Goods and Services Tax (GST) completed three years on July 1, 2020, it was introduced to keep the taxation system simple and beneficial for taxpayers. It brings various changes and also the compliance rate has been improved. But still, there is a major issue Central as well as the State government are complaining about, and the issue is “the shortfall in revenues”.

As per reports, the actual revenue in FY20 from the GST

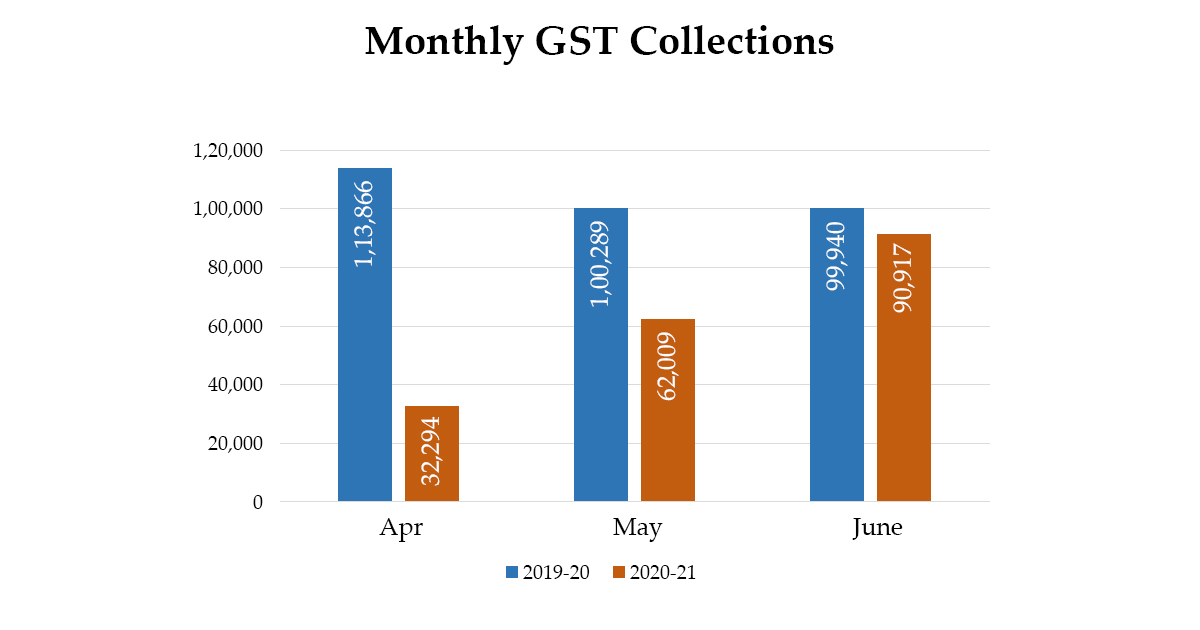

After seeing a lower collection of Rs 32,294 crore in April, and Rs 62,009 crore in May, a spike in the collection of June 2020 has been reported, the collection reached at Rs 90,917 crore in this month. But there are a few valid reasons behind this spike, it can be either due to lifting of the lockdown or due to delayed filing of GST returns

States will get compensation till FY22, but they are worried about revenue loss after expiring this agreement. And when the finance minister, in her budget speech, has categorically stated, “Hereinafter, transfers to the (compensation) fund would be limited only to the collection by way of GST compensation cess”, then this matter becomes more serious.

Many experts are thinking about Reforming the rate structure of GST

Serious reform of the tax system is possible if an increase in revenue collection is promised, the reason for the low revenue through tax can be its poor compliances of the tax. Another major reason is the lack of stability in the technology platform even after three years.

The GST council meeting