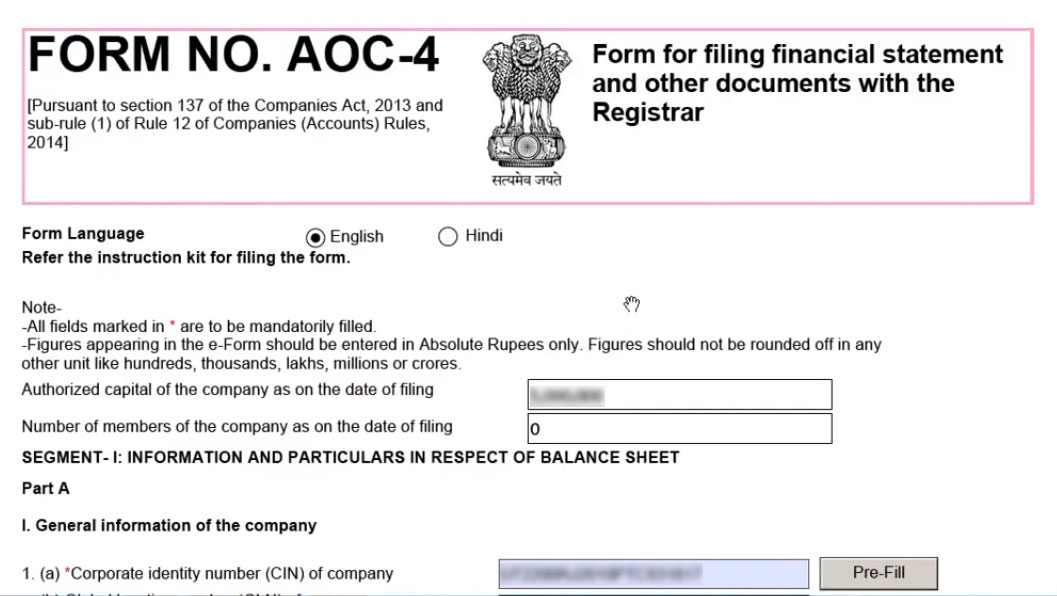

AOC 4 is an E-form that companies need to file on a yearly basis to file their financial statement and other documents with the ROC. Every registered company is compulsorily required to File AOC 4 for the end of the financial year. The generated AOC 4 has to be submitted by the company within 30 days from the date of the Annual General Meeting (AGM).

Required Documents to File AOC 4 Form:

- Audited Balance Sheet

- Profit and Loss Statement

- Cash Flow Statement

- Statement of Change in Equity

- Auditor Report

- Directors report

- Other Relevant Documents, (if Any Required)

Why Choose Gen CompLaw with XBRL Software for AOC-4 Filing?

Gen Complaw software is used for the preparation of the ROC e-Forms, XBRL, Resolutions, Minutes, Registers & various statutory reports. The software is coded by SAG Infotech for the companies & directors, etc to make filing fast and efficient. Gen Complaw software with XBRL (MCA/ROC Filing) is updated with the Latest E-forms, cost audit XBRL AS-XBRL, XBRL-IAS tool, etc. Moreover, the software also provides an import facility for various forms with others to give fast responses within a short time.

Steps by Step Guide to File AOC 4 via Gen Complaw with XBRL Software

Step 1: Firstly install a complete setup of a Gen Complaw with XBRL Software

Step 2: After installing the software, open the software dashboard

Step 3: Now select the ‘e-form’ option form the dashboard

Step 4: After selecting the ‘e-form’ option click on the ‘Annual Return form’ from the dashboard.

