GSTR 1 is a return filing for all taxpayers that includes all the outward supplies given in the transactions of the business dealings. Here we will discuss Table 6A of the GSTR 1 form for regular taxpayers which is basically for the refund on exports. To claim the refunds, the exporter has to file Table 6A of the GSTR 1 form. While all the details such as the Shipping Bill and Invoice must match those given in table 6A.

Exports Meaning Under Goods & Services

IGST Act Section 2(5) states that the Export of goods under GST means taking goods out of India to a place outside India. Laws and procedures for such exports of goods are mainly supervised as per the Customs Act.

Export of services is done under the GST on the satisfaction of five conditions. The law and procedure of export of services are mentioned in the Indian GST law. Meanwhile, five conditions are as follows:

- The service provider is located in India

- The service receiver is outside India

- Place of supply is located outside of India

- The received payment is in exchangeable foreign currency or otherwise in Indian Rupees if allowed by the Reserve Bank of India (RBI)

- As defined by GST law, the connection between the service provider and the recipient should not be that of a specific person. The condition implies that any transaction (taxable) between the head office and the branch office, either of which is outside India, can’t be considered as export, it will be considered as inter-state supply. Therefore, export benefits can’t be availed.

Exports Taxes and Duties Charged

Just like the import of goods, the export of goods is also subject to the below-mentioned taxes and duties.

- Basic customs duty at the relevant rate on the basis of the classification of goods levied on the assessable value.

- At a 10% rate, a social welfare surcharge at basic customs duty will be levied on basic customs duty.

- 18% IGST or such rate mentioned in GST law and will be charged on the total of the assessable amount + basic. Customs duty with social welfare surcharge, only if not exactly released under customs or GST law.

- Cess, if any, at the rate mentioned under GST law and charged on the addition of assessable value + basic customs duty + social welfare surcharge.

Export of service attracts two types of taxes IGST and cess if any.

Benefits Available to Exporters under GST

- Exporters can Claim refunds of IGST, which is paid on all types of exports except were not specifically available.

- Alternatively, if the IGST was not paid on exports due to the cover of LUT or bond, exporters may be allowed to claim the refund. In such cases, the accumulated input tax credit will be refunded on the raw materials or input services used to make such exports.

Steps for GST Refund under Exports

Taxpayers exporting goods or services can choose any of the following options for a GST refund:

- Accumulated input tax credit refund which was not used where goods/ services were exported without making payment of IGST and Under the bond / Letter of Undertaking (LUT).

- IGST’s refund paid on exports after set-off the Input tax credit without the cover of bond/LUT, except in the following cases:

- Where goods exported from India are subjected to export duty.

- In the case, where drawback is claimed for paid taxes for the export of goods or services.

- Notification 48/2017-Central Tax, released on 18th October 2017 added deemed exports excluding exported capital goods under the Export Promotion Capital Goods Scheme.

- Via Notification 40/2017-Central Tax (Rate), released on 23rd October 2017, Exporters of goods or services on which concessional tax paid for inter-state purchases and used in making such exports.

- Via Notification 78/2017 and 79/2017-Customs, dated 13th October 2017 added a case that Where IGST is exempted for export of goods or services from specified areas like Export Oriented Unit (EOU) / Software Technological Park (STP) / Hardware Technological Park (HTP) notified under the Customs Act.

- In the above cases, the GSTR refund should be claimed by filing the details in Table 6A of GSTR-1 * and then furnishing the monthly summary return in GSTR-3B.

If the export is of goods along with IGST payment, then the document of export which is also the Bill of Export or Shipping Bill will be considered to be the application for IGST refund.

After it, the GST Officer will verify the details stated in the shipping bill and declare by the exporter in GSTR-1 with the details presented on the ICEGATE portal.

Now if the officer is satisfied with the declaration details, he shall credit the refund amount into the bank account declared by the taxpayer at the time of GST registration.

However, exporters of services paying IGST on exports should fulfil their refund claim by applying with RFD-1 apart from GSTR-1 and GSTR-3B on the GST portal.

An important condition for export challan is that report the Bank Realisation Certificate (BRC/FIRC) number for any export invoice. An application reference number is generated after submission online and the GST officer will process the refund claim after proper verification.

An application reference number will be generated after online submission and the GST officer will process the refund claim after proper verification. The procedure is almost similar for claiming a refund of accumulated ITC without IGST payment on the export of goods and services.

The process starts with the exporter furnishing the Letter of Undertaking (LUT) before the exporter gets effected, within the stipulated time frame. The exporter should furnish ‘Tax amounts’ as ‘zero’ while declaring in Table 6A and Table 6B of GSTR-1.

