The Delhi High Court intervened in a matter involving the reconciliation of Tax Deducted at Source (TDS) that was deposited under an incorrect GSTIN. The court quashed the impugned order and provided the petitioner with an opportunity for a hearing.

Under Article 226 of the Constitution of India, Ebixcash Mobility Software India Limited, the petitioner-assessee, filed a petition. This petitioner, previously operating as M/s Trimax IT Infrastructure & Services Ltd., is an IT and IT-enabled services company with a significant workforce of over 2000 individuals across India.

The company secured GST registration (GSTIN 07AAACT3858L1ZY) at the inception of the Goods and Services Tax system.

The applicant, following a petition u/s 7 of the Insolvency and Bankruptcy Code, 2016 by M/s Corporation Bank, underwent corporate insolvency resolution Process(CIRP) proceedings. On 4th May 2020, the resolution plan was approved, and a new management took over.

The applicant on 19th June 2020 has obtained a new Goods and Services Tax(GST) registration (GSTIN 07AAACT3858L2ZX).

As per Notification No. 11/2020, a new GST registration was needed in CIRP, the applicant claimed. But some clients, such as BSNL and NIC, deposited the TDS under the old GST number inadvertently. With the old registration, the applicant asked for the credit for the TDS deposited.

A PMT-09 has been furnished by the applicant to deposit the TDS and transfer the left cash ledger balance to the new registration. But the respondents, while issuing the SCN on 21st November 2024, denied the same. On 21st December 2024, the applicant answered, but the demand was still raised in the final order.

Read Also: Simple Way to Correct Critical Errors in TDS Challan

It was validated by the applicant not attending the personal hearing. The applicant was provided with a chance, though they did not, the counsel of the respondent said. Invoices and certificates from suppliers were also not furnished by the applicant on reminder, the counsel of the respondent said.

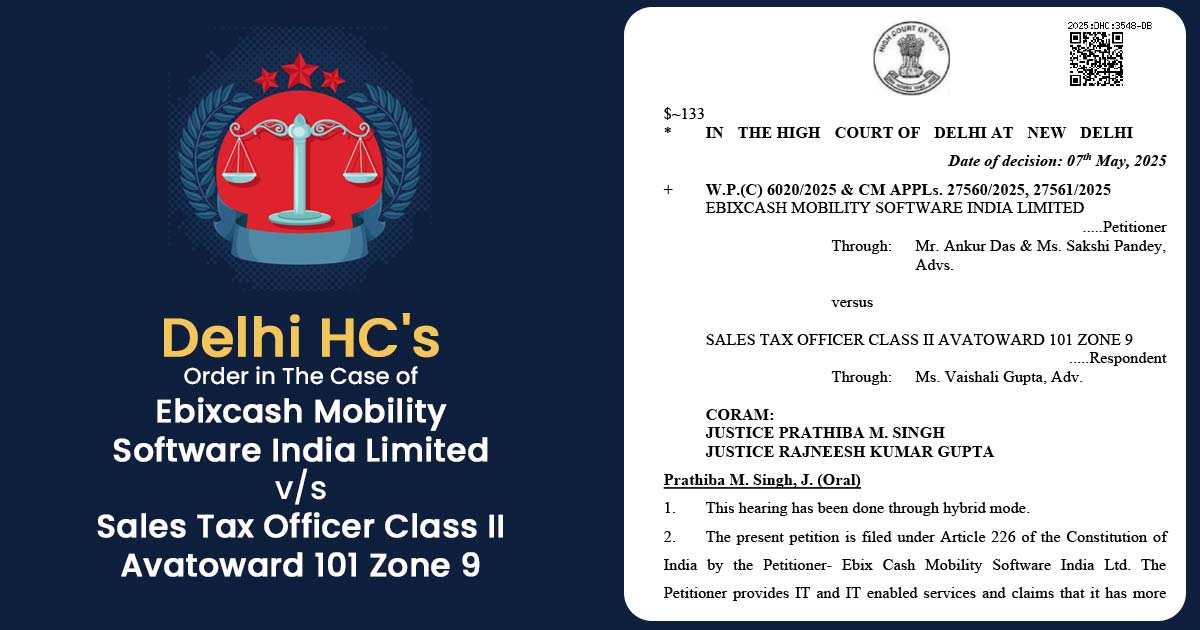

Setting aside the impugned order, the division bench of Justice Prathiba M. Singh and Justice Rajneesh Kumar Gupta said that the issue was regarding reconciling TDS deposited under the incorrect Goods & Service Tax Identification Number (GSTIN), and gave a chance to the applicant to present its case.

On 10th June 2025 applicant was asked to appear before the adjudicating authority and file any other documents via the portal. These documents shall be regarded as a complete adjudication shall be incurred.

The petition, therefore, was disposed of.

| Case Title | Ebixcash Mobility Software India Limited vs. Sales Tax Officer Class II Avatoward 101 Zone 9 |

| Case No. | W.P.(C) 6020/2025 & CM APPLs. 27560/2025, 27561/2025 |

| For The Petitioner | Mr. Ankur Das & Ms. Sakshi Pandey |

| For The Respondents | Ms. Vaishali Gupta |

| Delhi High Court | Read Order |