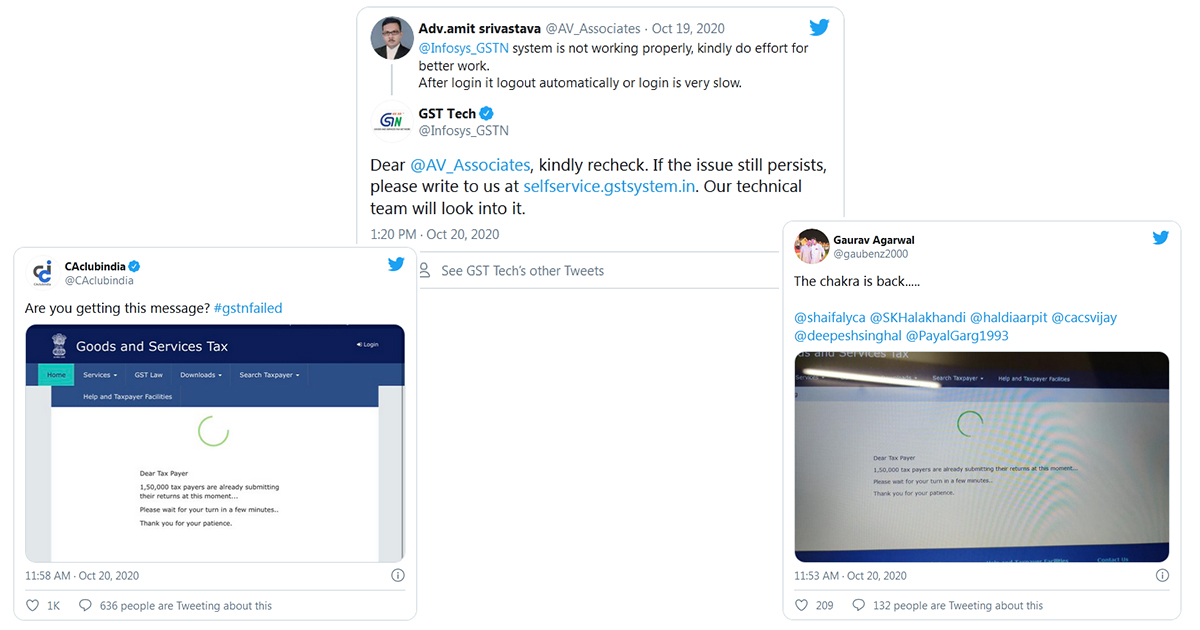

For September GSTR-3B filing a technical failure occurs on the GST portal on the last date of filing. In the past 6 six days, the GST portal has been challenging technical issues, and various people are complaining about the issues on Twitter.

October 31 is the last date for filing the GSTR 9 & 9C

The GST official account handler has answered some of the complaints asking the people to complain again if the issue gets repeated. GSTN said on October 18 states that a total of 27.4 lakh GSTR-3B have been filed so far for September 2020.

GSTN portal