The taxpayers at the time of filing their income tax return (ITR) have to clear their previous tax pending to complete the process of ITR filing. Adding to this, any mistakes made while submitting self-assessment tax or advance tax during the year will also result in non-deposit of tax. Such tax deposits will also not be reflected in Form 26AS, and further, the facility of the claim tax credit will also be unavailable for the same.

It is possible that you, as a taxpayer, select the wrong assessment year or the wrong tax category while furnishing your advance tax or self-assessment tax for a given year, leading to the discrepancy. There are common ways to correct the errors in income tax payments made by taxpayers in India.

Before that, the taxpayers should know that ITR can be filed to the credit of the government in two ways:

- Through online payments (by visiting the ‘Quick links’ tab present on the e-filing website of the income tax department https://www.incometax.gov.in/iec/foportal/

- By submitting physical challans at the bank branch

In Case of Online ITR Filing

In the case of online ITR, the correction can only be made by the assessing officer of the taxpayer. As per the ITR filing website, “the taxpayer must visit the assessing officer and request him to correct the mistake made by him in ITR. The office of the assessing officer can be easily located on the e-filing website of the income tax department.”

Here are detailed steps to find the assessing officer’s address on the official e-filing website:

- Step 1: Visit https://www.incometax.gov.in/iec/foportal/

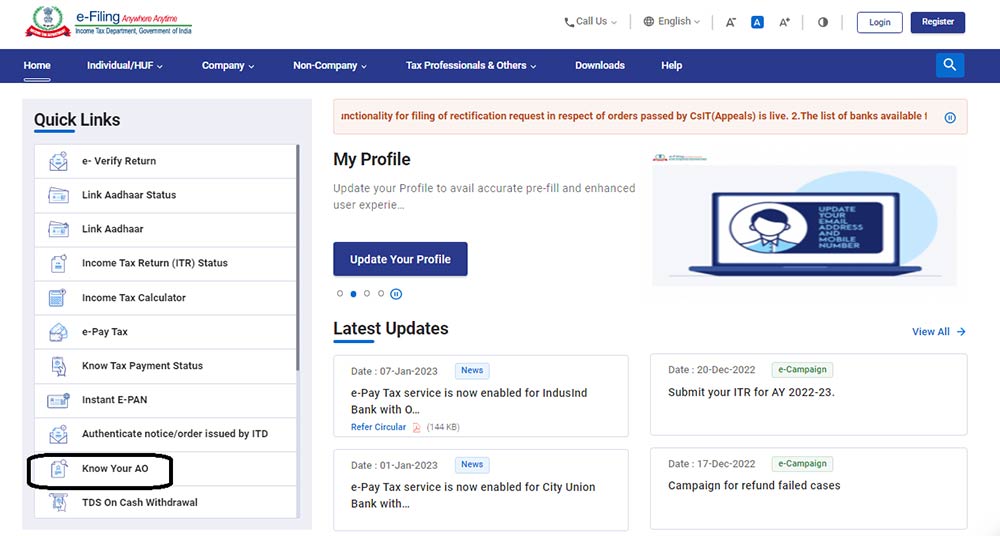

- Step 2: Once the user lands on the home page, click on the AO (‘Know your AO’) present under the ‘Quick Links’ tab.

- Step 3: A new web page will appear on the screen.

- Step 4: Select your PAN and mobile number and click on the Continue tab.

