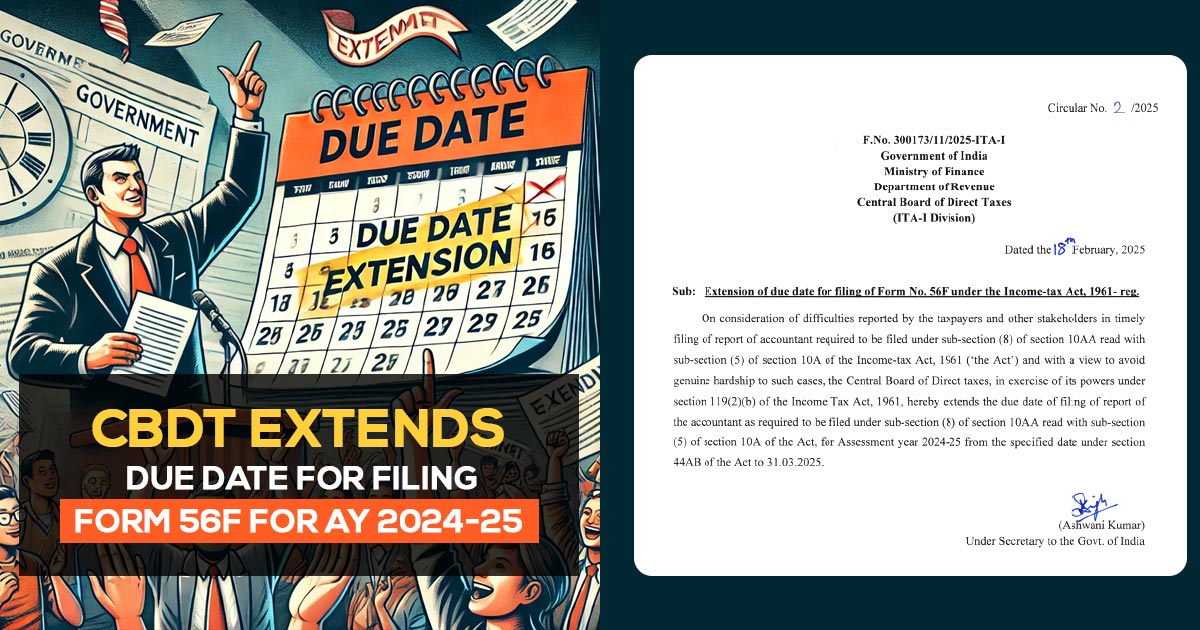

Circular No. 02/2025, has been issued by the Central Board of Direct Taxes (CBDT) extending the due date for filing Form No. 56F under the Income-tax Act, 1961.

The same extension furnishes relief for taxpayers and stakeholders facing contentions in timely submission of the report of the accountant needed u/s 10AA(8) and Section 10A(5) of the Act.

CBDT Circular 2/2025 Highlights

- Revised Deadline: The due date for Form 56F (AY 2024-25) has been extended from the Section 44AB deadline to March 31, 2025.

- Justification for Extension: Issues were reported in receiving and submitting the report of the accountant within the original duration.

- Legal Basis: U/s 119(2)(b) of the Income-tax Act, 1961, the extension has been granted to ease genuine hardship faced by taxpayers.

The Text of the CBDT Circular is Cited as

On regarding the issues notified via the taxpayers and the other stakeholders in timely report filing of accountant mandated to be submitted under sub-section (8) of section 10AA read with sub-section (5) of section 10A of the Income-tax Act, 1961 (‘the Act’) and with an opinion to prevent the genuine hardship to these matters, the Central Board of Direct taxes, in the exercise of its powers u/s 119(2)(b) of the Income Tax Act, 1961, hereby extends the deadline to submit the report of the accountant as needed to be filed under sub-section (8) of section 10AA read with sub-section (5) of section 10A of the Act, for Assessment year 2024-25 from the established date u/s 44AB of the Act to 31.03.2025.