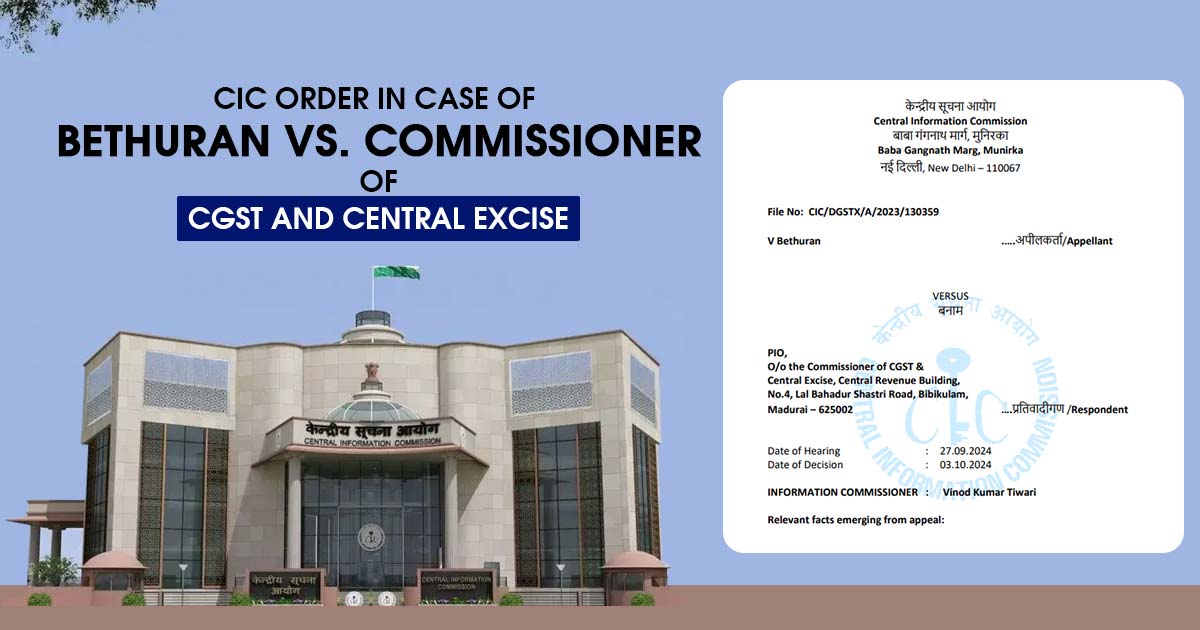

| Case Title | Bethuran vs. Commissioner of CGST and Central Excise |

| Citation | CIC/DGSTX/A/2023/130359 |

| Date | 03.10.2024 |

| Information Commissioner | Vinod Kumar Tiwari |

| CIC Order | Read Order |