Several business segments and industries are worrying about the new Goods and Service Tax (GST) Regime in India, as less than three weeks are left now for implementing GST. Most of the industries are not prepared for the new GST Regime but still, there is a confusion on what taxation rates will be levied on automobile industry either it is 28 percent or 30 percent.

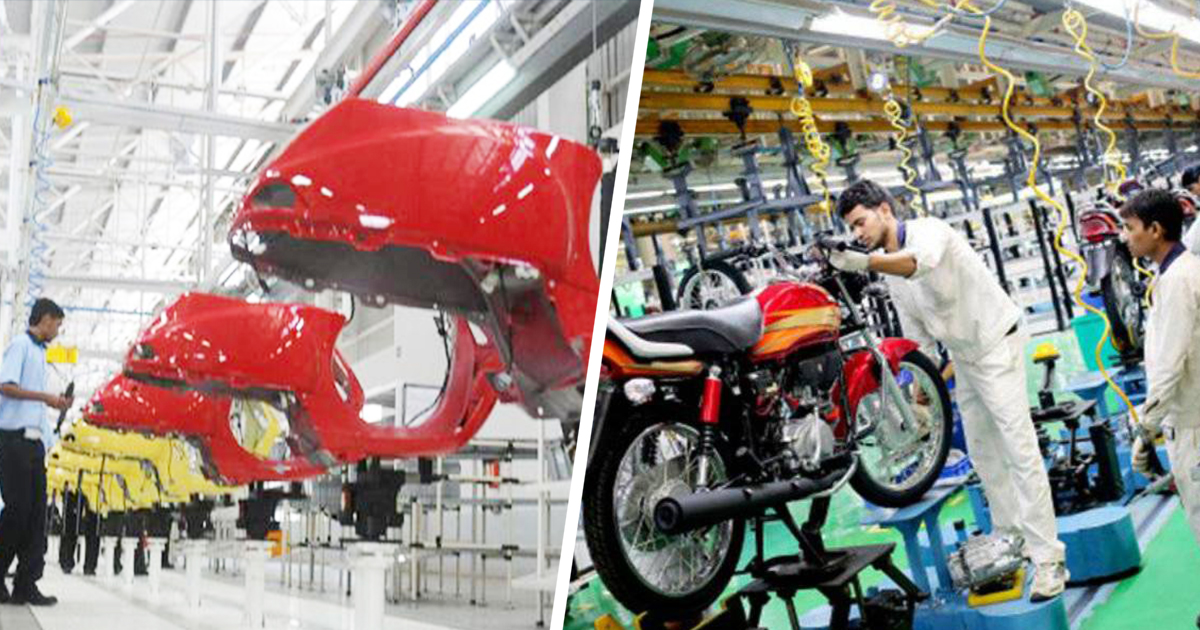

Dealers and retailers of two- wheeler automobile industry do not want to maintain inventories in the retail outlets due to the doubts of tax payments in new indirect taxation regime. It is expected that new GST Regime may lead to lower factory dispatches which will be shown in sales of June.

Dealers of two-wheeler automobile industry have declared that they had started maintaining lower stock levels of two-wheelers in this month. Retail outlets of two- wheeler manufacturer in Tamil Nadu have told to the company that they start lowering their stock levels from the plants, outlets and factories during this month. This happens due to SGST i.e state tax payment will levy on vehicles in Tamil Nadu.

Read Also: Goods and Services Tax Online Payment Guide for Petty Tax Payers in India

Under the current taxation structure system, Dealers of two- wheeler in the State are required to pay 90 percent VAT in a form of entry tax to be transported vehicles in retail outlets or showrooms and the remaining 10 percent tax paid by the automobile industry once the vehicle sold.

“Assuming we take 100 vehicles this month, we would have paid 90 percent as entry tax. However, if we end up selling only 70, the balance 10 per cent tax for these vehicles will be adjusted against the amount already paid for the 100 delivered,” says a Bajaj Auto dealer.

However, Bajaj Dealers are stocking limited numbers of vehicles or motorcycles from the plant to adjust the remaining amount with sales tax. “We have requested Bajaj to allow us to keep stock levels minimal and will confine ourselves to only some top-selling models and ensure that retails are decent,” Bajaj dealer says

Two- wheeler manufacturer, Honda has declared that the automobile industry will retain lower inventories due to the confusion of GST rates. The base GST rate is not yet clear whether it will be 28 or 30 percent,” Honda dealer says.

Two-wheeler dealers are pulling customers to purchase scooters or motorcycles before the implementation of GST because they want to clear their available stock. “Do your booking right now as prices might increase after July 1,” cautions a sales executive to a customer at a Chennai dealership.

A two-wheeler dealer says that “Actually, GST rate at 28 per cent should lead to a marginal reduction in prices of two wheelers. However, companies have already hiked prices and benefits are not likely to be passed on to buyers from July in the GST regime,” says a two-wheeler dealer.