The Jaipur Bench of Income Tax Appellate Tribunal (ITAT) permitted an appeal filed by a retired State Bank of India employee, carrying that the revised Rs 25 lakh exemption limit for leave encashment u/s 10(10AA) of the Income Tax Act,1961, applied retrospectively as notified by the Central Board of Direct Taxes (CBDT).

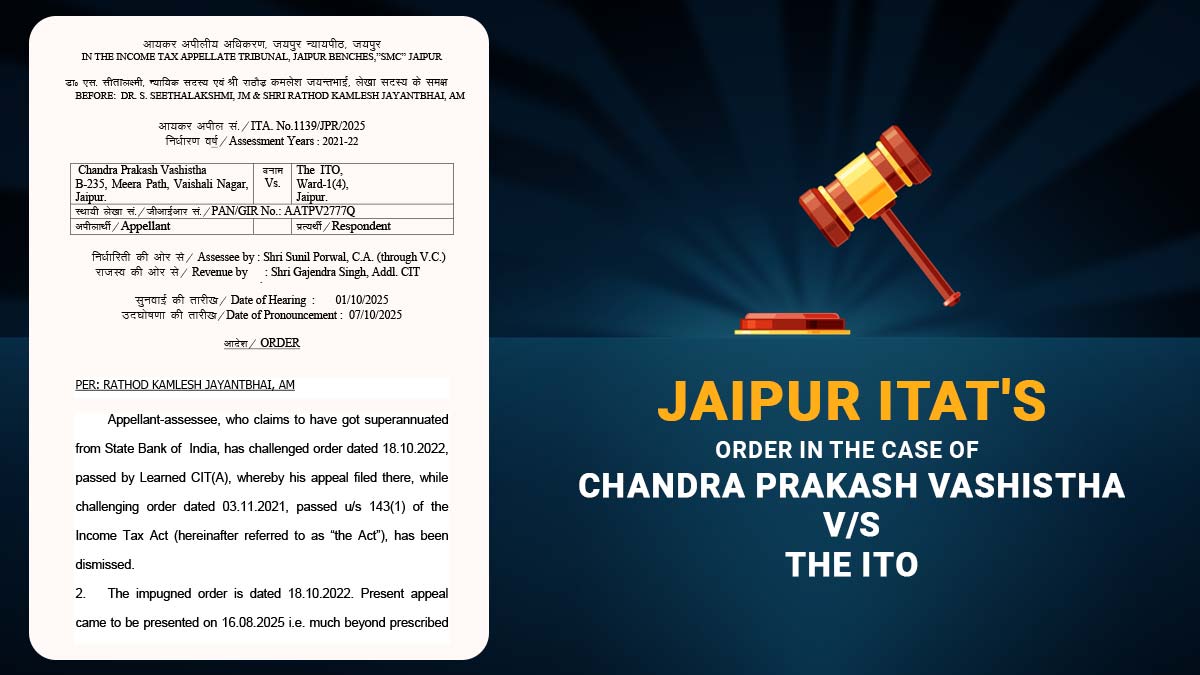

The taxpayer, Chandra Prakash Vashistha, and a retired employee of the State Bank of India, had submitted an appeal against the order dated 18.10.2022 passed by the Commissioner of Income Tax (Appeals) [CIT(A)], which kept the intimation issued u/s 143(1) of the Act on 03.11.2021. On 16.08.2025, the appeal submitted was late by 959 days, for which a condonation application was filed.

The counsel of the taxpayer had addressed the issue of delay, citing that the taxpayer, who is a retired bank employee of age over 65 years, was not able to submit the appeal within time, as he had approached various tax consultants before choosing to contest the impugned order. Therefore, the counsel asked that the late filing of the appeal be condoned.

The two-member bench, Dr S.Seethalakshmi (Judicial Member) and Rathod Kamlesh Jayanbhai (Accountant Member), stated that the taxpayer had filed an affidavit attested before a notary public along with the condonation application. It cited that the taxpayer, a retired bank employee, had received leave encashment benefits on superannuation.

Read Also: New Tax Regime (U/S 115BAC) Process in Gen IT Software

As the taxpayer had cited on oath that the delay had taken place because of consulting various legal experts before submitting the appeal, and the statement stayed uncontested, the tribunal accepted the explanation and condoned the late filing of the appeal.

The counsel of the taxpayer, the taxpayer obtained Rs 13,05,810 as leave encashment u/s 10(10AA) of the Act. It cited that the CBDT, via a notification on 24.05.2023, had increased the exemption limit for non-government employees to Rs 25 lakhs with retrospective effect. The counsel stated that the CIT(A) was unable to apply this notification and hence made a mistake in validating the assessment order.

The departmental representative did not contest the notification or the revised limit.

The tribunal, acknowledging the same, held that the notification was advantageous to non-government employees and set aside the Assessing Officer and the CIT(A) orders. As per that, the appeal was permitted with directions to apply the revised exemption limit.

| Case Title | Chandra Prakash Vashistha vs. The ITO |

| Case No. | ITA. No.1139/JPR/2025 |

| Assessee by | Shri Sunil Porwal |

| Revenue by | Shri Gajendra Singh |

| Jaipur ITAT | Read Order |