Most of the taxpayers in India take a helping hand from a Chartered Accountant to file tax on behalf of them. CA, being an expert in legal and tax compliances can easily get you out of the tosses of tax compliances. If you are one of the many taxpayers who seek help from the CA to file returns than this is an important piece of information for you.

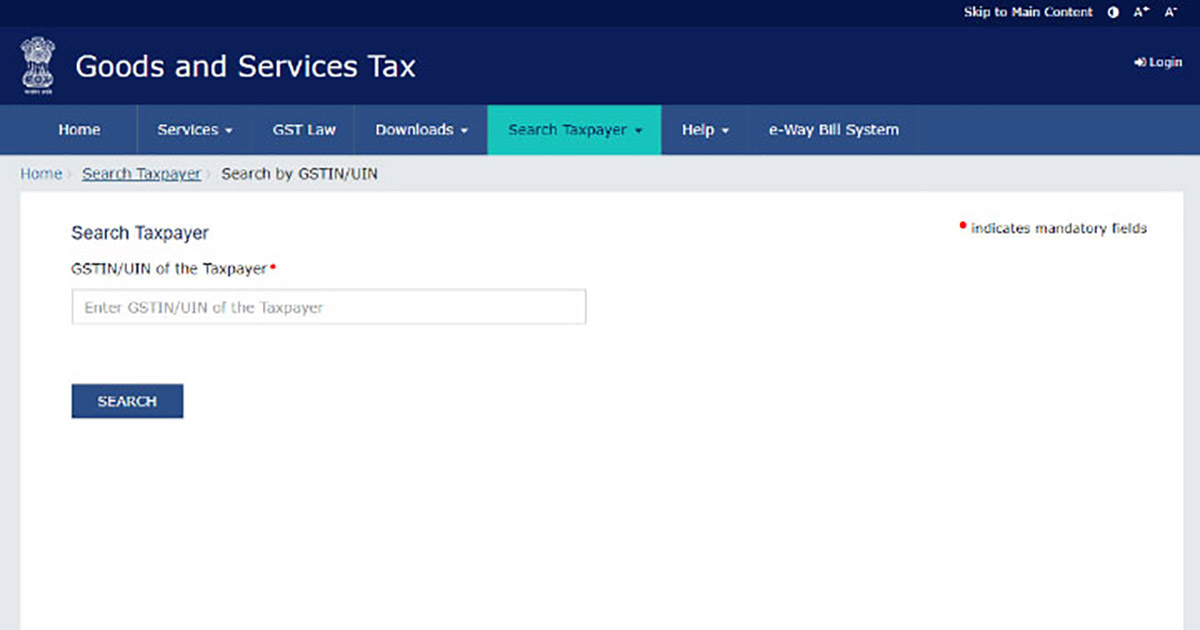

For accomplishing the process of tax filing the taxpayer has to render his most personal information like mobile number, email id and GST number

There are recorded instances, where the tax notice released by the Supreme Court (SC) for the taxpayer, didn’t reach him due to negligence by his CA. As a result of the consequence, the taxpayer was held guilty of not responding to the notices and was directed by the court to pay the penalty. After investigation, it was revealed that all those notices were sent to his CA on behalf of that taxpayer.

To this, the Supreme Court said that the notice sent to either the taxpayer or his CA is considered valid by law. Now there is a big question mark on the mechanism which a CA follows to inform the taxpayer (his client) about various notices or other information by the IT Department. It is mandatory to note that every notice from the income tax department

While throwing light on the instances of negligence by CA, “CNBC Awaz” in a special interview said that the taxpayer should have access to his own login ID and the e-mail so that he can anytime switch on to his account and check his pending compliance and notice (if any) by the department.