EPF is a retirement benefits scheme in which both the Employee and the Employer make a contribution to the Employee’s PF account. It is mandatory for every company with more than 20 employees to get itself registered with EPFO (Employees Provident Fund Organisation of India), so chances are quite high that almost every salaried person has faced problems in checking their PF balance at least once in their lifetime.

Earlier, the inquiry for balance in the PF account was very cumbersome; a lot of forms were required to be filled out, but with time, the process of checking the PF balance has been made easier. Now, anyone can check their Provident Fund balances within a few seconds.

Here we are sharing the different methods through which one can keep track of their PF account.

Read Also: Generate PF/ESI Challan & TDS Filing Via Gen Payroll Software

How to Check PF Account Balance Online?

In order to check your PF (Provident Fund) account balance online, you will need your UAN (Universal Account Number) assigned at the time of registration on the portal password. Once you have these details, follow the steps below to check your PF balance and/or download the passbook online.

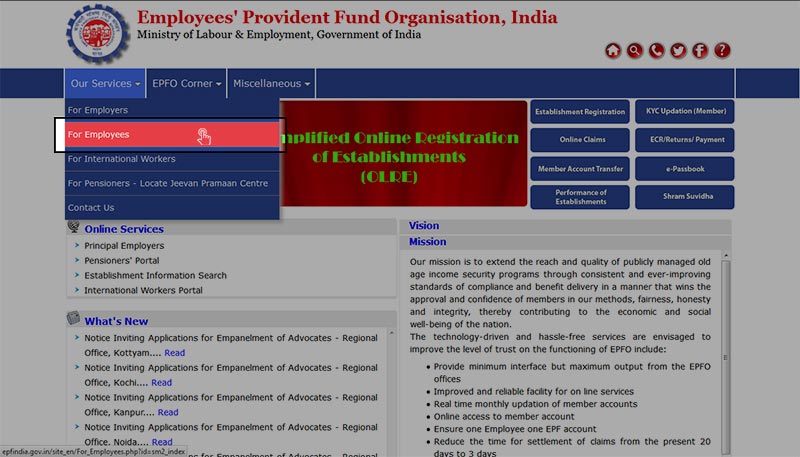

Step 1: Open the epfindia.gov.in website and from the top bar, select Our Services – For Employees.

It will open a new page- For Employees section.

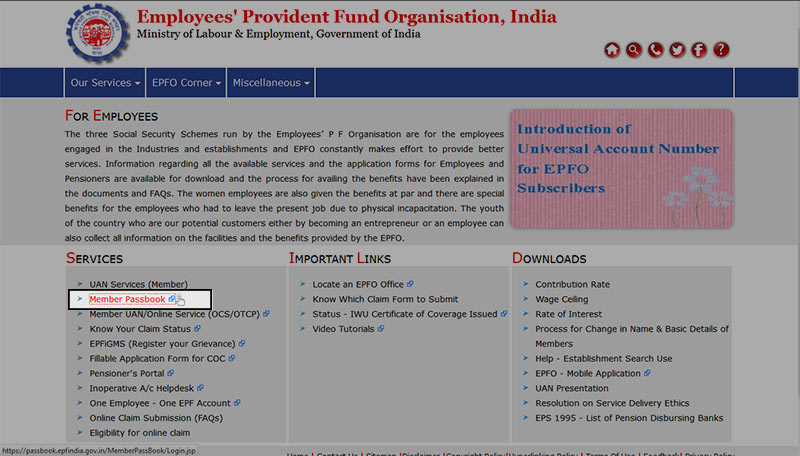

Step 2: Click on the Member Passbook option (under SERVICES), as shown in the image.

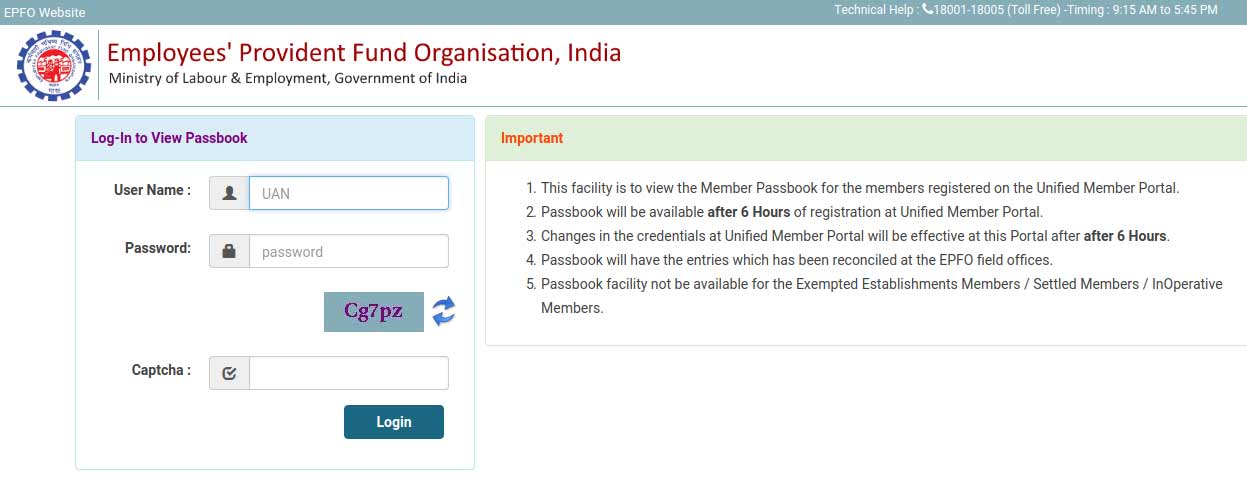

Step 3: Now, enter your activated “UAN No.” and “EPFO Password” in the respective fields, and click the Login button.

