A new format for Form 16 has been notified by the CBDT (Central Board of Direct Taxes), which is the ‘salary TDS certificate’. This new format will break down the tax-exempt allowances in detail, which are paid to the employee and apart from this, the entire tax breaks that are claimed by the taxpayers.

Salary TDS Certificate Notified Date & When It Came Into Effect?

The CBDT notified the new format for Form 16 through a notification on 12th April 2019. It has come into effect from 12th May 2019, i.e. before the deadline of issuing Form 16 or the TDS certificate by employers for salary. So, the person who will issue Form 16 after the mentioned date will have to do it in the new format.

How is this new format different from the Earlier Format?

The earlier format permitted the firms or companies to give aggregate data or break-ups in different formats for both of them, which resulted in problems with their personal composition.

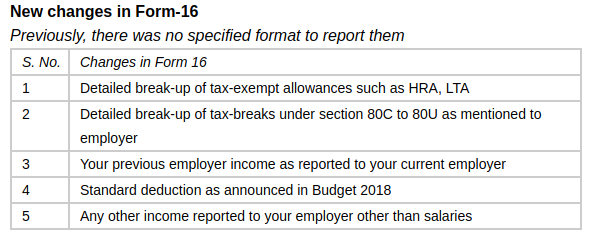

What Changes have been made in the New Format of the TDS Return?

To allow tax employees to recheck the ITR, Form 16 and the TDS returns of the company with ease, the tax department has made concurrent changes in the new format of the TDS returns (details of TDS from the salary of employees) filed by the companies.

“Tax-exempt allowances received by an employee are to be reported in the new Form-16 under section 10

Reasons Why the Salary TDS Certificate has been Notified?

The salary TDS certificate has been notified because in the previous year, the tax person found many incorrect claims made by the employees, which too in huge income tax refunds. So this new format has been notified to remove all such false claims in the future.

How is the New Format Better than the Old One?

With the help of the new format, the tax department can see the breakup of the income and tax breaks in detail for the salaried person in the first occurrence itself. Apart from this, the tax department can also see if there is any difference between the income and deductions in Form 16 and if an individual files the Income Tax Returns (ITR), it will also be seen immediately.

Read Also: Easy Guide to Generate Form 16 via Gen TDS Return Software

It also helps the department to recheck the data digitally, as the company has already provided the breakup of the income and deduction and also fixes the format as they provided it.

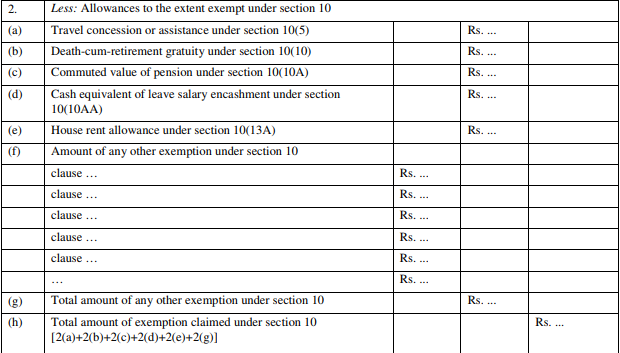

According to the new format for Form 16, the form issued by any employer must mandatorily mention the nature of the tax-exempt allowances which is paid to the employee. “The previous format of Form-16 did not provide the specific list of tax-exempt allowances on which the salaried person was not required to pay any tax. Now, as per the revised format, the employer will have to specify the nature as well as the amount of allowances that are exempt from tax.

Similar details have also been asked for in this year’s ITR-1,” said Abhishek Soni, CEO of Tax2filing.in, a tax-filing website. The new format gives full details of the allowances like the house rent allowance under section 10(13A), Travel concession or assistance under section 10(5), and many other exemptions under the Income Tax Act.