For every eligible taxpayer, filing the ITR would be a yearly obligation in India. It’s a legal obligation that guarantees correct reporting of income and financial activities to the government; it’s not merely a formality.

The Income Tax Department uses an automated system to carefully review the submitted returns in order to speed up this procedure and guarantee the correctness of the information given by taxpayers. The department issues a Notice under section 139(9), commonly known as a Defective Income Tax Return Notice, when inconsistencies or mistakes are discovered. In this post, we’ll examine the specifics of this notification, its motivations, and the measures you need to take to successfully reply.

Simple to Understand Notice U/S of 139(9) for Defective ITR

When errors or inconsistencies are found in a submitted income tax return (ITR), the Income Tax Department automatically issues a notification under Section 139(9).

The message is produced by the system as soon as the taxpayer files their financial year return. It’s important to realise that this notification isn’t intended as a punishment, but rather as a method to make sure that the taxpayer’s information is valid and consistent with the data found in other databases.

Main Causes for Issuing Income Tax Notice U/S 139(9) for Defective Return

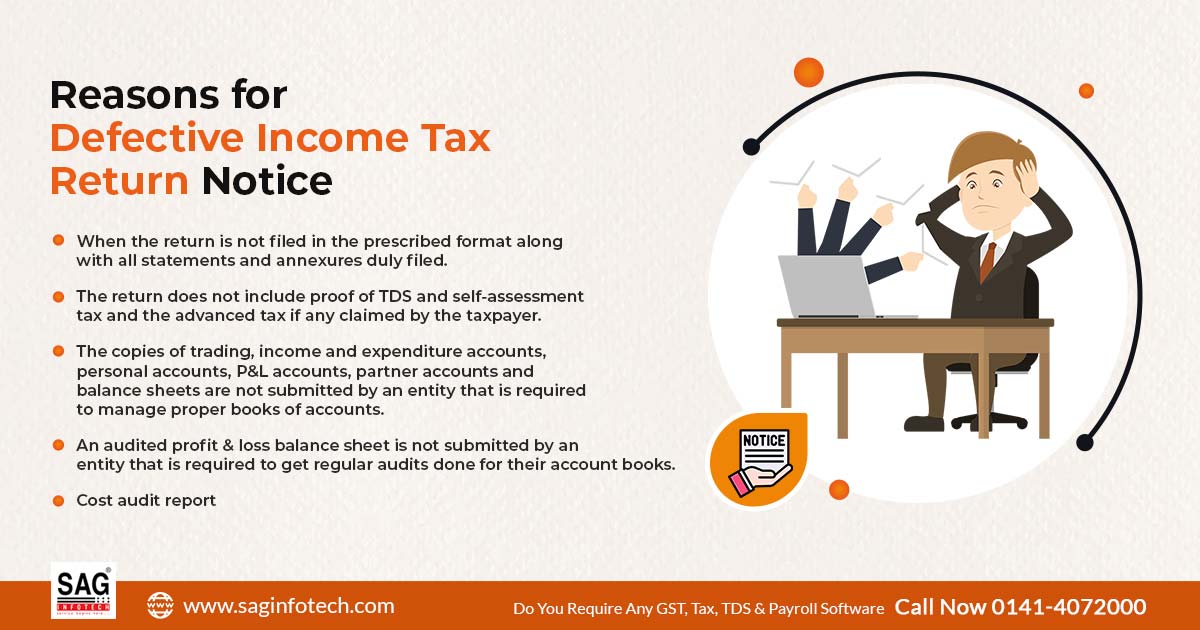

The primary objective of the notice, which may be triggered for a number of different reasons, is to reconcile the reported income in the ITR with information from other sources. The following are some typical justifications for publishing this notice:

- Differences in Registered Income: The system analyses the income reported in the ITR to data from sources such as the AIS (Annual Information Statement), the TIS (Tax Information Network), and Form 26AS. If there are any differences, the notification will be generated.

- Detailed information on TDS credits and omitted income: A notice can be published if a taxpayer forgets to report the income related to TDS. In the same way, if TDS credit has been claimed and receipts appear to be higher than reported income on Form 26AS, a notice may appear.

- Tax Liability with Zero Income: A notification may be issued if a taxpayer declares “nil” or “0” income under each category of income while still computing and paying tax.

- Missing Obligatory Fields: Specific required fields on the ITR forms must be correctly completed. The return is deemed flawed if any of these fields are left empty or are not filled out completely.

- Ignoring Financial Reports: A Balance Sheet and Profit and Loss Account must be submitted by taxpayers who have income classified under the “Profits and gains of Business or Profession” head. A notification could be sent if you don’t comply.

- Mismatch of the Name: A notification might be issued if the taxpayer’s name in the ITR and the PAN database don’t match.

- Wrong reporting under Section 194N: It is the responsibility of the taxpayer to confirm that the bank accurately reported any TDS that was claimed under Section 194N (cash withdrawal). If there are any differences, a notification could be produced.

- Losses claimed incorrectly: If losses are carried forward after the due date, and claimed under the wrong head.

- Income declared under the wrong ITR Form.

- Tax calculation of income tax and interest under sections 234A, 234B and 234C does not match with utility calculations.

What is the Process to Reply Defective ITR Notice U/S 139(9)?

Depending on the kind of discrepancy, taxpayers have certain options after getting the notice:

- Filing ITR under Section 139(9): Taxpayers may file a return under Section 139(9) with the correct information even if the deadline for filing a revised ITR has passed.

- Accurate differences: If the notification identifies actual inaccuracies or omissions, the taxpayer may submit an amended return including the updated data. If the deadline for submitting an amended return for that assessment year hasn’t passed, then this is relevant.

- Provide the reply online: The taxpayer can respond online using their income tax portal account if they think the inconsistencies listed in the notification are erroneous. In order to address the issues raised in the notice, clarifications and supporting documentation can be offered.

ITAT Tribunals Orders in Case of Defective ITR Notice

The taxpayers can also rely on the choice of the following honourable tribunals, where the courts have directed the AO to treat the return as a correct ITR.

- Honourable ITAT, Jaipur, in the Case of Wholery Infrastructure Private Limited vs The DCIT. Read Order

- Honourable ITAT Pune in the Case of Mahila Seva Mandal Vs ITO. Read Order

Closure: A tool to guarantee the integrity of the assessee provided in their income tax forms is noticed under section 139(9). To reduce the likelihood of receiving such letters, taxpayers must meticulously cross-check their filed returns with the information found in AIS, TIS, and Form 26AS.

When a notice is received, action must be taken right away to correct any errors or offer clarifications. In addition to meeting one’s legal requirements, filing correct and comprehensive income tax returns helps to create a fair and effective tax system.