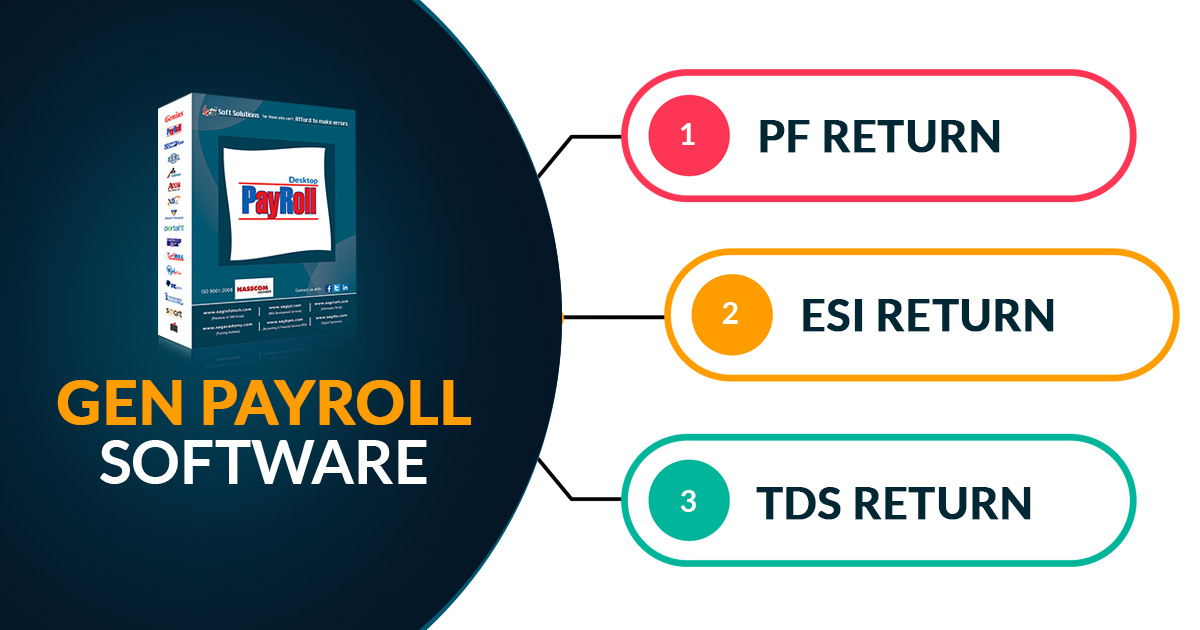

In the era of Quarantine amidst the Corona Crisis with which our country and the entire world are grappling, The employers covered under ESI Scheme can now file & pay ESI Contribution via Gen Payroll Software for the month of April 2021 till June 15, 2021 — the Previous Last Date was May 15, 2021. Consequently, This would provide a relief of an extended window to nearly 12.36 lakh Employers for paying the contribution under the ESI scheme.

The regular life of the entire population has been out of order with restrictions and prohibitions of not going out of home & unable to work, closure of Industries, norms of social distancing, and so on. Employees’ State Insurance Corporation (ESIC) has eased the provisions as mentioned in Regulation 31 of ESI (General) Regulations, 1950.

“In line with the relief measures being extended by Government to business entities and workers, Employees’ State Insurance Corporation (ESIC) has relaxed the provision and allowed the filing of ESI contribution

ESIC has more than 3 crore insured persons and there are more than 12 crore beneficiaries in all, considering a family size of four. And The scheme is applicable to all establishments with 10 or more employees.

Under the umbrella of the ESI scheme, the person who is insured is permitted to access the medical benefits, disablement benefits, sickness benefits, maternity benefits, and so on