All eligible individuals are required to file their income tax returns in compliance with the regulations. The 2024-25 financial year has brought new modifications to the Income Tax Rules, which will be implemented from April 1, 2024.

The new fiscal year (FY) 2024-25 begins on April 1, and the pronouncements made by Union Finance Minister Nirmala Sitharaman in the annual Union budget on February 1 will take effect as soon as FY 24 begins. Changes to income tax regulations, on the other hand, will have the greatest impact on taxpayers.

Latest Updates

- Budget 2026: The Finance Minister announced that there are no changes to the income tax slab rates for FY 2026–27.

New Changes in Income Tax Rules for the FY 2024-25

As a result, the following are the ten key income tax law changes that will take effect on April 1:

- Standard Tax Deduction: Under the old regime the deduction of Rs 50,000 would not be revised However under the New regime Standard Deduction is Rs.75000. Thus no tax liability will arise on total salary of Rs.5,50,000 Under Old Regime and Rs.7,75,000 Under New Regime. Budget 2024 has increased the family pension deduction has also been increased from ₹15,000 to ₹ 25,000.

New Income Tax Slabs with Rates: The new tax rates would be specified as:

- Yearly salary up to ₹3 lacks: Nil

- Rs3 lakh- Rs 7 lakh: 5%

- Rs 7 lakh to Rs 10 lakh: 10%

- Rs 10 lakh to Rs 12 lakh: 15%

- Rs 12 lakh to Rs 15 lakh: 20%

- Above Rs 15 lakh: 30%

New Changes in Income Tax Rules for the FY 2023-24

As a result, the following are the ten key income tax law changes that will take effect on April 1:

New Tax Regime: The finance minister announces that the new tax regime shall be the default one if, at the time of submitting returns, the individual does not mention which regime he opts old or new, for submitting the return.

Limit of Income Tax Rebate: The rebate limit would surge from Rs 5 lakh to Rs 7 lakh. It directed that a person who secures a salary of less than Rs 7 lakh a year would not need to make the investments to claim exemptions.

Standard Tax Deduction: Under the old regime, the deduction of Rs 50,000 would not be revised. A salaried person with a yearly income of Rs 5.15 lakh or exceeding that will benefit by Rs 52,500 as the same facility would get extended to the new regime.

New Income Tax Slabs with Rates: The new tax rates would be specified as:

- Yearly salary up to ₹3 lacks: Nil

- Rs3 lakh- Rs 6 lakh: 5%

- Rs 6 lakh to Rs 9 lakh: 10%

- Rs 9 lakh to Rs 12 lakh: 15%

- Rs 12 lakh to Rs15 lakh: 20%

- Above Rs 15 lakh: 30%

Leave Travel Allowance: From Rs 3 lakh the leave travel allowance encashment limit has been raised to Rs 25 lakh since 2002.

Premiums of Life Insurance Policies: Tax is to be levied on the Proceeds from life insurance premiums over the annual premium of Rs 5 lakh.

Benefits for Senior Citizens: Under the senior citizens’ savings scheme, the maximum deposit limit is extended to Rs 30 lakh from Rs 15 lakh, to Rs 9 lakh from Rs 4.5 lakh, and to Rs 15 lakh from Rs 7.5 lakh for the monthly income scheme (single and joint accounts, respectively).

Gold Conversion: If physical gold is converted to Electronic Gold Receipt (EGR), or vice-versa, then no capital tax gain needs to be paid.

Major Income Tax Changes Made for the FY 2021-22

We mentioned major changes below in the income tax return filing for the financial year of 2021-22:

Non-Filing of ITR for Over 75 Years of Age

Individuals over 75 years of age with pension income and interest from accounts maintained in the same bank from which the pension is received will be exempt from filing income tax returns under the new budget of 2021.

TDS at a Higher Tax Rate

New sections 206AB and 206CCA of the Income Tax Act have been introduced to raise the TDS deduction rates in the budget 2021. A minimum of 5% of TDS or TCS must be paid by the individuals who haven’t filed their ITR and have a TDS or TCS deduction exceeding Rs 50,000 over the past two years. It is the deductor’s responsibility to collect the ITR proofs from the individuals in order to comply with the law.