Remember that you must be registered on the EPFO member portal to be able to perform this action. (See ‘NOTE’ below if not registered)

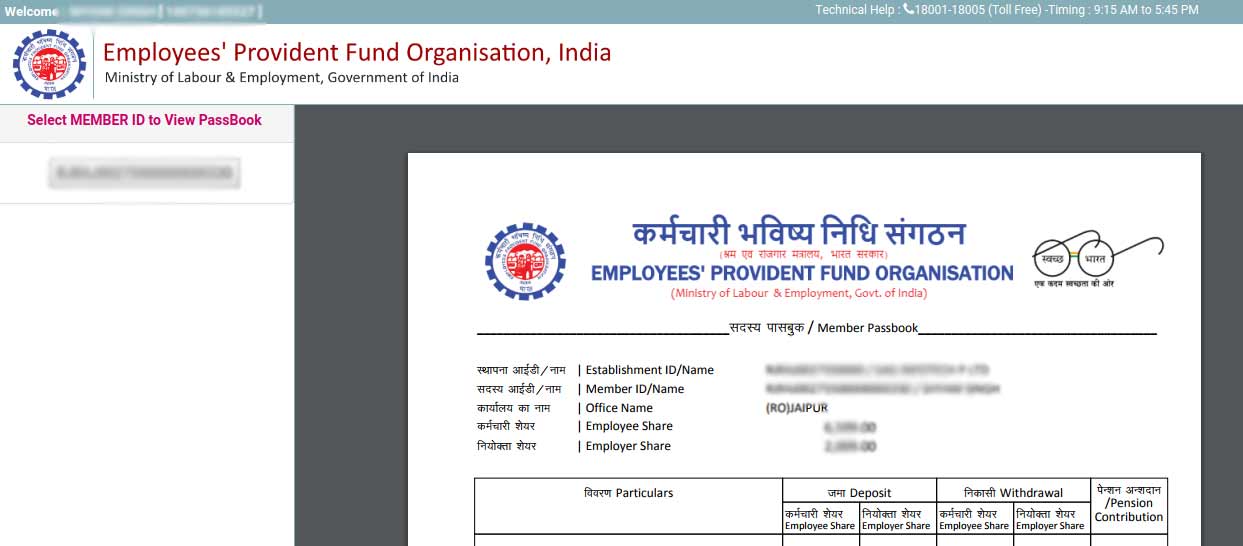

Step 4: On the next page, you will see a link below “Select MEMBER ID to View PassBook”. After the click, you can view or download the PDF copy of your EPF passbook.

In the passbook PDF, you can see your PF account balance as well as the contributions made by your company towards the account.

Direct Link to Download Member Passbook- https://passbook.epfindia.gov.in/

This is the latest information about the balance inquiry of the PF account. The previous link doesn’t exist anymore, so the http://www.epfindia.com/site_en/KYEPFB.php link will not be opened, and you will get the message- ‘Sorry, the link is not found.‘.

NOTE: If you haven’t already registered with EPFO online, you can register now by following the link below.

https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Click the “Activate UAN” link in the right sidebar. Enter your UAN number, Name, DoB, Mobile No and other details and submit to get the authorisation pin on your mobile. Once you verify the PIN, you will be able to create a password that will enable you to log in to the member portal.

How to Check PF Balance with a Mobile Phone:

PF Balance by Missed Call: It is possible that you may not have access to the internet all the time. During that time, this method comes to the rescue. For this method, your KYC must be integrated with your UAN No. Once that is done, every time you give a missed call to 011-22901406, you will receive a message with your PF account balance.

PF Balance by SMS: In order to be able to check your PF account balance through SMS, you must have your activated UAN number and have registered your mobile number with UAN.

To check your balance by SMS, send an SMS from your registered mobile number to 7738299899 in the following format.

EPFOHO UAN ENG

where ENG refers to English (the language in which you want to receive your PF account details) and UAN is your UAN number. (The SMS is not toll-free)

How to Check PF Balance Through Mobile App

These days, there is a mobile app for almost everything, then why not one for your PF status!

EPFO provides a centralised mobile app for the government, which is the UMANG application. Employees can check their EPF balance and get their PF passbook by logging in using UAN and OTP on their phones by downloading the UMANG app from the Google Play Store or App Store.

EPFO India has launched an Android mobile app (m-epf) for the convenience of the employees so that they can keep track of their PF account balance in just one touch. Also, the official mobile app offered by EPFO India is available for the Android version only. To use the mobile app, all you need to know is your UAN No. and your registered mobile no.

NOTE: If you landed here while searching for ‘cmpf balance inquiry’ – Follow the link below to get redirected to the official CMPF website – http://117.239.23.50/memberlogin.php

Do remember that your ‘Aadhar Number Is Now a CMPF Number’. Official Site- http://cmpfo.gov.in/

Do put forward your views and comments regarding any problem faced while checking the online PF balance. We would be more than happy to assist you in all possible ways.