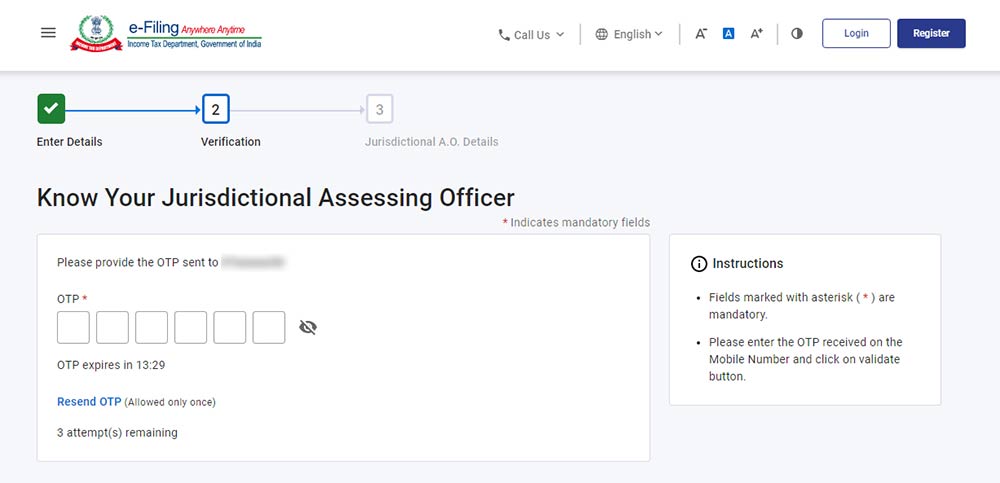

- Step 5: Enter the OTP received on your registered number

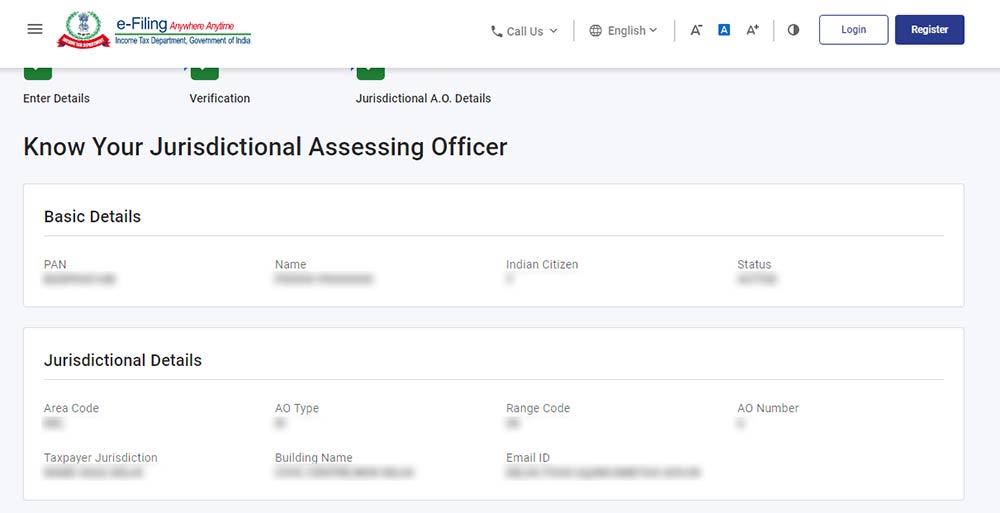

- Step 6: The address of your Income Tax Assessing officer will be shown after the correct OTP is entered.

Read Also: Easy Ways to Reset Password On Income Tax Return E-filing Website

After getting the address, you should visit the AO’s office to get the correction done.

In Case of an Income Tax Return (ITR) Filed via a Bank Branch

If the payment of advance tax or self-assessment tax has been made via a bank branch, the bank has the authority to correct certain mistakes in ITR within a given period.

The mistakes that can be corrected in ITR by the bank include:

- Assessment Year

- Major Head Code

- Nature of payment (TDS Codes)

- Minor Head Code

- TAN/PAN

- Total Amount

Note: Other income tax return errors can only be corrected by the assessing officer

Bank can make corrections in ITR but with certain conditions applied. These conditions are as follows:

- Correction in the name is not allowed

- Correction in Both Minor Head, e.g. self-assessment taxes and Assessment Year, is not allowed together.

- PAN/TAN correction is allowed only when the challan name matches the name in PAN/TAN.

- The ITR Amount under rectification must match the figure received by the bank and govt account

- Correction is allowed only once in the case of a single challan. However, if the first is made only for the amount, the second one can be raised for correction in other fields

- No partial acceptance of change correction requests will be allowed. Either all the requested changes will be allowed upon passing the validation, or all change requests will be rejected.

Detailed Procedure for Correction in Self-Assessment Tax via a bank:

Step 1: Visit the bank branch receipt where the tax was deposited and carry the original challan receipt with you.

Step 2: Ask and fill up the request form for tax correction. Submit a duplicate copy of the same to the related bank branch.

Step 3: Submit the original challan counterfoil along with the correction application. Keep an application copy with you as well. In the case of challan numbers starting from 280,282 and 283, a copy of the PAN card will be needed too.

For more than one correction in the income tax return form, a separate request form for correction needs to be submitted.

Request for correction in online tax challan, like wrong assessment year and minor head , selected advance tax instead of self assessment tax , be made through email to AO ?