Subsequently, upon successful completion of the export, the details of the accumulated ITC will be reported to the GST portal by furnishing Form RFD-01 for its refund.

Timelines for Claiming GST Refund on Exports

The refund application can be furnished within two years from an appropriate date in any case of a refund. However, the date will vary according to the type of refund claim.

The relevant or appropriate dates and the cases are provided in the table below.

| Sl no. | Type of refund | Relevant date |

|---|---|---|

| 1 | Goods exported outside India, where a refund of tax paid is available | |

| a) “Goods are exported by sea or air” | “The date on which the ship or aircraft carrying such goods leaves India” | |

| b) “Goods are exported by land” | “Date on which such items Cross the border” | |

| c) “Goods are exported by post” | “Despatch date of goodsby the Post Office concerned to a place located outside India” | |

| 2 | “Services exported out of India where a refund of tax paid is available”– | |

| a) “Supply of service is completed before receipt of payment” | “Date of receipt of payment in convertible foreign exchange” | |

| b) “Services received in advance prior to the date of issue of invoice” | “Date of issue of invoice” | |

| 3 | “Refund of the unutilised input tax credit on inputs on account of taxes not paid at the time of export of goods or services” | “End of the financial year in which such claim for refund arises” |

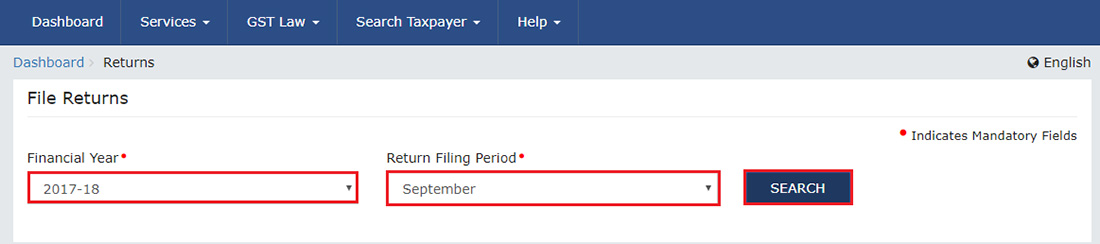

Step 1: Login and Navigate to Table 6A of FORM GSTR-1 page

- For the GST Home page, go to www.gst.gov.in URL.

- Login to the GST Portal by filling in accurate credentials.

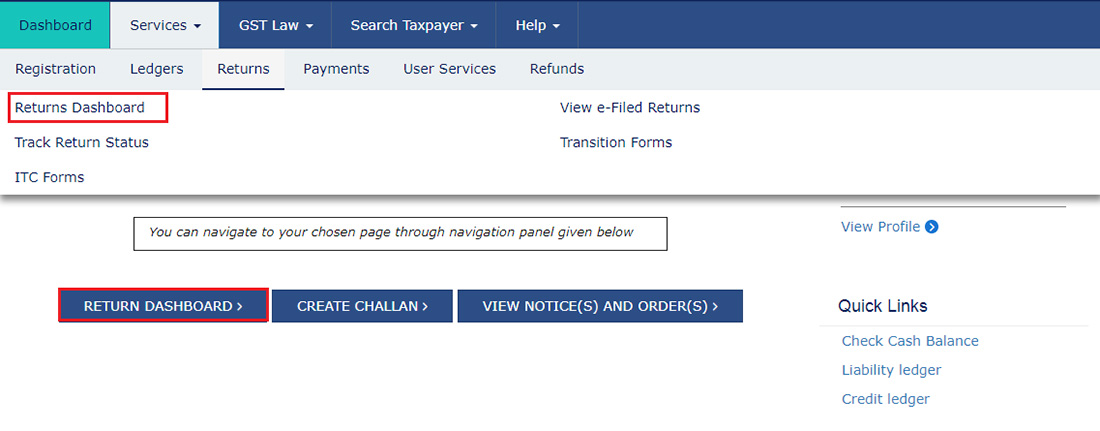

- Click on the Services and then Returns and then the Returns Dashboard command.

- Click the Returns Dashboard link on the Dashboard.

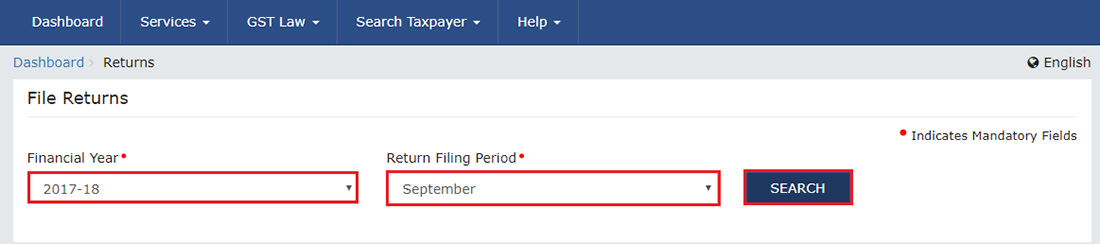

- This will present the File Returns Page. From the drop-down list, choose the Financial Year & Return Filing Period (Month) for which you need to file the return.

