The finance ministry has to come up with solid plans to get the desired figures of tax revenue. Finance Minister Nirmala Sitharaman, who was supposed to introduce measures to accelerate the stagnant economy within a month of her maiden budget being approved by Parliament. The council is asking for suggestions from separate section stakeholders before presenting the annual budget for the financial year 2020-21 on February 1.

This is for the first time that the Department of Revenue in the finance ministry is seeking suggestions related to changes in income tax rates

The circular was released on 11 November asking suggestions from influentials in various sectors related to changes in the duty structure, rates and broadening of tax base on both direct and indirect taxes along with the justification for the same.

Released by the finance ministry the circular said, “Your suggestions and views may be supplemented and justified by relevant statistical information about the production, prices, revenue implication of the changes suggested and any other information to support your proposal,”.

Following the new budget released by FM Nirmala Sitharaman on 5 July, in the council meeting on 20 September, a 22% rate cut in corporate tax

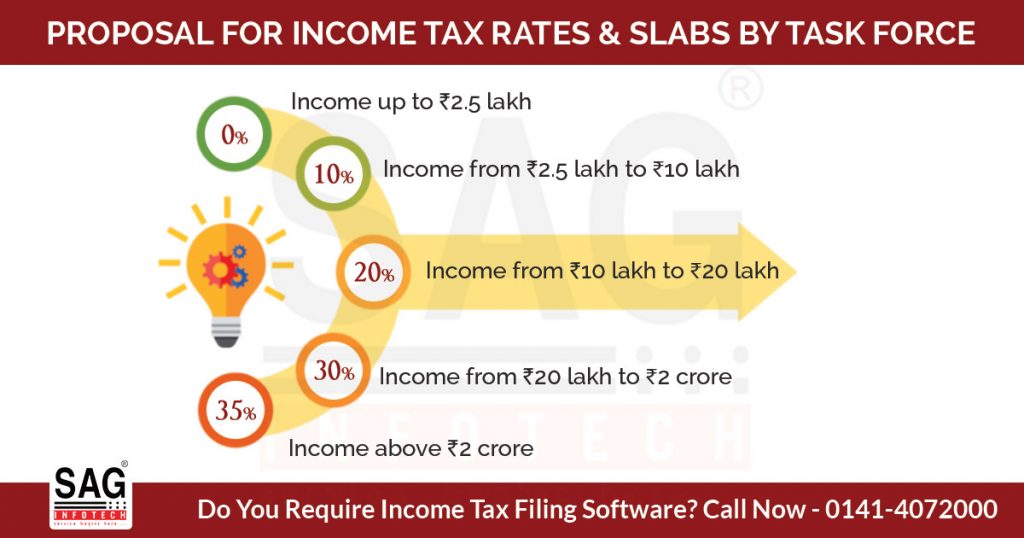

Along with this, there are demands for decreasing tax rates for individual taxpayers and small industries so that they have enough to spend retrieving the economy from a stagnant phase. The country’s economic growth has come down to 5% in the April-June quarter despite the fact that the government is working for the betterment of real estate and financial sectors.

“The government’s policy for direct taxes

The ultimate decision is of the GST council comprising of ministers from the state as well as central level. The order said that GST related requests are not recognized as part of the annual budget.

“The request for correction of inverted duty structure for any commodity (if needed) should necessarily be supported by adding the value of the commodity at each stage of the manufacturing process. Working on the suggestions would be easy if they are explained or are supported by adequate justification/statistics,” the order said.