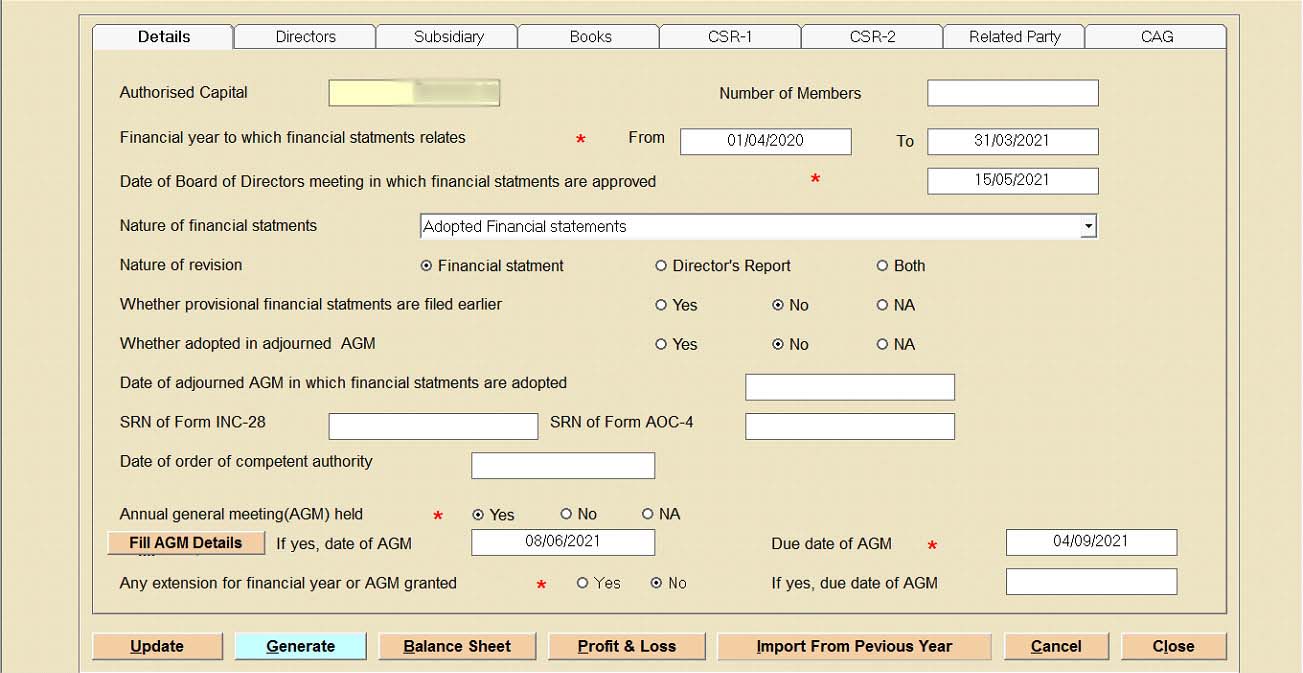

Step 5: Then, select the ‘AOC 4 form‘ from the e-form dashboard

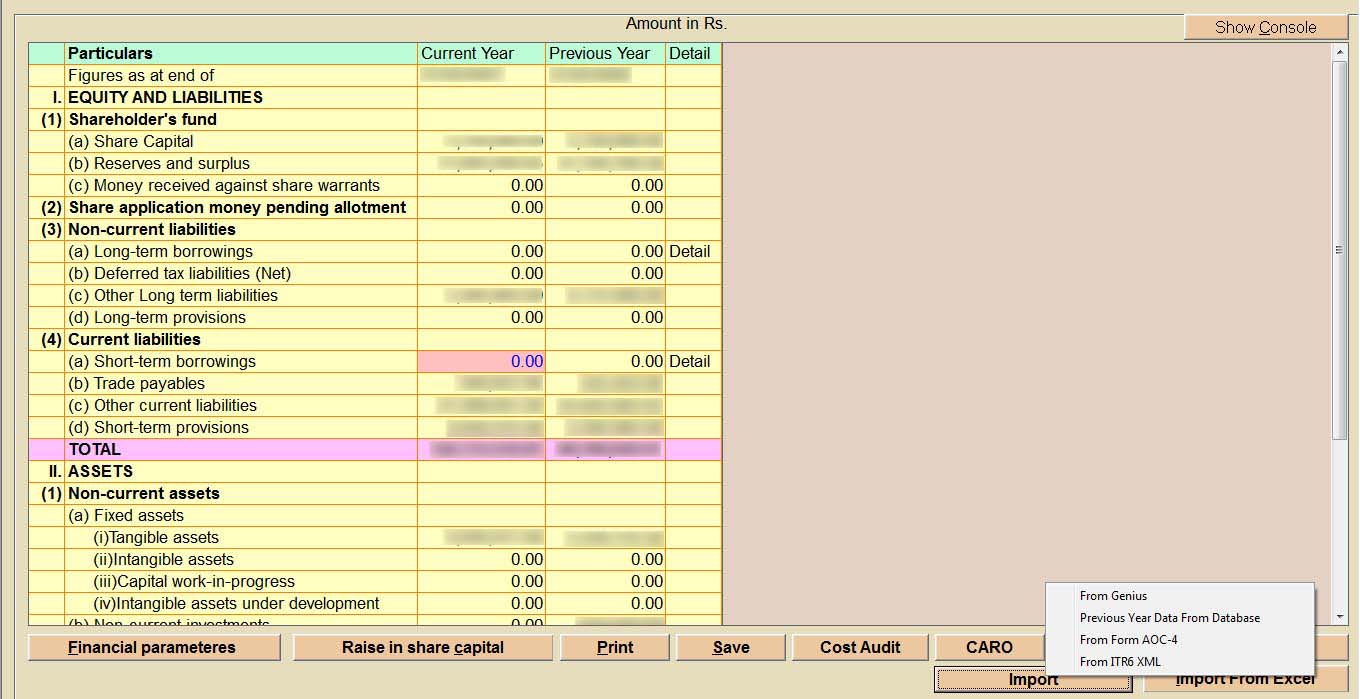

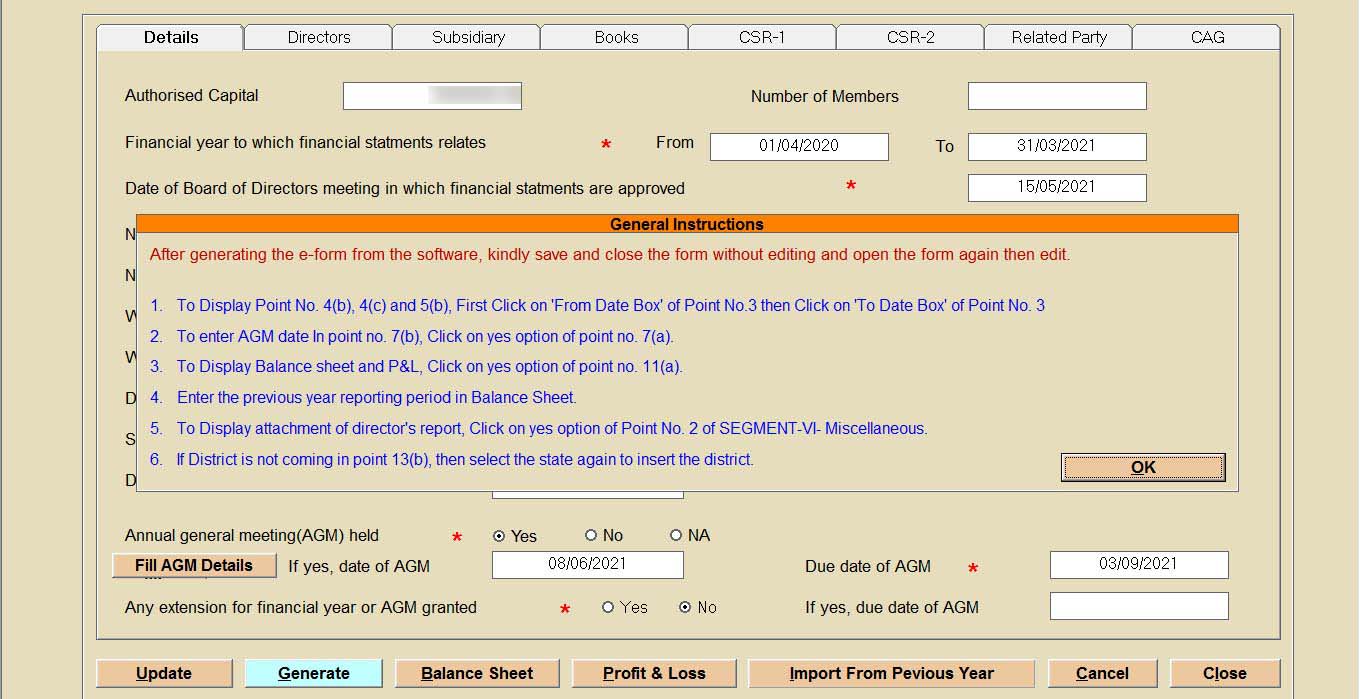

Step 6: After clicking the AOC 4 button, fill in all required details such as balance sheet, profit, and loss etc. Moreover, the user can also import the details from Aoc-4 forms. From previous year data etc. After filling in the information, click the ‘update’ button for save data.