- Now click the SEARCH button.

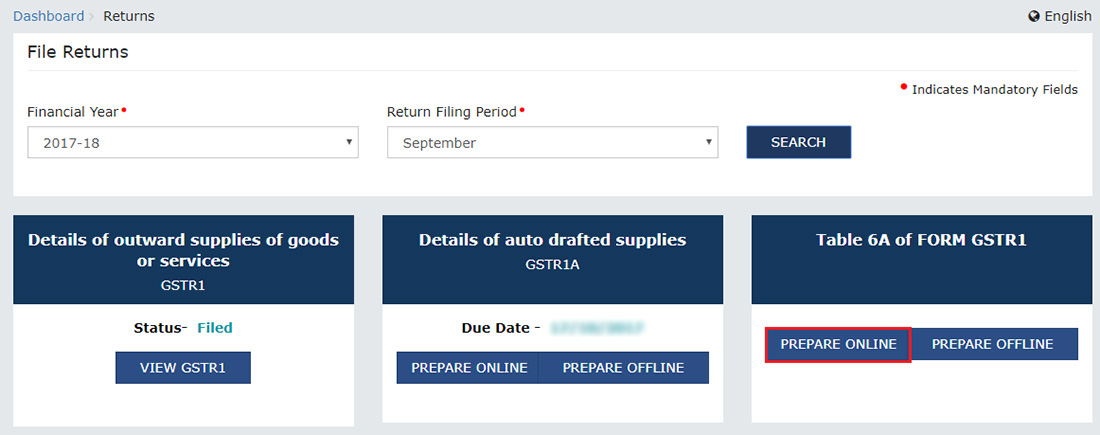

- The File Returns which gets displayed shows the due date of filing the returns, which the taxpayer needs to file utilising separate tiles.

- Click the prepare online button in the Table 6A of form GSTR 1 tile, if you prefer to prepare the return by creating entries on the GST Portal.

Note: Table 6A of form GSTR 1 cannot be filed if GSTR 1 is filed for the present/ current return period.

