The Supreme Court stated that technological challenges cannot justify harassing an assessee, urging the Income Tax Department to improve its software to prevent future errors.

The Court ordered the Central Board for Direct Taxes to take appropriate actions to correct the software.

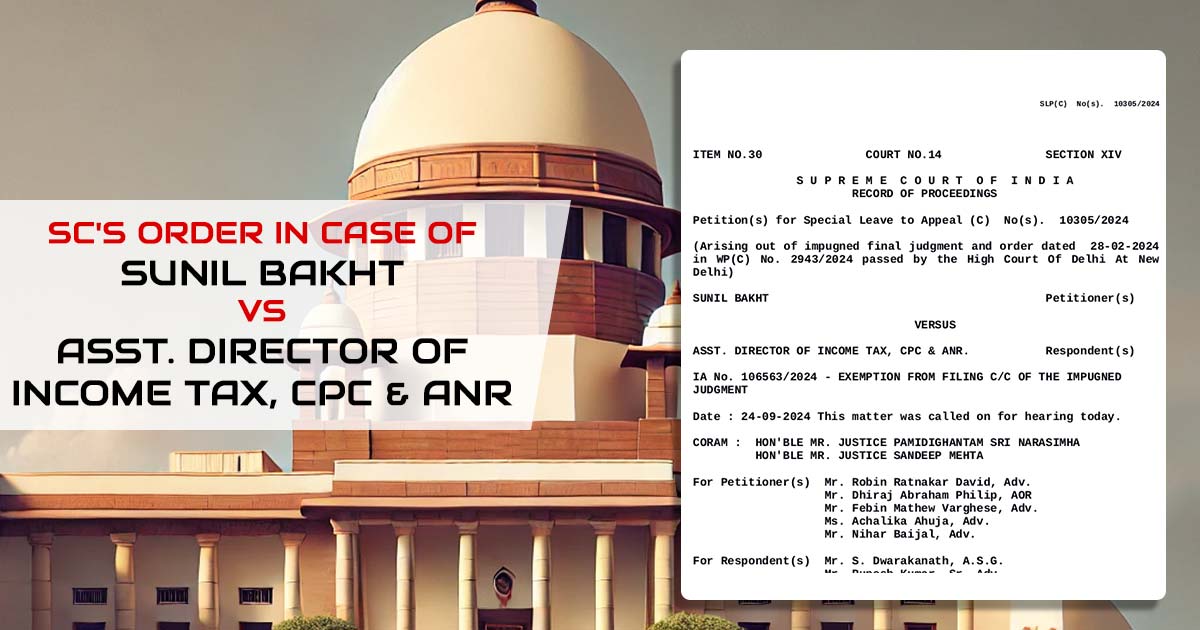

A bench of Justices PS Narasimha and Sandeep Mehta was hearing an appeal filed by a taxpayer challenging the levying of a surcharge on Rs. 1.57 Crores and asking Rs. 2.01 Crores for the AY 2022-23.

It was remarked by the bench that for the former AY 2021-2022, an identical levying of a surcharge was contested and the Revenue admitted to remit Rs 1.33 Crores.

Recommended: Enhancement of Monetary Limits for Filing Appeals

The revenue’s counsel furnished that even in the current proceedings (AY 2022-2023), there is rectification of the excess surcharge and the amount was remitted to the applicant dated 06.06.2024.

In the pendency of the proceedings, an additional demand notice was raised on 28.05.2024 for the AY 2023-2024, under which the surcharge was calculated at 37%, and a demand of Rs. 62,85,070/- has been raised.

It was furnished by the revenue that the error is emerging as the Central Processing Centre (CPC) does not follow the process of removing excess computation as it is programmed to that has been computed and raise demand.

Read Also: More Difficulties in I-T Portal Delaying Audit Report Filing, Disappointing Tax Experts

The bench in this regard observed that:

“The technological impediment cannot be a reason for harassing an assessee year after year. Immediate steps must be taken by the Revenue to upgrade the software or take such other steps as may be necessary to ensure that such mistake does not occur in future.”

The Revenue for the Assessment Year 2023-2024, was asked to take immediate steps and communicate the order of withdrawal of the excess surcharge amount within 6 weeks from the date of the receipt of the order.

“The Central Board for Direct Taxes shall also take necessary steps for rectifying the software as the issue may not be resolved by the Jurisdictional Assessing Officer,” the Court noted.

| Case Title | Sunil Bakht VS ASST. Director of Income Tax, CPC & ANR |

| Appeal No. | 10305/2024 |

| Date | 24-09-2024 |

| For Petitioner(s) | Mr. Robin Ratnakar David, Adv. Mr. Dhiraj Abraham Philip, AOR Mr. Febin Mathew Varghese, Adv. Ms. Achalika Ahuja, Adv. Mr. Nihar Baijal, Adv. |

| For Respondent(s) | Mr. S. Dwarakanath, A.S.G. Mr. Rupesh Kumar, Sr. Adv. Mr. Raj Bahadur Yadav, AOR Mr. H R Rao, Adv. Mr. Navanjay Mahapatra, Adv. Mr. Satya Prakash, Adv. |

| Supreme Court | Read Order |