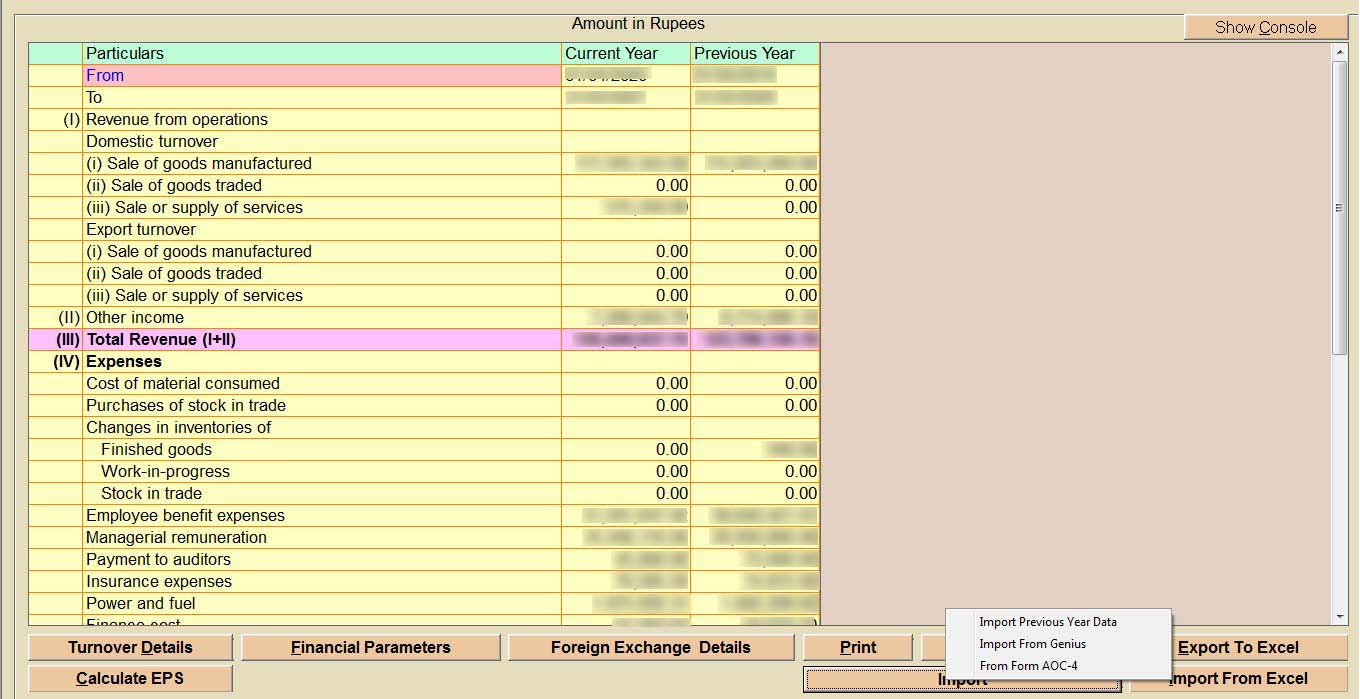

Step 7: Then fill in the details, create a balance sheet for the current and previous year. You can also import the data via Genius software, previous year database, E form AOC-4, and ITR6 XML.

Step 8: In this step, fill in the details of profit & loss section for the current and previous year. Otherwise, import details via Genius software, Import previous year data and import via an AOC 4 form.

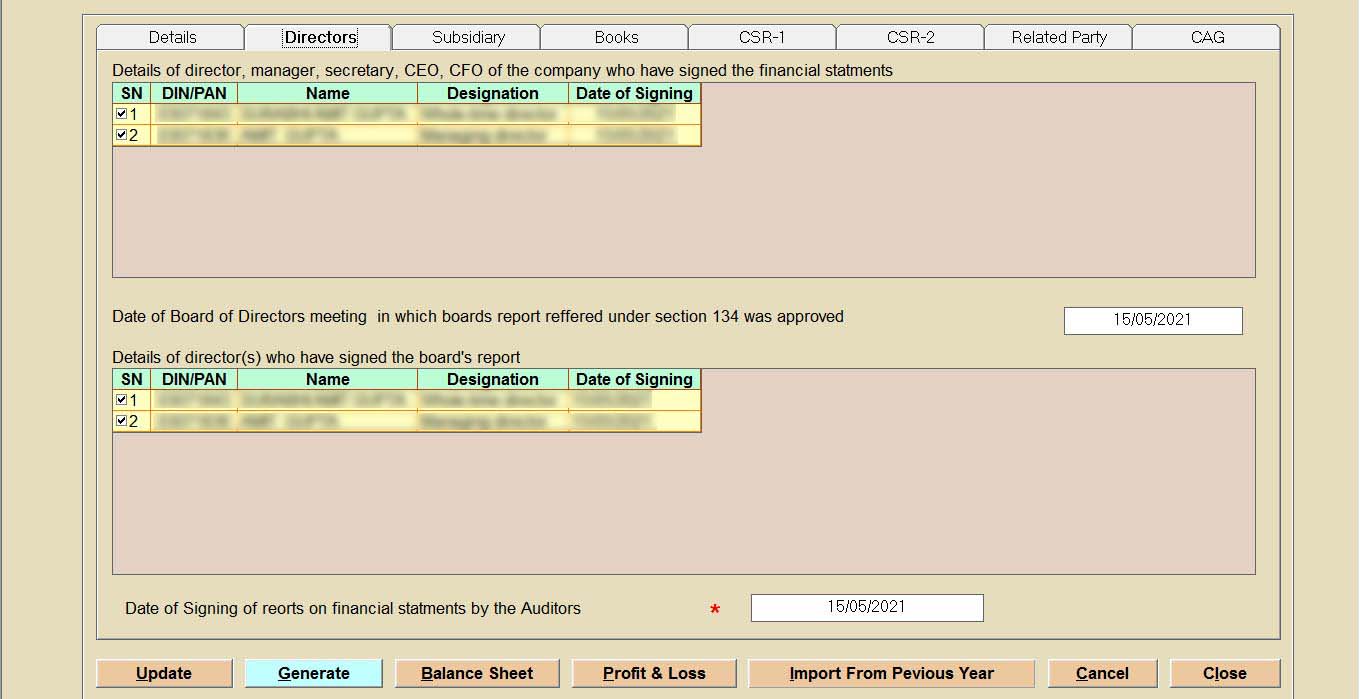

Step 9: After filling the details, select save option and then select back option for main window of the form, now move a cursor to the director tab. The details of the director will automatically get filed if you have provided the details in software, such as DIN, name, designation and date of signing.