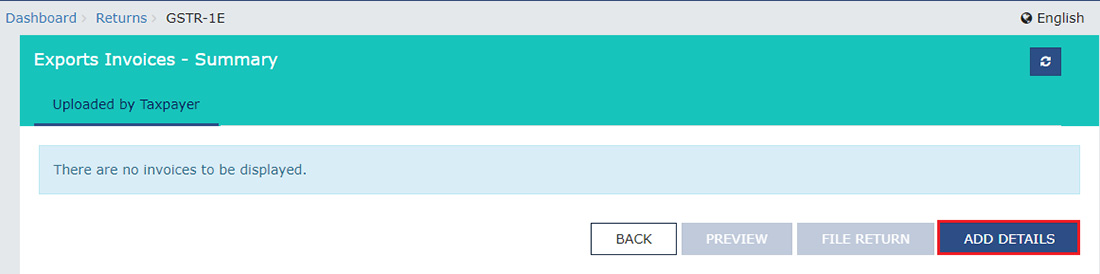

Step 2: Fill the Details in Export Invoices Summary page

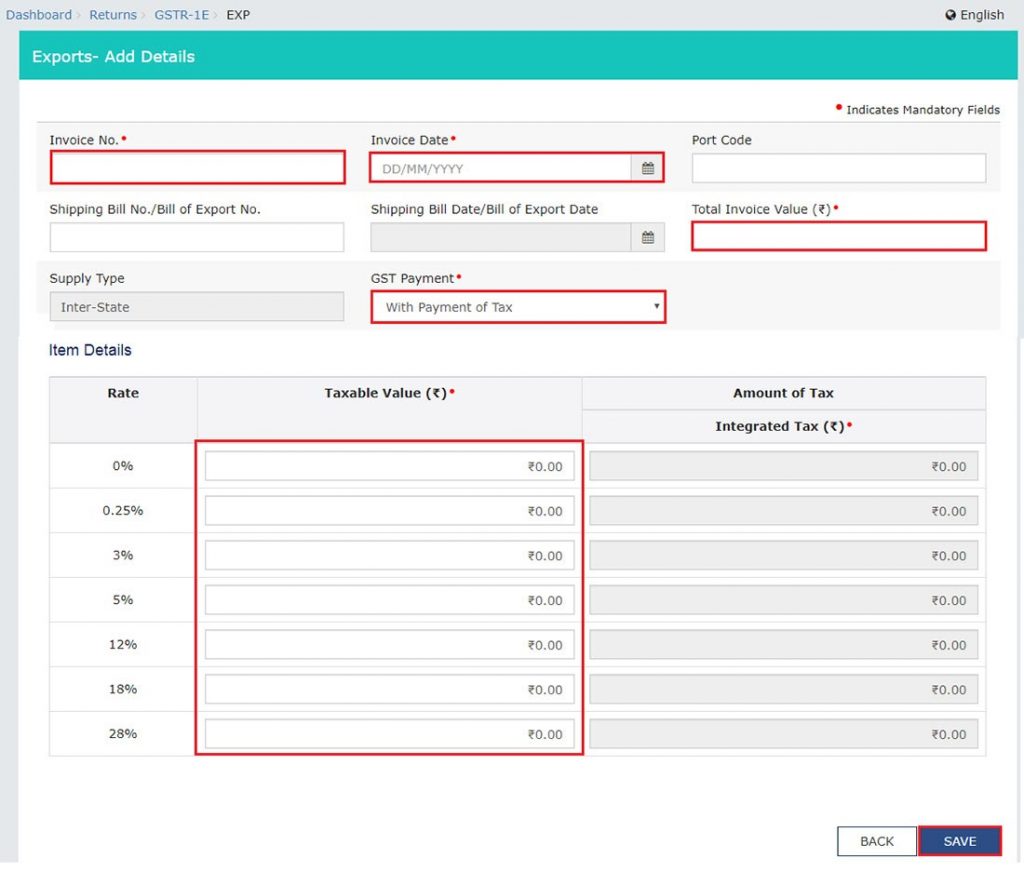

- The page – Exports- Add Details is arrive

- Fill the invoice number in the field of Invoice No

- Fill the field of Invoice Date by using the calendar and opting for the date of invoice generation.

- Fill the port code in the field of Port Code

- Fill in the shipping bill no. / bill of export no. in the field of Shipping Bill No./Bill of Export No.

- After filling the shipping bill no. / bill of export no., Shipping Bill Date/Bill of Export Date field is enabled.

- Fill the field of Shipping Bill Date/Bill of Export Date by opting for the date of shipping bill or the date when the bill of export was generated, via the calendar.

- Fill in the total value of the invoice in the field of Total Invoice Value.

- From the GST Payment drop-down list, choose whether GST payment is with or without the payment of tax.

- Fill the taxable value of the goods or services in the field of Taxable Value.

Note: When you fill the taxable value field, the Amount of Tax fields get auto-populated on the basis of the value you filled. However, it can be edited by the taxpayer.

- Click the save button and save the details of the invoice.

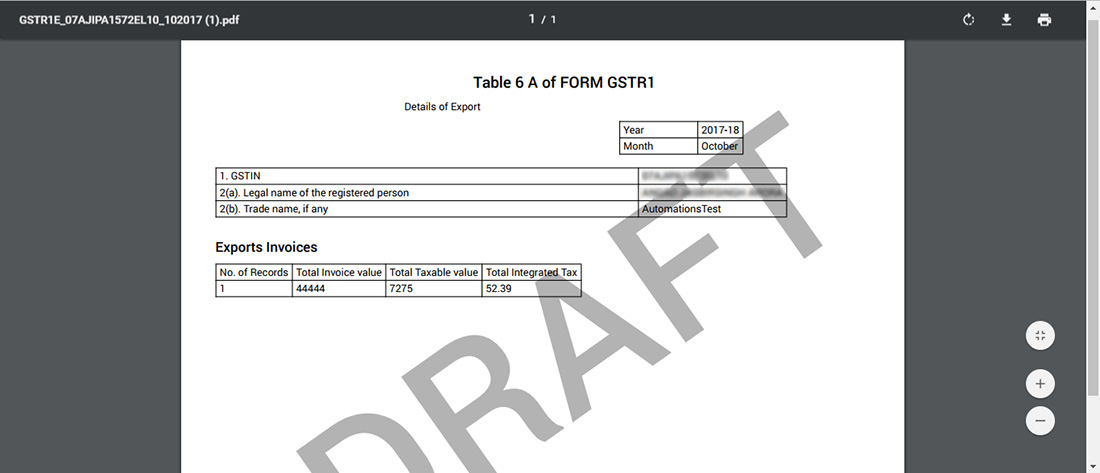

Step 3: Preview Table 6A of FORM GSTR-1

- After adding the invoices, click the preview button.

