The Ahmedabad ITAT has sent back a case involving a ₹60.51 lakh addition for Long-Term Capital Gains (LTCG), noting that the land was transferred via a development agreement without sale consideration.

For the Assessment Year 2018-19, Nikanth (Narol) Co-op. Shops & Off Society Ltd. (the assessee) faced reassessment. The Assessing Officer (AO) treated the entire ₹60.51 lakh consideration from the property transfer as Long-Term Capital Gains (LTCG), relying on third-party transaction reports.

New: Because the assessee did not comply with the issued notices, the Assessing Officer (AO) proceeded with an ex parte order. This order deemed the entire transaction value as taxable capital gains, and consequently, penalty proceedings u/s 270A and fees u/s 234F were initiated due to the non-compliance.

Taxpayer submitted a plea to the Commissioner of Income Tax (Appeals)[CIT(A)] as of were not satisfied with the order of the AO. The appeal has been rejected by the CIT(A) due to being delayed by 18 days. The CIT(A) denies condoning the delay. The plea was also dismissed for non-prosecution as the taxpayer does not appear even after various hearing chances.

The taxpayer, dissatisfied with the CIT(A)’s order, submitted a plea to the Ahmedabad ITAT. The taxpayer claimed that they do not know about previous proceedings as of the non-receipt of notices and said to now cooperate and provide all the required documents along with the development agreement.

No consideration was obtained, and the transaction was only part of a development arrangement where the developer accounted for the move, the taxpayer stated.

Read Also: ITAT Ahmedabad Restores Reassessment Case, Citing AO’s Failure to Consider Evidence on Cash Deposits

Both the assessment along the appellate order have passed without an effective chance to the taxpayer, the Two-member bench comprising Siddhartha Nautiyal (Judicial Member) and Makarand V. MahaDeokar (Accountant Member) stated.

The tribunal noted that although the assessee had previously been non-compliant, the delay was minimal, and substantive justice called for a fresh hearing. However, the tribunal also expressed disapproval of the assessee’s repeated non-compliance and imposed a cost of Rs. 5,000, which must be paid to the Income Tax Department before any new proceedings can take place.

Assessing Officer (AO) asked by the tribunal to reconsider the case afresh after furnishing the taxpayer enough chance to show the proof, specifically for the development agreement and the absence of actual fiscal consideration. The AO asked to validate whether the sale proceeds were correctly taxed to the developer.

For statistical objectives, the taxpayer’s appeal was permitted.

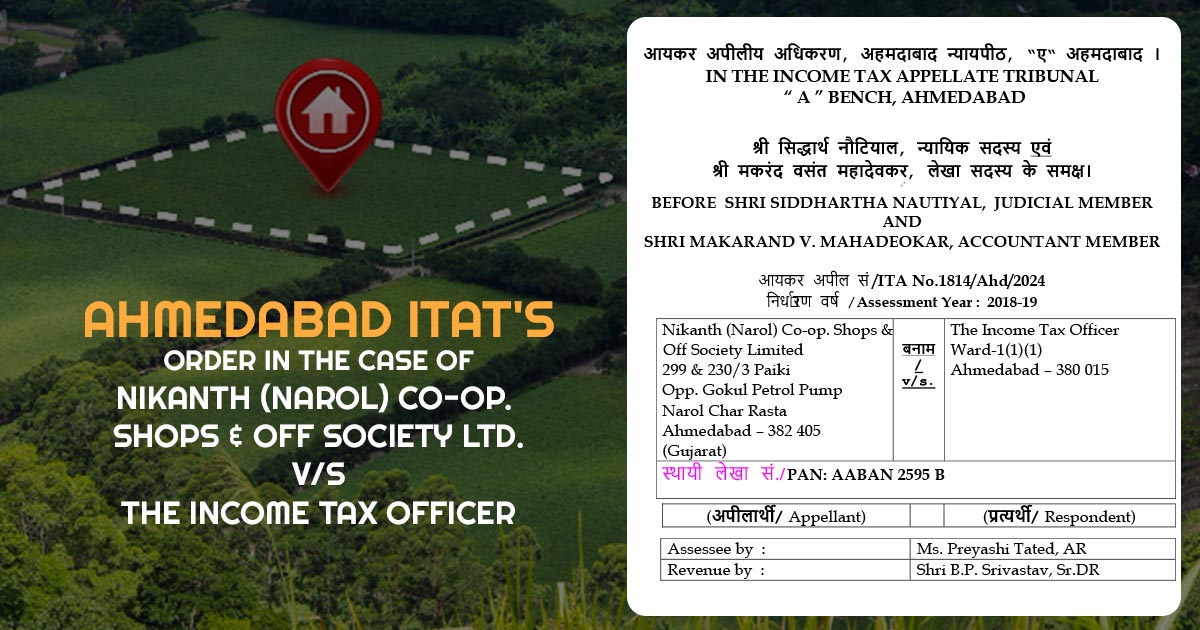

| Case Title | Nikanth (Narol) Co-op. Shops & Off Society Ltd. vs. The Income Tax Officer |

| Case No.: | ITA No.1814/Ahd/2024 |

| Assessee by | Ms. Preyashi Tated |

| Revenue by | Shri B.P. Srivastav |

| Ahmedabad ITAT | Read Order |