It has been mentioned by the Tamil Nadu Authority for Advance Ruling (AAR) that health insurance services furnished via United India Insurance Company Limited to the Tamil Nadu State Government (TNSG) are waived from Goods and Services Tax (GST) under S.No.40 of Notification No.12/2017 Central Tax (Rate).

It was quoted under the decision that reinsurance services obtained from foreign reinsurers are waived from GST but the domestic reinsurance stays outside the ruling.

The judgment addressed the problems raised by the petitioner, M/s. United India Insurance Company Limited for the applicability of the GST on the insurance and reinsurance services.

The clarity has been asked via the petitioner company on whether their health insurance services for the TNSG are entitled to GST exemption and the status of reinsurance services, specifically, those furnished via foreign reinsurers.

Read Also:- Simple to Learn About GST Identification Number (GSTIN)

The petitioners claimed that as the health insurance premiums for TNSG are completely covered by the state government, the services must get waived from GST under Serial Number 40 of Notification No. 12/2017-Central Tax (Rate).

It was indeed argued that reinsurance services furnished in concern with such policies must get waived as mentioned under serial number 36A of the identical notification.

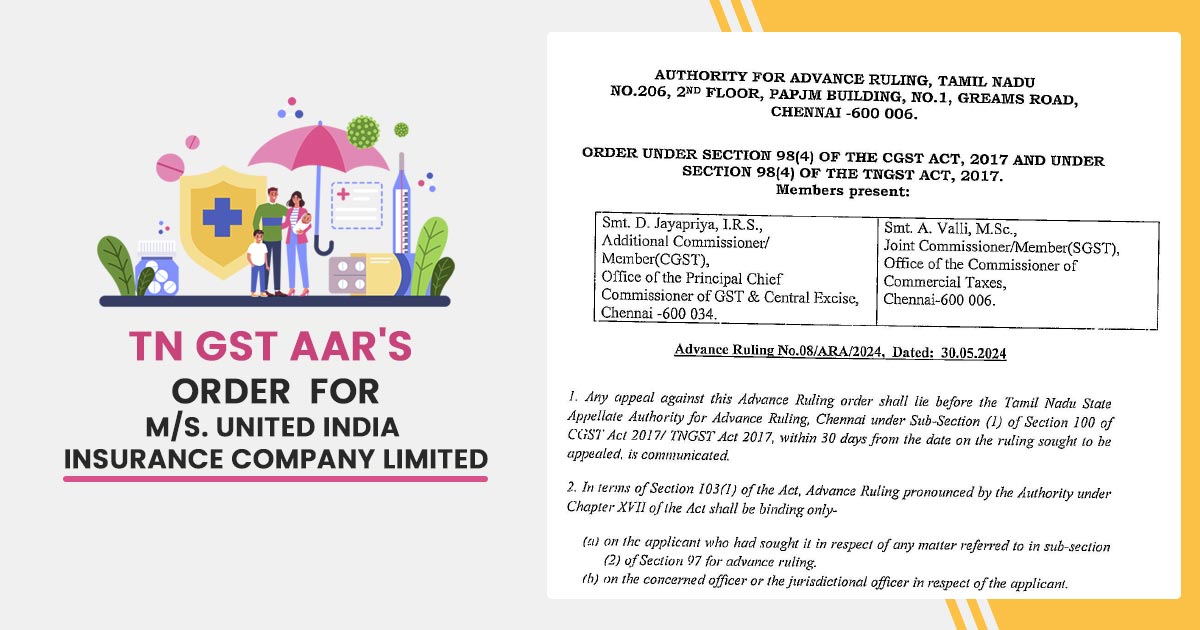

The two-member authority comprising Smt. D. Jayapriya, I.R.S. (CGST Member), and Smt. A. Valli (SGST Member) confirmed that the health insurance services generated to the TNSG are exempt from GST.

This exemption is in line with Circular No. 16/16/2017-GST and minutes from the 23rd GST Council meeting, which reinforce the notion that government-funded insurance schemes are not within GST.

The AAR for the concern of reinsurance held that the services furnished via foreign reinsurers are waived from GST. No applicability of the tax obligation under the Reverse Charge Mechanism (RCM) is there in the matter for the foreign reinsurers since the services are considered waived.

It was established by the judgment that reinsurance services obtained from reinsurers are waived from GST, thereby negating the provision for the petitioner to release the GST under the RCM for these services.

The ruling does not extend to domestic reinsurance since this problem was regarded outside the scope of the present ruling. The ruling does not address the validation questions or the applicability of the ITC as such cases were considered contingent on the main problem of GST waiving.

Also Read:- Tamil Nadu AAR: GST Applicable on Increased Rent for Past Periods

AAR ruling has furnished transparency for the insurers and the other entities that are comprised of furnishing the services to the state governments, stating the tax treatment for the government-funded insurance schemes and international reinsurance transactions.

| Applicant Name | United India Insurance Company Limited |

| GSTIN of the Applicant | 33AAACU5552C1 ZQ |

| Date | 30.05.2024 |

| Tamil Nadu GST AAR | Read Order |