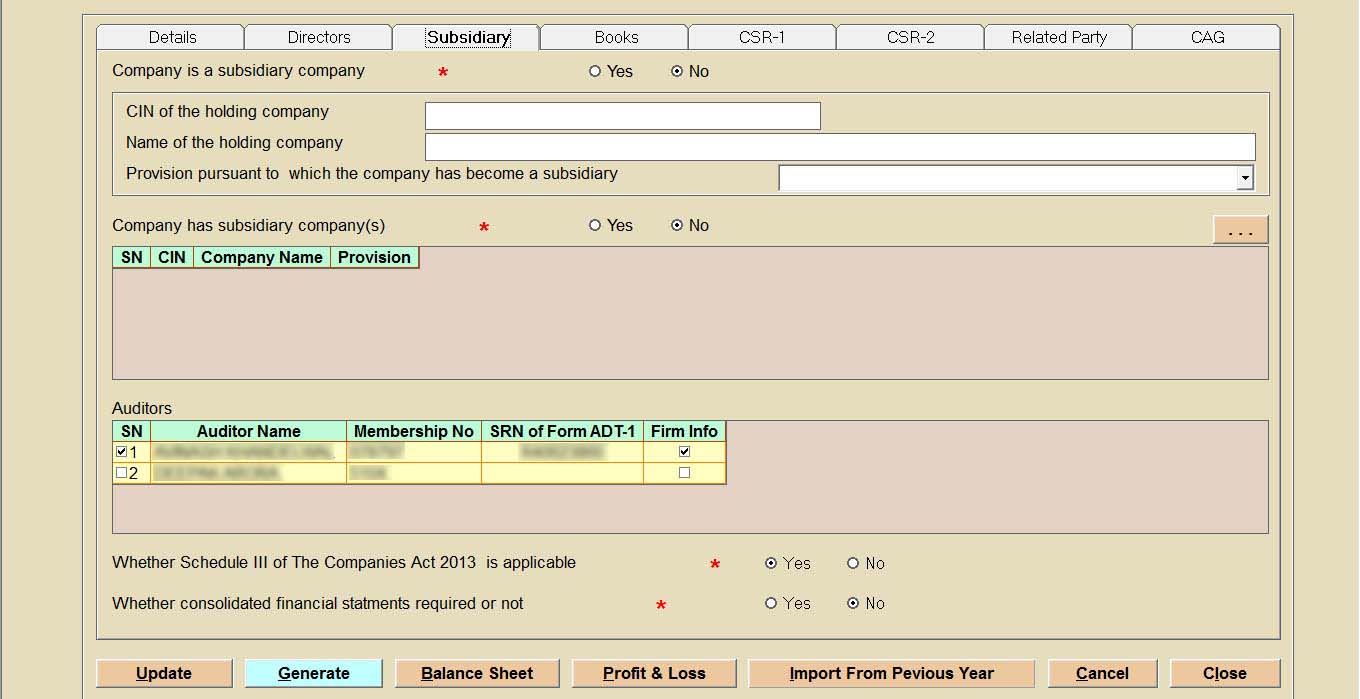

Step 10: Now move the cursor at the subsidiary tab if applicable for your company, details if provided in the software will automatically get imported, else fill the details of the subsidiary company CIN number, company holding name and provision.

