In a recent case, Rajasthan High Court rejected the petition filed by Shree Motors, as well as the court also denied transitional credit due to non-attempt to file GST Tran-1. In this case, the petition was filed by Shree Motors and the petitioners had purchased goods before the appointed date, 01.07.2017. The goods were held in stock on the appointed date. The Central GST Act

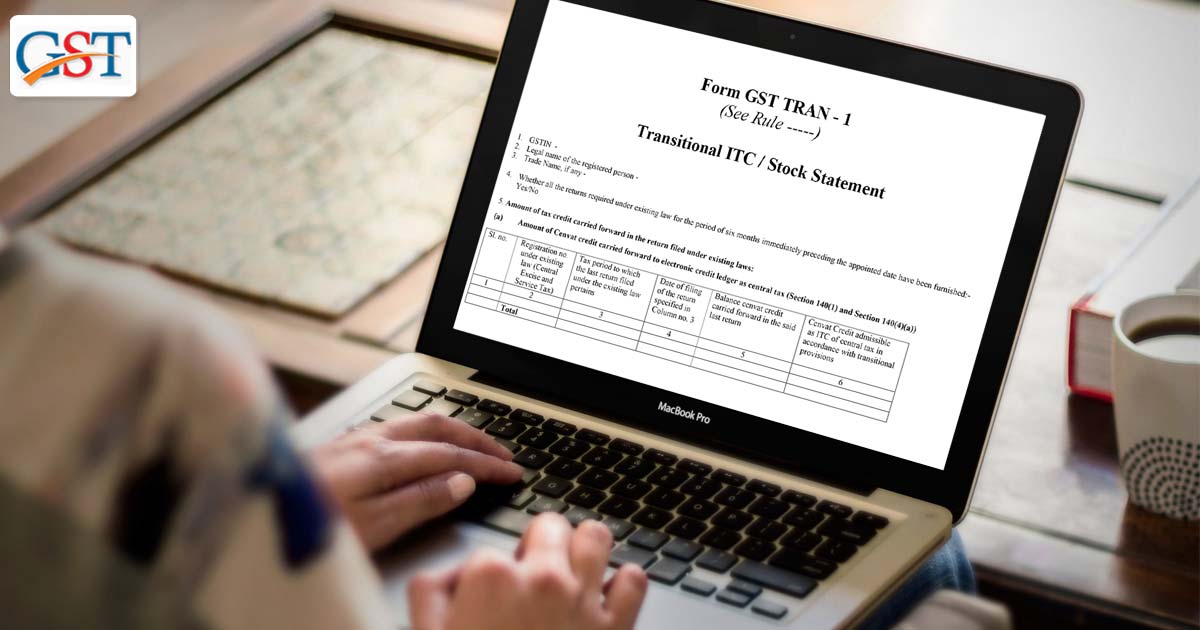

Rule 117 of the CGST Rules, 2017 was constructed for allowing carry forward of the eligible duties available with the goods or assessee on the day immediately preceding 01.07.2017, which imposed a time limit of 90 days to receive credits of applicable duties in electronic credit ledger.

In the case, It was claimed that the etitioners have failed to file GST Tran-1 at the online portal within the due time under Rule 117 of the CGST Rules. As per the petitioners, the reason for failed attempts was various technical glitches/system error on the portal. They also attempted help at the GST network portal

However, the learned counsel for the respondent stated that’ after going through the log, there was no evidence of any glitch or error or submission or filing of Form GST Tran-1 by the petitioners. Thus, the petitioners on account of alleged vested rights are not eligible to seek any relaxation in the limitation and reopening of the portal for the purpose.

All the allegations made about the technical glitches and errors and that the assessees were generally denied the credit on account of such technical glitches are baseless because there were a huge number of Form GST Tran-1 that was filed successfully in between the same time frame and transitional credit was also given. After not finding any evidence of error or submission/ filing of Form GST Tran-1

Justice Arun Bhansali (Rajasthan High Court) commented that “The theory of vested rights and the implication of limitation on the said aspect of the vested right has been considered by Hon’ble Supreme Court in the case of Osram Surya (P) Ltd., wherein, while considering the proviso II to Rule 57G of the Act of 1944 it was laid down that by providing limitation the statute has not taken away any of the vested rights, which accrue to the manufacturers and what is restricted is the time, within which, the manufacturer has to enforce that right and, therefore, once the provisions of Rule 117 of the CGST Rules, which prescribe limitation has been upheld, the plea raised pertaining to the denial of vested right on account of petitioners failing to submit/file Form GST Tran-1 in time cannot be countenanced”.