The preview button will download the draft Summary page of Table 6A of FORM GSTR 1 to let you reassess the summary of entries which you made in Export Invoices section, before the final submission of Table 6A of FORM GSTR 1.

The PDF file which you will discover would have a watermark of draft as the details are yet left to be furnished.

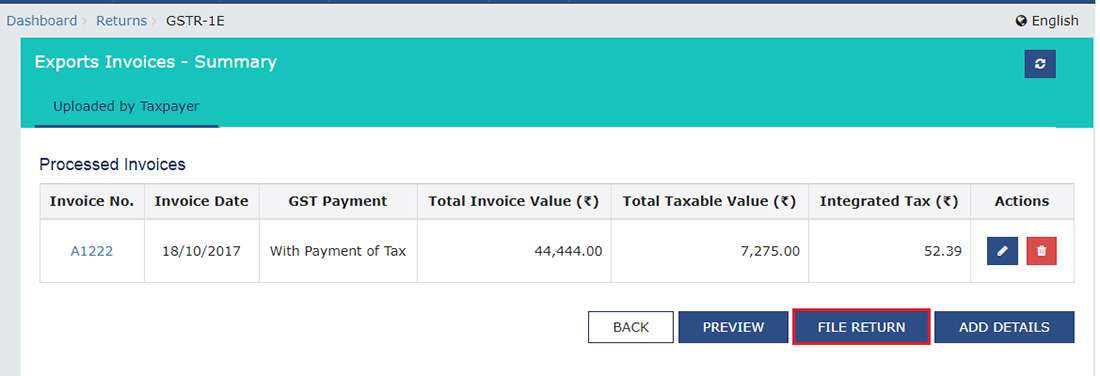

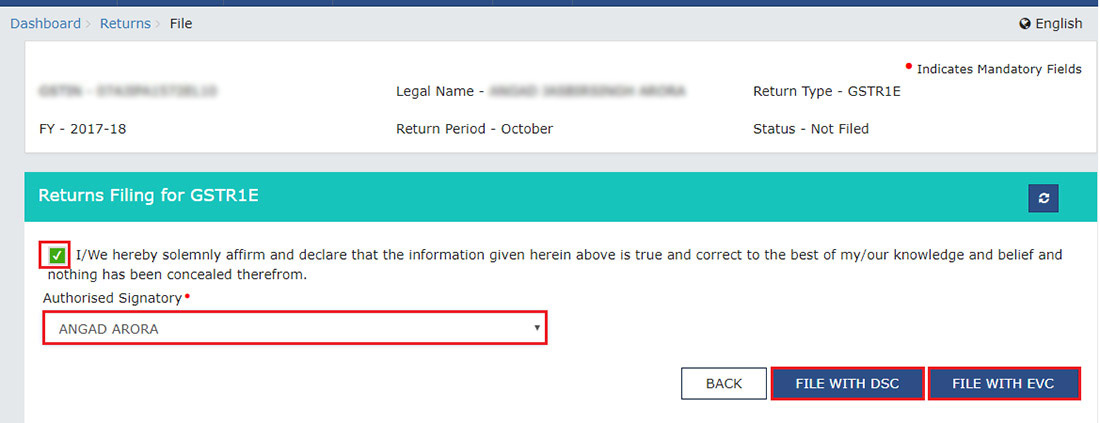

Step 4: File Table 6A of FORM GSTR-1 with DSC/ EVC

- Click the button – File Return

- The page – Returns Filing for GSTR1E displays. Opt the Declaration checkbox.

- Opt the authorised signatory in the drop-down list of Authorised Signatory, and you will get an option – ‘FILE WITH DSC or FILE WITH EVC’.

- Choose either button – FILE WITH DSC or FILE WITH EVC to file Table 6A of FORM GSTR1.

Read also: Common Errors in GSTR 1 JSON on GST Portal with Solutions

Note: Filing of the table 6A of form GSTR 1 is followed by notification via email and SMS to the Authorized Signatory.

File with DSC:

