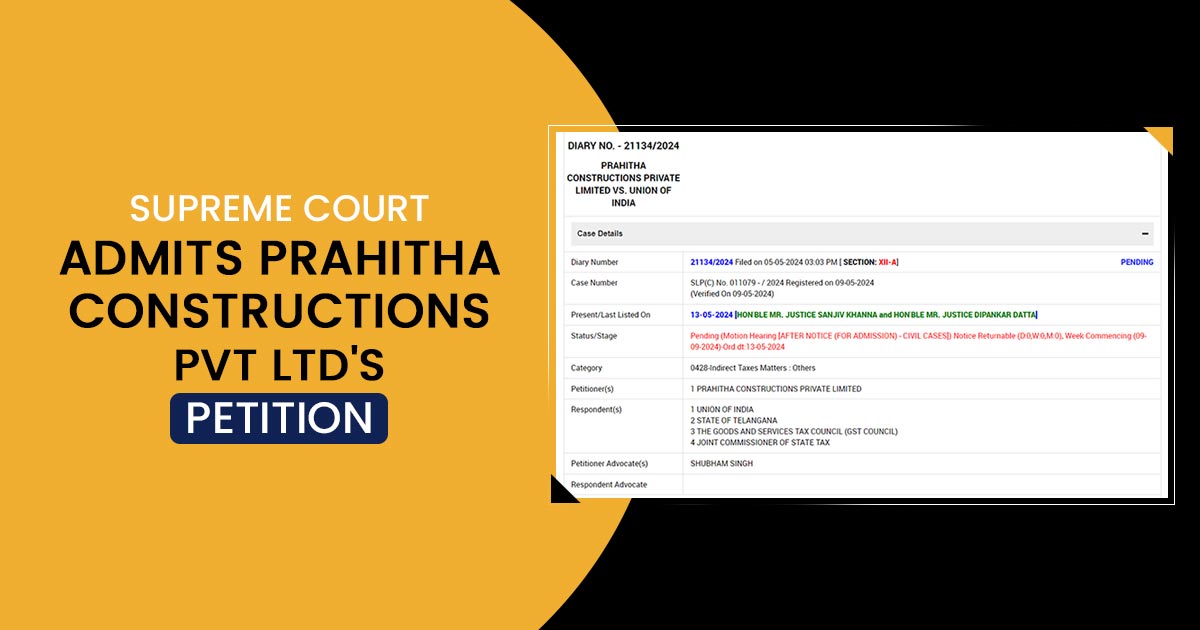

A petition contesting the levying of the GST on the transfer of development rights within joint development agreements between realty developers and landowners has been considered by the Supreme Court of India.

The court in the case has furnished the notices before the Union government, GST Council, and Central Board of Indirect Taxes and Customs (CBIC) asking them to furnish their response to the special leave petition (SLP) filed via a property developer in Telangana.

An 18% GST applicability is towards the impact of the real estate projects in all the property markets all across the country marking a significant transformation in the cost dynamics of the joint developments and redevelopment projects.

Before the same Telangana High Court in February had dismissed a statute challenge drawn via the identical developer, who proceeded to the Supreme Court asking for relief.

Tax expert while representing the developer claimed that in the identical matter of barter, the issue is that if the ancillary and the incidental right attached with the sale of the land shall be within the GST since the supply of the land is not been included from the purview of the GST.

He claimed that the second leg of the barter transaction in the form of works contract services without any dispute is already within the tax and the imposition of the GST on the development rights shall directed to double taxation.

A writ petition has been filed via a South India-based developer in 2020 with a GST notification in 2019 which furnished for the point of taxation to levy the tax on the transfer of the development rights via the landowner to the realty developer. Through the same, the petition has cited that the authority has planned to levy the tax on the transaction similar to the land sale.

Real estate developers have approached the Ministry of Finance with their opinion on the impact of the GST being imposed on the rehabilitation apartments being built and delivered back, free of cost, to existing occupants as part of redevelopment projects.

In the functionality of property markets projects involving joint development and redevelopment secure an important role particularly provided the backdrop of enhancing the land prices and the dwindling availability of vacant land parcels in urban centres.

The problem is concerned with the charge of 18% GST on the value of development rights that shall make diverse projects in the markets including Mumbai, Pune, Bengaluru, Hyderabad, and Kolkata unfeasible for all stakeholders including landowners.

Read Also: Impact of GST on Real Estate Sector in India

The case resultant seems to change the landscape of property development impacting the stakeholders as well as again making the methods in the real estate sector.

Gst department issuing notice to builder and demanding GST @5,%on market rate flats allocated to existing society members builder is putting this liability at flat owner I don’t know what kinds of tax Govt want that day is not far when FM will ask to pay gst on single breaths. Some one will listen our voice and help common people from terrorism of tax.