Read Also: Steps to Create a New Company and Director via Gen XBRL Software

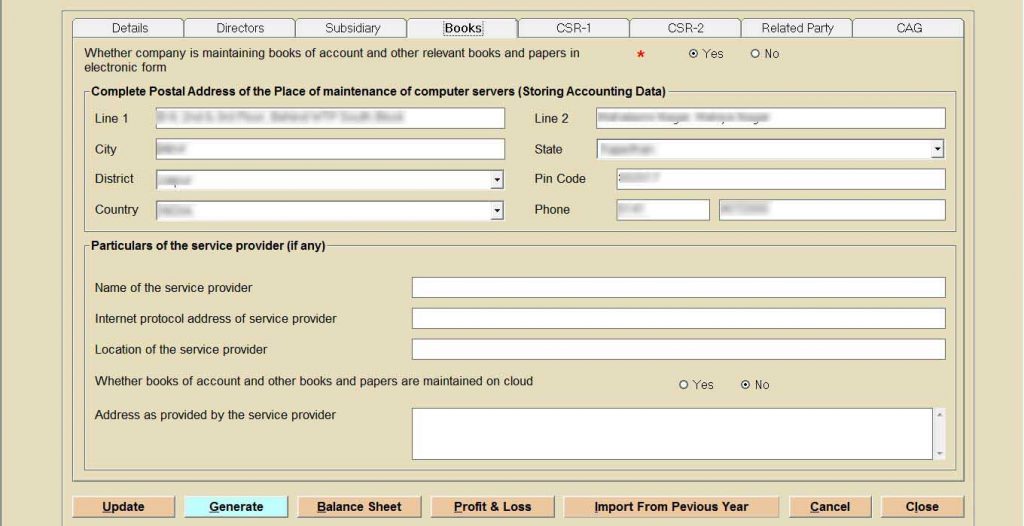

Step 11: Click on ‘Books’ and fill the postal address and company server storing account data such as service provider name, IP address with location and address.

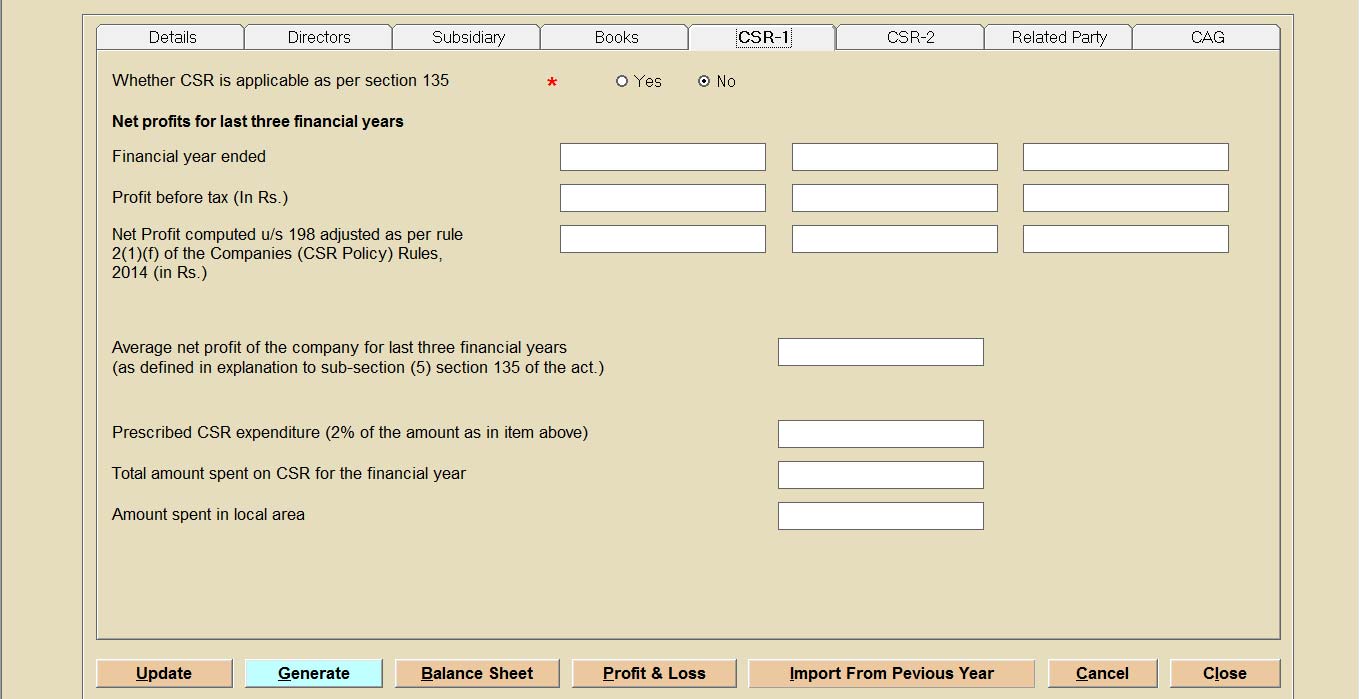

Step 12: After filling the details ‘book’, select ‘CSR-1’ tab and mention the net profit last three year, profit before tax and CSR policy rule.