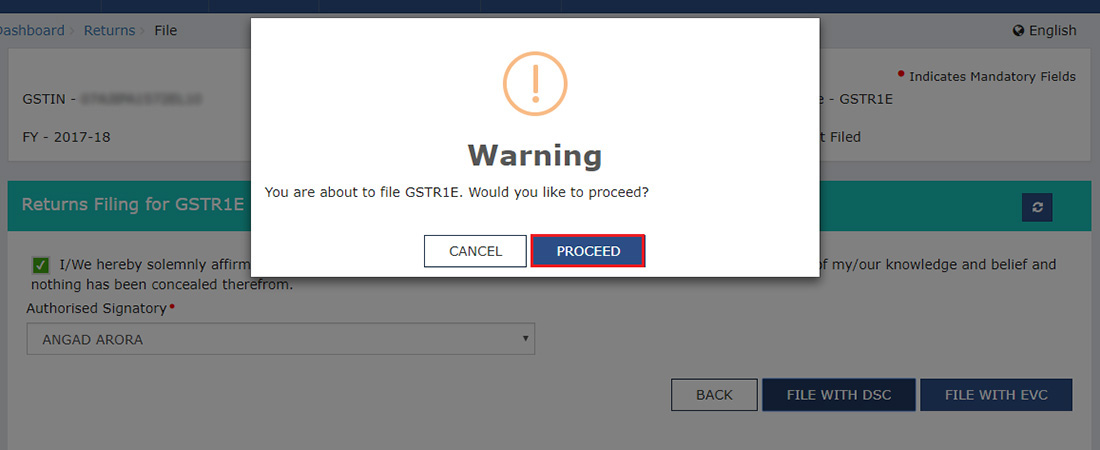

- Click the button – Proceed

- Choose the certificate and click the button – Sign

File with EVC:

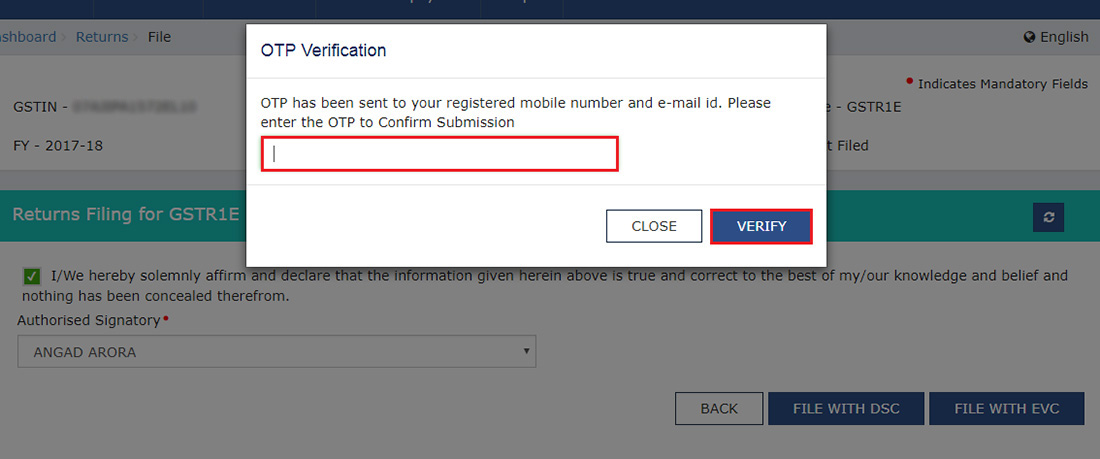

- Fill the OTP sent on email and mobile number of the registered (on GST portal) authorized Signatory and click the button – Verify button.

