GSTR 9C is a statement of reconciliation among the Annual Returns in GSTR 9 filed for a Fiscal Year and the figures based on audited annual Financial Statements of the taxpayer.

Every registered individual whose aggregate turnover during a fiscal year is more than INR 2 crore must get his accounts audited as prescribed under sub-section (5) of section 35 of the CGST Act. Besides, he must mandatory to furnish a copy of the audited annual accounts and a duly certified reconciliation statement in form GSTR 9C.

Taking into account the issues faced by the tax filers while filing of GSTR 9C form

Issue: Auto-population of the value of ITC in Table 8A of Form GSTR-9 as per Form GSTR-2A

One of the reasons responsible for the mismatch between the ITC that is pre-populated can be:

- Values of table 8A of Form GSTR 9

- Input Tax Credit on supplies of the fiscal year 2017-18, if reported after 30th April, won’t be auto-populated in Table 8A of Form GSTR-9 but will reflect in Form GSTR-2A.

Use Initiate Filing- Noteworthy Point to File GSTR 9C

GSTR 9C Table obtained from GSTR 9 (PDF) can be downloaded by using the ‘INITIATE FILING’ tab, followed by the issuance of the PDF file to the Auditor by the taxpayer for form GSTR 9C preparation for reference).

For the preparation of GSTR 9C by the auditor, the taxpayer need not download the pre-filed JSON file from the portal.

Note: Do not try to download the JSON file if any such file prepared by your Auditor has not been uploaded by you.

The issue associated with Signature- While Using GSTR 9C Offline Utility

Here, the issue is Error “Auditors sign is invalid” appears for users.

The solution for the same is to ensure the following DSC related points.

- Digital Signature Certificate (DSC)

- Digital Signature Certification (DSC) must be as per PAN and it should have PKCS7 format.

- DSC must be incorrupted

- DSC must be valid/ not be expired.

To-Do with JSON File- Post receipt of JSON file

- ‘JSON File’ i.e the Reconciliation statement created & attested by Auditor is uploaded on the GST Portal using the ‘PREPARE OFFLINE’ tab (Reconciliation statement as prepared & signed by Auditor) on GST Portal. The button is to used for downloading erroneous JSON file (if any).

- Financial statements like Balance Sheet, P&L Account, etc can be uploaded in PDF/JPEG format using the ‘INITIATE FILING’ tab. The same tab is used to file form GSTR 9C prepared by the auditor.

- Once the signed JSON file/ Reconciliation statement and Audited Financial Statement are successfully uploaded, the ‘PROCEED TO FILE’ tab gets enabled.

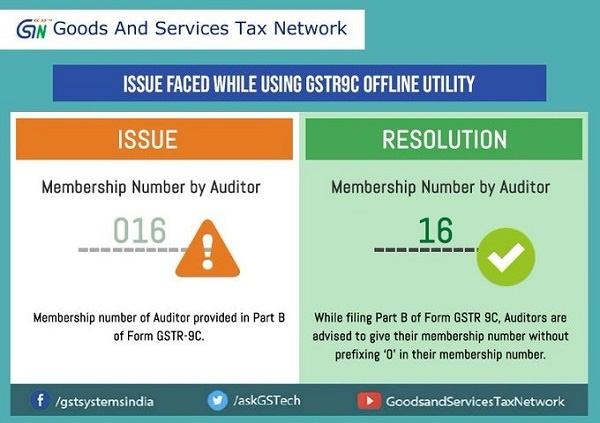

Problems that came up While Using GSTR 9C Offline Utility