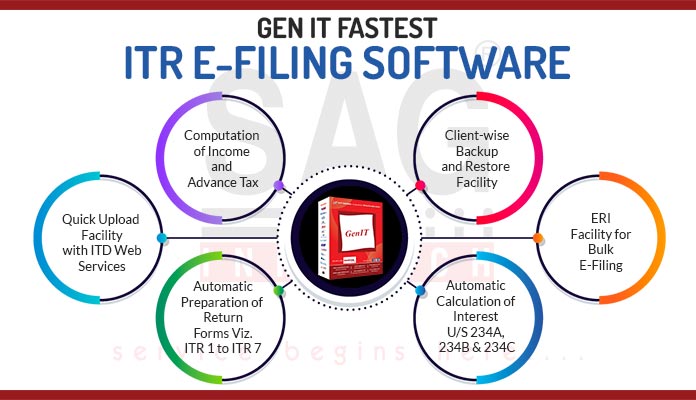

Pre-filled Income Tax Return Forms

The new budget will provide taxpayers with pre-filled ITR forms. The purpose of this proposal is to simplify the regulations for taxpayers. In the ITR, details such as tax payment, salary income, TDS, etc., will be prefilled. In addition, details of dividend income, capital gains from listed securities, interest from post offices and banks, etc., will also be prefilled to simplify ITR filing. A simplified approach to filing income tax returns is proposed.

Below are the Major Changes Made for the FY 2020-21:-

Income tax returns have to be filed by every eligible candidate by the norms & regulations. With the Union Budget 2020-21, FM Nirmala Sitharaman has introduced some major changes in the Income Tax Rules. From 1st April 2020, these changes will come into effect.

From 1st April 2020, FM Nirmala Sitharaman has introduced a new optional tax regime. Those who opt for such a regime will have to forego certain deductions and exemptions.

For Individuals and HUF:- New section 115BAC has been proposed to be introduced to provide tax at low rates. Individuals/HUFs not having a business income can opt for such a regime. The option once exercised can be withdrawn only once. If the individuals/ HUF ceases to have business income can again opt for such a scheme.

IT Slabs Rate for FY 2020-21 Under the New Regime:-

| Rate of Tax | F.Y. 2020-21 |

|---|---|

| Nil | Up to INR 2,50,000 |

| 5% | From INR 2,50,001 to INR 5,00,000 |

| 10% | From INR 5,00,001 to INR 7,50,000 |

| 15% | From INR 7,50,001 to INR 10,00,000 |

| 20% | From INR 10,00,001 to INR 12,50,000 |

| 25% | From INR 12,50,001 to INR 15,00,000 |

| 30% | Exceeding INR 15,00,000 |

Surcharge Rates will be as follows:-

- Total Income exceeding Rs 50 lakhs but not exceeding 1 crore @ 10%

- Total Income exceeding Rs 1 crore but not exceeding Rs 2 crores @ 15%

- Total Income exceeding 2 crores but not exceeding 5 crores @ 25%

- Total Income exceeding Rs 5 crore @ 37%

For the assessee opting for a new tax regime, the total income shall be computed without providing the following exemptions:-

- Without claiming the exemption, deductions and incentives available under the specified section of the IT Act, namely sections 10AA, 32AD, 33ABA, 35(1)(ii), 35(1)(iia), 35(1)(iii), section 35(2AA), 35AD, 35CCC, and chapter VI A deductions (except

- Leave Travel Allowance under clause 5 of Section 10(5).

- House Rent Allowance under Section 10(13A).

- Allowances to MPs/MLAs under section 10(17).

- Allowances for income of minor u/s 10(32), etc.

- Standard deduction of Rs 50,000 u/s 16.

- Deductions from House Property Income of interest paid on house loan (Self-occupied/Vacant) u/s 24.

- Entertainment allowance and employment/ professional tax will not be available.

- Deduction of Rs 25,000 for family pension u/s 57.

- Set off of carry forward loss and depreciation from earlier assessment years is not allowed.

- Without setting off a loss under the head of income from house property.

- Without the benefit of accelerated depreciation u/s 32(1)(iia). However, normal depreciation can be claimed u/s 32.

However, the following are the exemptions/ deductions/ allowances that still remain available to the assessee in the new tax regime as well:-1.

- Individuals/ HUF having units in the International Financial Service Center (IFSC), deductions u/s 80LA

- Deduction U/s 80CCD(2) and 80JJAA will be available.

- The deduction will still remain available for Post Office Savings Interest ( Rs 3500 for Individual Account Holders and Rs 7000 for Joint Account Holders).