Similar: GSTR 1 JSON File Validation Process Via Gen GST Software

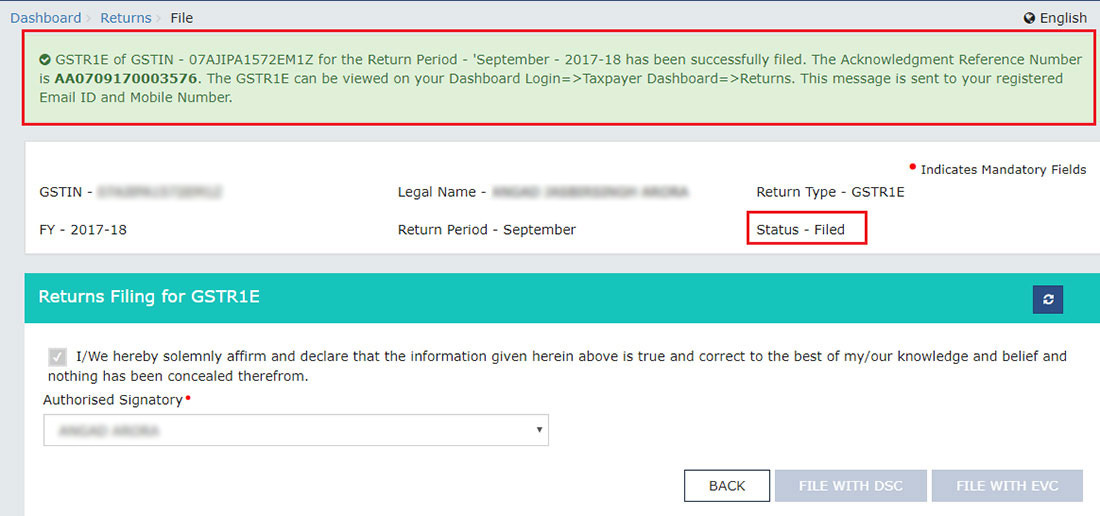

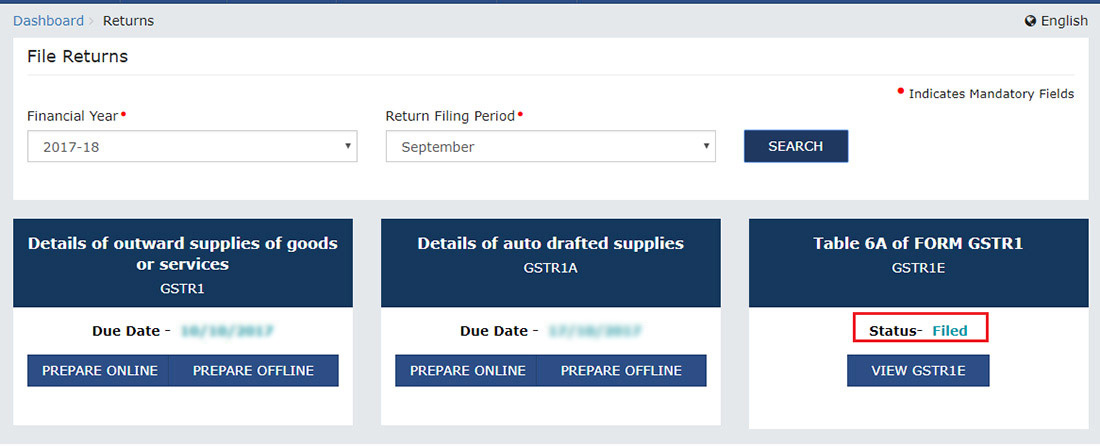

- The success message arrives and the status of Table 6A of FORM GSTR-1 return becomes- “Filed”.

Step 5: View Table 6A of FORM GSTR-1 Status

- The page – File Returns displays. Choose the Financial Year & Return Filing Period (Month), from the drop-down list, for which you wish to assess the return.

- Click the button – Search

- Status of the return becomes “Filed”.

FAQs – Table 6A (Export) of GSTR 1 Form

Q.1 – What do you mean by Table 6A of FORM GSTR-1?

Table 6A of FORM GSTR1 refers to the table of GSTR-1 outward Supplies Statement of the Supplier. It has been recently rolled out to facilitate exporters to claim GST refunds or ITC.

Q.2 – Where can I file Table 6A of FORM GSTR-1?

Table 6A of FORM GSTR1 can be filed electronically on the GST Portal. One can access it by clicking on Services > Returns > Returns Dashboard. After choosing the financial year and tax period, Table 6A of FORM GSTR1 of the given period arrives. Now click prepare online button to furnish the details.

Q.3 – Who needs to file Table 6A of FORM GSTR-1?

Every registered taxable person, who wish to claim a refund on taxes paid on exports can e-file Table 6A of FORM GSTR 1 on the GST Portal. This category excludes the compounding taxpayer, input service distributor, TCS Collector and TDS Deductor.

Q.4 Is the table needs to be filed in case of supplies to SEZ also?

No, the details of the supplies to SEZ and SEZ developers needs to be furnished in Table 6B of Form GSTR 1 and not in this table.

Q.5 By when can I file Table 6A of FORM GSTR-1?

Table 6A of FORM GSTR 1 can be filed before the submission of GSTR 1 for the current return period.

Q.6 – Do an individual needs to furnish the same data while filing GSTR 1 of the tax period if he has already furnished the data in Table 6A?

No, there is no need to furnish the data again as the data furnished in table 6A gets auto-populated in table 6A of GSTR 1 and is accessible in non-edit mode.

Q.7 – Is the form revisable after filing?

No, the form is irreversible. However, amendments can be made via Table 9 of Form GSTR 1 of subsequent tax periods.

Q.8 – How can one receive IGST refund when the commercial invoices data of Shipping Bills are mismatching with GST invoice data of GSTR 1/Table 6A of GSTR-1?

In such a case, one needs to modify his/her invoice declared under Table 6A of GSTR 1 in Table 9A of GSTR-1 of the tax period which is just next. GST System will re-validate it and send it to Customs for further treatment.

Q.9 – Can the form be filed for September 2023 if it is not filed for August 2023?

No, the Table 6A of Form GSTR 1 for September 2023 cannot be filed if the same has not been filed for August 2023.