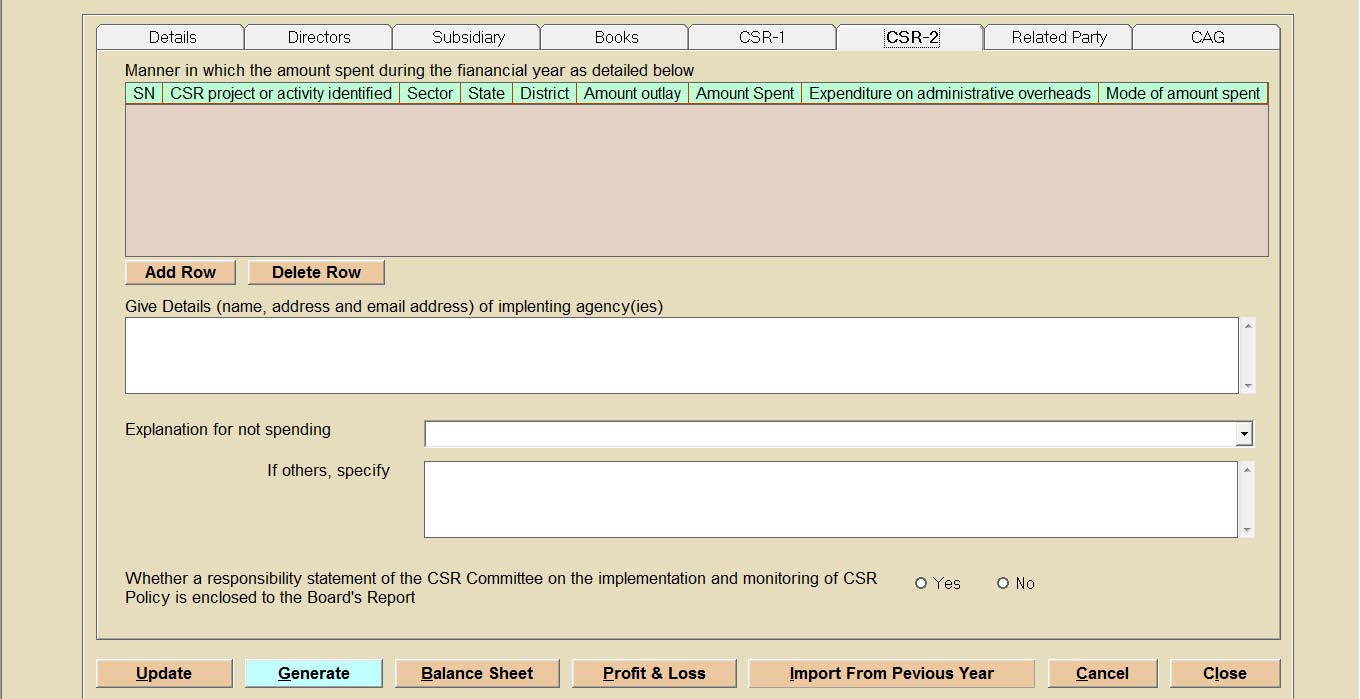

Step 13: Now select option ‘CSR-2’ for add and delete row amount spent during the financial year details.

