A Special Leave Petition (SLP) has been dismissed by the Supreme Court, which was submitted via the revenue against Standard Chartered Bank for filing of TRAN-01 through another state’s Goods and Services Tax (GST) portal amid technical glitches.

Revenue furnished the SLP contesting the ruling of the Telangana High Court, which kept the action of Standard Chartered Bank of filing TRAN-01 through a distinct GST portal of the state, because of the portal issues.

The facts are that the applicant, Standard Chartered Bank, headquartered in Mumbai, Maharashtra, tried to file its TRAN-01 return on the Maharashtra GST portal. However, due to technical glitches, the bank could not complete the filing.

As the bank also had a registered branch in Telangana, it submitted the GST TRAN-01 return on the Telangana GST portal dated October 18, 2017. The credit was taken and thereafter transferred to the Maharashtra GST portal on the same day.

The revenue, even after this issued a pre-show cause notice dated September 3, 2021, alleging that the credit taken via the Telangana GST registration was not qualified and required to be reversed along with the interest and penalties.

The applicant’s answer dated September 9, 2021, specifies that the total transitional credit of Rs 1,41,26,69,646 has been transferred to the Maharashtra GST registration on the same filing day with merely a differential balance of Rs 2,00,000 left in Telangana. Also, the bank furnished the supporting proof along with its electronic credit ledger from July 2017 to March 2018.

The revenue was not pleased with the explanation and proceeded with an adverse order in the original dated October 31, 2023. The applicant contesting the same order proceeded to the HC.

The Telangana High Court, in its ruling, referred to the decision of the Supreme Court in M/s. Godrej Sara Lee Ltd. highlighted that purely legal disputes must be adjudicated by High Courts instead of being dismissed on the grounds of alternative remedies.

It was marked by the HC that u/s 140(1) of the GST Act, a registered person is qualified to claim the CENVAT credit in their electronic credit ledger, and as the GST registration and PAN of the bank were the same all across the country, there was no statutory need to limit the filing to Maharashtra’s portal alone.

HC, the department is obligated to maintain the functionality of the GST portal, taxpayers must not be penalized for system failures. It concluded that the department could not take the benefit of its weaknesses to levy the liabilities on the taxpayer.

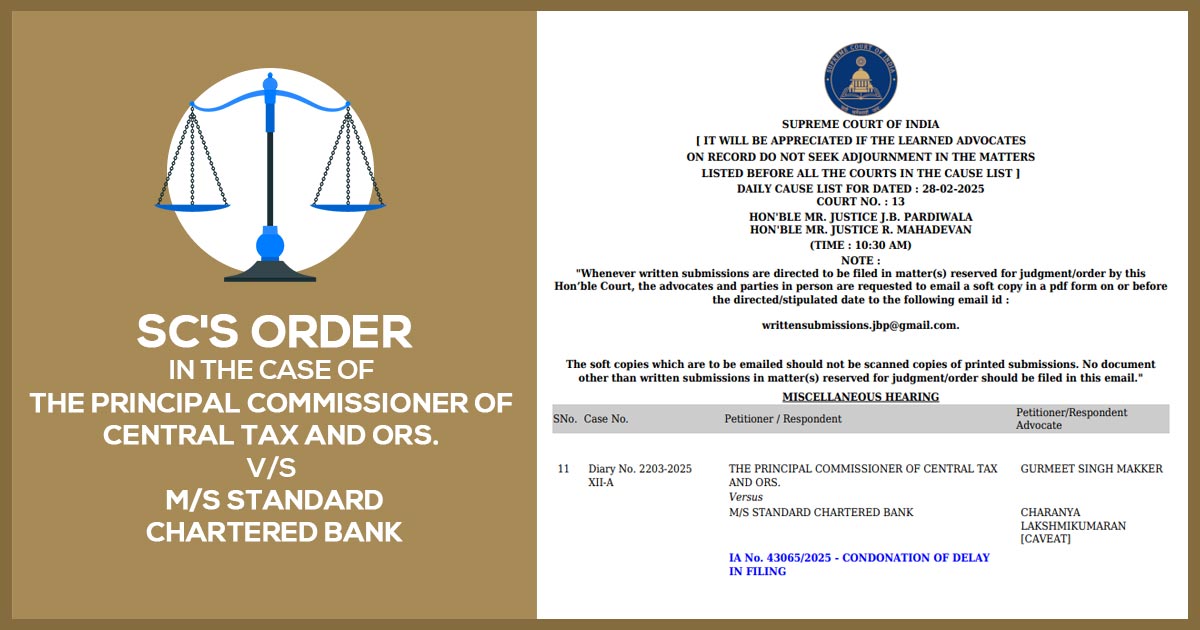

Therefore, the bench of Justices J.B. Pardiwala and R. Mahadevan did not interrupt the Telangana HC ruling and kept the filing of TRAN-01 but another state’s GST portal when the designated portal underwent technical glitches.