Disclaimer:- "All the information given is from credible and authentic resources and has been published after moderation. Any change in detail or information other than fact must be considered a human error. The blog we write is to provide updated information. You can raise any query on matters related to blog content. Also, note that we don’t provide any type of consultancy so we are sorry for being unable to reply to consultancy queries. Also, we do mention that our replies are solely on a practical basis and we advise you to cross verify with professional authorities for a fact check."

Sir,

We have export shipping bills from 2020 to 2022. But, Missed filing it on GST portal.

Now, We need to claim the refund on exports of IGST paid. We have all the shipping bills with us.

How to Proceed applying for Refund now?

an Export Invoice was raised on US Firm and supplied material to their office in India. So, in GSTR6A should I have to mentioned with Tax Payment or Without Tax Payment.

In case of export of service, what should I fill for port code, bill of export no.

kindly please help me with the same

how can reduce value for gstr1, export order cancel?

What is Shipping Bill Number in GSTR-1 Table 6 in case of CSB-5 because they accept only 7 digit shipping bill number and courier shipping number is more than 7 digits.

CSB V bills have 5 digit shipping number. Just put 2 zeroes before those 5 digits. That will be the shipping bill number.

Original challan does not update, you can update the extra payment for 26QB in the software.

SIR WHILE FILING 6A , THE INVOICE NO WAS WRONGLY MENTIONED AS 04 INSTEAD OF 43, HOW CAN I AMEND THE INVOICE NO

You can amend the same in Next return period

OUR SALE WITHOUT PAYMENT OF GST IN JAN 2024

FOB VALUE RS 247500 (USD 3000) 12 % GST LOCAL

+

FREIGHT RS 99000(USD 1200) 18 % GST LOCAL

TOTAL INVOICE VALUE USD 4200.00 .

SO I WANT TO KNOW WHAT AMOUNT WE FILL IN TABLE 6A OF GSTR 1 IN

Total invoice value (₹) AND Taxable value (₹)

Total Invoice Value

Sir, in one of my shipping bill FOB value is 798801.96 rs, IGST value is 794065.98 rs and IGST AMT. is 95287.92 rs. my question is, In GSTR-1 return what is my Total Invoice value and Taxable value ?

889353.90

Hello Sir, I have only 1 export invoice every month. I am filing GSTR1 & GSTR3B every month & adding the invoice details. So while filing GSTR1 and GSTR3B every month do I need to attach copy of invoice on GST portal? If yes, where I need to attach it?

No

Q-1Invoice value entered in table 6-A should be the amount received in bank account as per forex rate (In INR)

As invoice issued to client is in particular currency like $.

Q-2 If LUT is filed, then GST payment will be selected as “Without payment of Tax” and taxable value will be entered in 0% rate slab.

Please confirm

Ans1. Yes

Ans2. Yes

If I have received some advance for export invoice or I have to adjust some advance received in previous month against export invoice, where should i show the advance received and advance adjusted in GSTR 1.

You need to show Advance received in Table 11A & Advance adjustment in Table 11B of GSTR-1

we filed one export invoice in gstr1 without mentioned port code, our export is under LUT. Now we see that total invoice submitted invoice place that particular invoice is missing, is it must to amended sir, if amended, is it will affect annual return

After amendment, it will affect annual return with amendment effect only i.e. (Amended amount – Original amount)

Sir, where to show export without payment of tax in Table-6A ie. in 0% or 28%, if tax rate in domestic market is 28%.

Thanks

28%

If I made Export Bill without payment mode. That product is eligible for 18% Tax in Local Sales. Now my question is in which taxable % I can enter that Taxable amount. In 0% or 18%

If you made a bill without payment mode then you should show the same under 18% rate

is exports without tax included in HSN summary in GSTR 1?

Yes

Where in GSTR-1 as well as in GSTR-3B data to be filled in case of item exported is exempted supply.

In GSTR-1, it is to be shown under Export section & Ans in GSTR 3B it is shown under Zero-rated sales

Do e-invoices transmitted to ice gate and the same is validated by ICEGATE? can ve amend the same in next month GSTR-1?

No

I skip to file GSTR6A separately and filed GSTR1 and GSTR3B how to issue a refund.

If Export invoice is generated in the month of July but Shipping bill is generated during august. Please clarify that about this export sale in which month it will be booked in GSTR 1.

Sir, it can be booked in July month without mentioning Shipping bill no., as mentioning of the same on the GST portal is not mandatory but if you want to mention shipping bill no. then you have to wait till Aug month

Which value should be entered in invoice value field? Shipping bill value or Invoice value?

Invoice vale

Will you please tell us ki In case there is a difference in Value there in invoice and Shipping bill Value then which value is to be shown in GSTR-1 and GSTR-3B?

Value as per the Invoice or Shipping Bill Value?

As per Invoice value