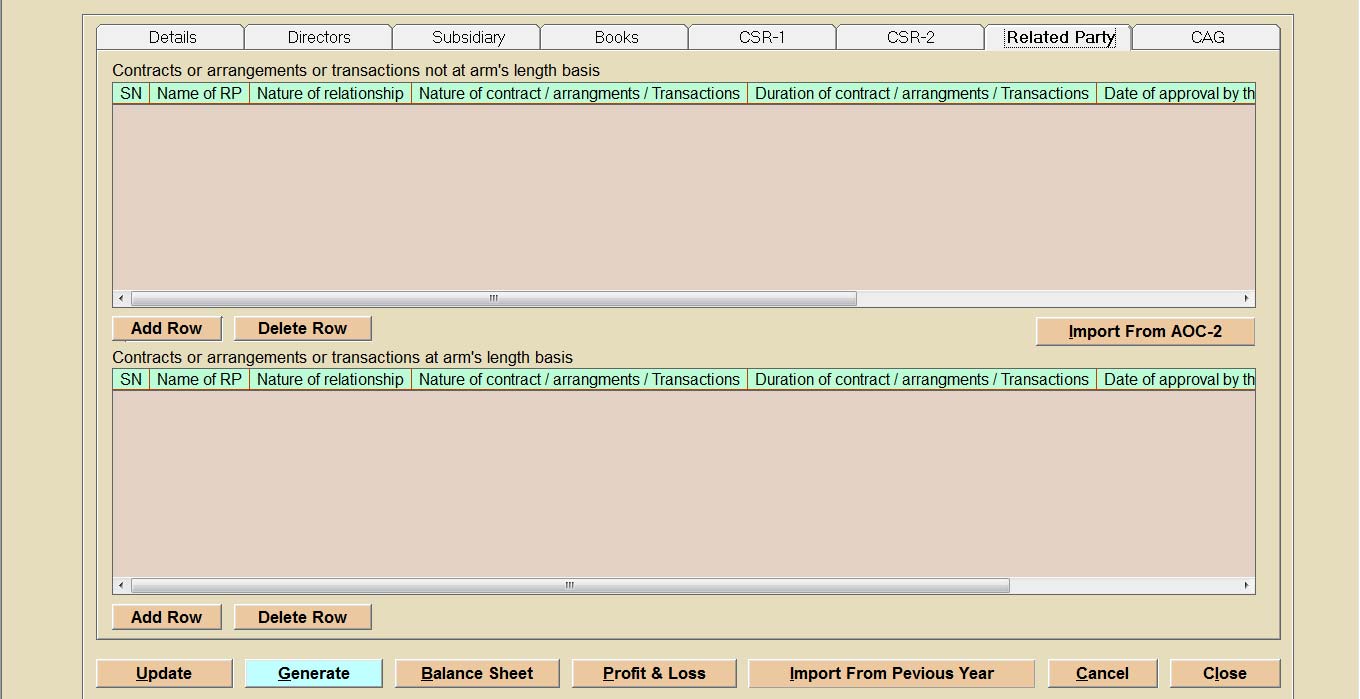

Step 14: Now select a ‘related party’ to mention the nature of contract, transaction, relationship, etc. Otherwise, import the details via an AOC-2 form.

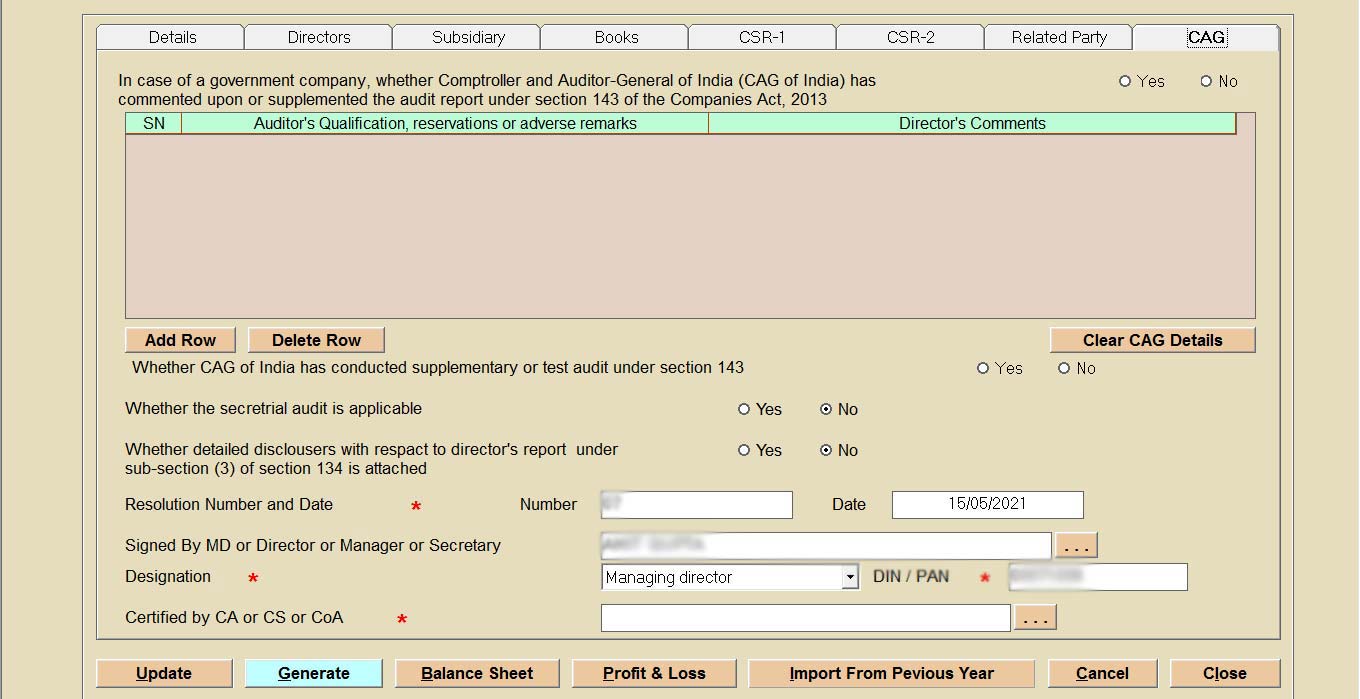

Step15: If ‘CAG is applicable on your company provide the details for the same in under mentioned column after that provide the resolution number and date, select the director/manager/MD or secretary whose DSc you want to put on the form, and select the professional i.e CA, CS and COA whom you want to certify the form if applicable.

Step 16: After filling all the details, now click on the generate button then show a pop-up follow the instruction given in the dialogue box, after the user can save the AOC 4 form.

Step 17: Finally save the AOC 4 PDF in our desktop, then click the pre-fil button to get details that have been mentioned by Gen Complow with XBRL software.