- The maturity Amount Received in LIC will be exempt.

- Interest accrued and maturity amount received in the Sukanya Samridhi Yogana will still remain exempt.

- Employer’s Contributions towards NPS, EPF or Superannuation fund will still remain exempt up to Rs 7.5 lac, and any amount over it will be taxable in the employee’s hands.

- Gifts received up to Rs 5000 from the employer will still remain exempt in the hands of employees. More than it will remain taxable.

- Food coupons received from the employer will be exempt up to Rs 50 per meal to a maximum of 2 meals per day.

- The amount received on Leave Encashment will remain exempt.

- The amount received on the Voluntary Retirement Scheme will remain exempt up to Rs 5,00,000.

For Cooperative Society:- New section 115BAD has been introduced to provide taxability of resident co-operative Society at the rate of 22%. A surcharge of 10% will be charged. No AMT liability will be imposed on that resident co-operative who opts for the new tax regime. The option once exercised by the resident cooperative society can’t be withdrawn in the subsequent years.

FM Nirmala Sitaraman has made some changes in the old regime as well. Some of the changes are as follows:-

- Dividend Distribution Tax is not applicable to companies from 1st April 2020. The dividend is now taxable in the hands of recipients.

- New Direct Tax Dispute Scheme, i.e. VivadSaeVishwas Scheme, has been launched. Interest and penalty will be waived for those who will pay the amount by 31st March 2020. However, the date of 31st March 2020 has been extended to 30th June 2020 due to the COVID-19 Effect.

- Tax Audit threshold limit under section 44AB has been increased from 1 crore to 5 crore, provided that turnover/gross receipts in cash during the previous year does not exceed 5%. Also, the payment made in cash during the previous year does not exceed 5%.

- For new manufacturing and power Sector Companies concessional corporate tax rate of 15% has been introduced.

- Section 234G (insertion of the new section) relating to the payment of a fee of Rs. 200 per day for default in furnishing statements or certificates under section 35 by a research association, university, college, company or any other institution.

Under the Head Capital Gain

- Section 43CA, if the value adopted for the purpose of stamp duty does not exceed 110% of the actual consideration received, then consideration so received shall be deemed to be the full value of the consideration for computing profits and gains on transfer of such asset other than capital assets. Before the amendment, it was 105% instead of 110%.

- Section 50C in case of transfer of capital asset being land or building or both if value adopted for the purpose of stamp duty does not exceed 110% of the actual consideration received, then consideration so received shall be deemed to be the full value of consideration for computing capital gain on transfer of such capital assets. Before the amendment, it was 105% instead of 110%.

Under the head, House Property under section 80EEA, the additional deduction of Rs 1.5 lakh for the interest on the home loan will be allowed for the loan sanctioned till 31st March 2021.

Under the Head TDS

- Section 194:- TDS @ 10% will be deducted by Indian companies on dividends paid to a shareholder who is a resident of India if the amount exceeds Rs 5000.

- Section 194O:- If the annual amount paid or credited by the e-commerce operator to its participants during the financial year exceeds Rs 5 Lakh then the operator will have to deduct TDS @ 1% (upto 30th Sep 2024) and 0.1% (1st Oct 2024 onwards)

- Section 194K: – TDS @ 10% on dividend paid by Mutual Fund if the amount of Dividend exceeds Rs 5000.

- Section 194J:- TDS 2% on fees for technical services.

- Section 206AA:- If PAN Number is not available in the case of section 194O, then TDS @ 5% will be charged instead of 20%.

Is the number of houses restricted to maximum 2 for saving LTCG, Can a Taxpayer invest in 3rd or 4th house to save tax or not

Are there any other amendments applicable for Income from other source chapters for AY 2021 -22?

WHILE SUBMISSION OF TAX RETURN FOR F.Y.2018-19, FORM 10E HAS NOT BEEN SUBMITTED AND RELIEF U/S 89 HAS NOT AVAILED. CAN I SUBMIT THE REVISED RETURN CLAIMING RELIEF U/S 89 ALONG WITH FORM 10E? IF YES THEN the LAST DATE PLEASE.

Last date to file belated and revise return for Fy 2018-19 is 30 Sep 2020 and you can file form 10E along with the ITR.

What is the first date ITR 3 filling f/y 2019?

The due date for filing returns for the AY 2019-20 is 31.07.2019. For ITR-3, the department has released excel utility today.