Similar to Tax Exemption, Every budget and every successive government proposes a rebate of tax for a certain level of income. At Present, the rebate of tax is accessible for those individuals whose income is not over ₹5 lakhs. Notably, This rebate is available as per Section 87A. Let us discuss how this section works for you.

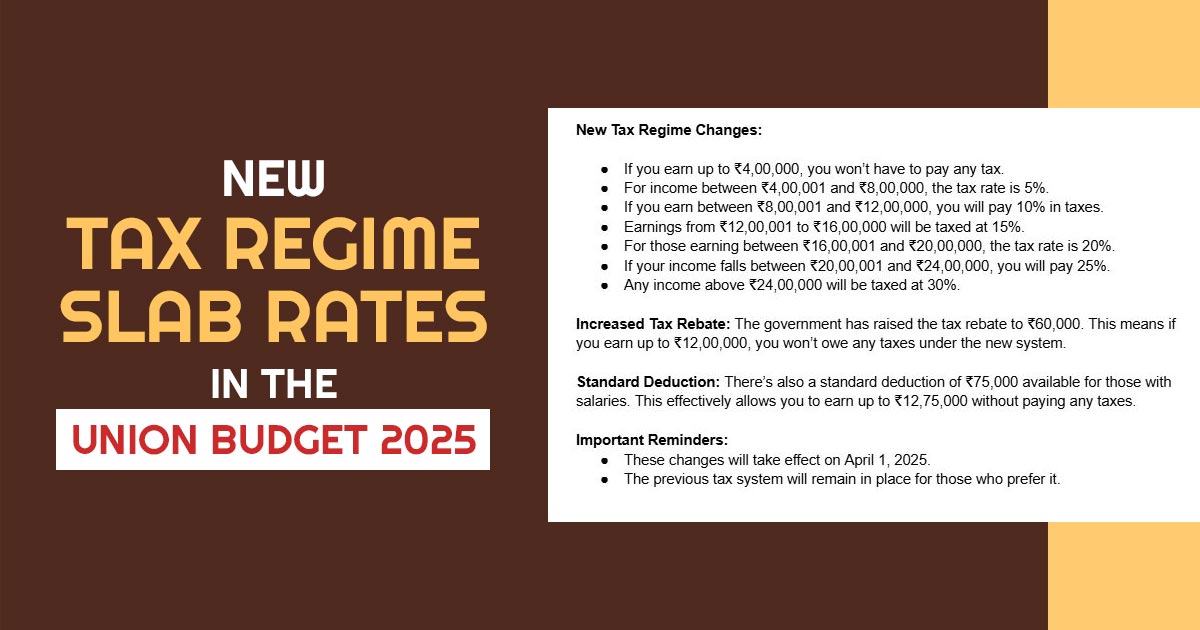

Union Budget 2025: New Tax Regime Slab Rates

What is the Provision Related to Section 87A of the Income Tax Act?

Recalling history in a hurry, Section 87A was inserted in the Finance Act 2003, which has changed from time to time. The present law on rebate of tax entitles a tax rebate of up to Rs 12,500 against an individual’s tax liability if his income is not more than ₹5 lakhs. However, everybody and anybody is entitled to take advantage of the aforesaid rebate. Anybody and everybody are not eligible for this rebate. For Instance, HUFs and NRIs are not entitled to this rebate.

So, Who is Eligible for This Rebate Under Section 87A?

There has always been chaos, confusion, and heated debate on this issue.

So, the parameters for the eligibility of this rebate under section 87A of the Income Tax Act 1961 are mentioned below in steps.

Step 1: To begin with, the income to be taken into consideration for the access to a rebate under section 87A is arrived at after setting off the ‘brought forward losses’ of the previous year from the income of the current year.

Step 2: Thereafter, from the net income left after the set-off of such losses, you have to subtract all the available deductions that come as per various sections of Chapter VIA. Chapter VIA contains within its purview deductions for various items: Section 80C (For PPF, ELSS, LIP, EPF, home loan repayment, tuition fee and so on), 80G (donations), Section Section 80D (Health Insurance), and 80 TTA and 80TTB (Bank interest), 80CCD (NPS).

Step 3: Liability against which rebate can and cannot be adjusted?

A rebate up to Rs. 12,500 is not always applicable in the case of all liabilities. This rebate can be claimed in the following cases:

- In the case of normal income, which is taxable at the slab rate

- In Section 112. Section 112 is applicable for long-term capital gains on the sale of any capital assets except Listed equity shares, in addition to equity-oriented schemes of mutual funds.)

- The aforesaid rebate is also available against an individual’s tax liability for short-term capital gains on listed equity shares in addition to equity-oriented schemes of mutual funds as per Section 111A on which tax is to be paid at a flat rate of 20%.

It is worthwhile to mention here that an individual is not entitled to set off his tax liability in respect of

- Long-term capital gains as per Section 112A arising on the sale of listed equity shares

- Equity-oriented schemes of mutual funds that are payable 12.5% after the initial exemption of Rs. 1.25 lakhs.

Latest Changes in the New Rebate U/S 87A in Budget 2023

In 2013, a proposal for the Section 87A rebate was made for the first time. It was updated again in the year 2019 and is now updated in the year 2023.

According to the provisions of section 87A of the Act, an assessee, who is a resident individual in India, is given a rebate of 100% of the amount of income tax that is due, meaning that a person with income up to Rs 5 lakh is not obliged to pay any income tax.

A person resident of India who is an assessee and whose income is subject to tax under the proposed sub-section (1A) of section 115BAC from the assessment year 2024–25 onwards shall be entitled to a refund of 100% of the amount of income tax payable on a total income not exceeding Rs 7 lakh.

This would imply that no income tax would be due on earnings up to Rs 7 lakh.

New Tax Regime Slab Rates for AY 2025-26

| Tax Slabs | New Tax Regime |

|---|---|

| 0-3 lakh | NIL |

| 3-7 lakh | 5% |

| 7-10 lakh | 10% |

| 10-12 lakh | 15% |

| 12-15 lakh | 20% |

| Above 15 lakhs | 30% |

New Section 87A Rebate Suggested in Budget 2023

According to these slabs, Rs. 25000 in income tax is due on a total income of Rs. 7 lakh. According to the new proposed amendment, everybody with an annual taxable income of up to Rs 7 lakhs is now qualified for a Rs 25000 income tax rebate.

How Does the Rebate Work in Real Life?

Ordinarily, Individuals are under the false impression that if their income does not exceed ₹7 lakhs, they don’t have to pay any tax. However, if an individual’s income comprises income that is taxed at a rate of 20% (being short-term capital gains) or 12.5% (being other long-term capital gains), he has to still pay some tax even if his income does not exceed five lakhs.