The Raipur ITAT has refused an appeal associated with a tax penalty under Section 271(1)(b) of the Income Tax Act. This judgment arrived after the appellant, who appealed, decided to fix their tax issues via the Direct Tax Vivad Se Vishwas Scheme, 2024.

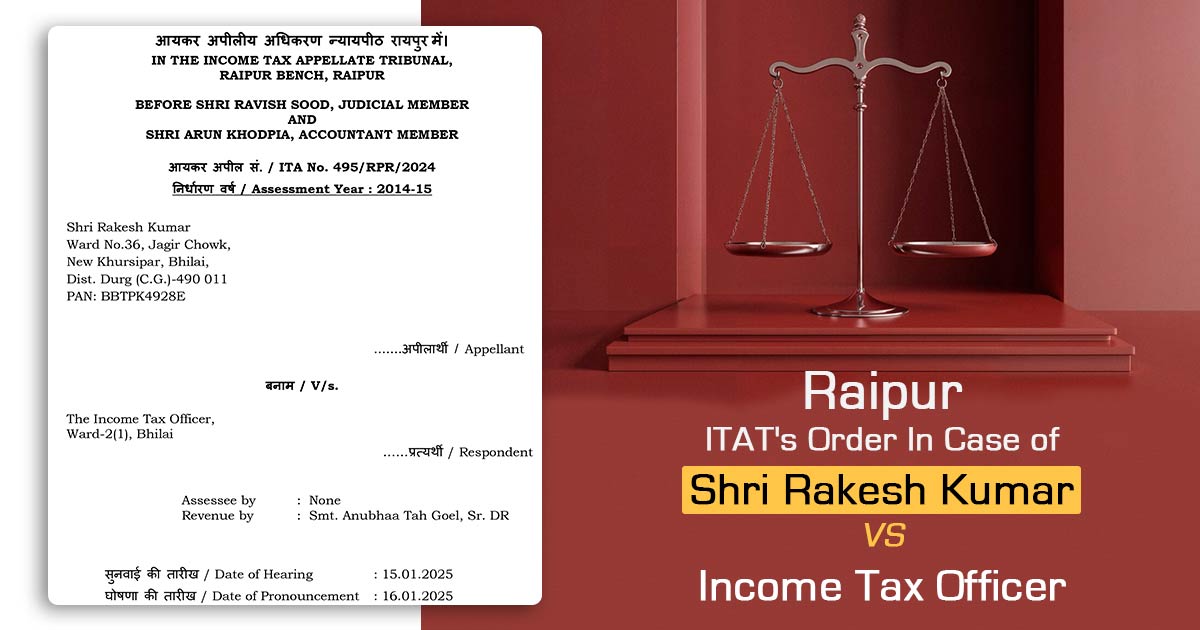

Rakesh Kumar, resident of Bhilai, has submitted the appeal against the order of the Commissioner of Income Tax (Appeals), National Faceless Appeal Centre, Delhi [CIT(A], dated 20 September 2024. The case has arrived from the order of the Assessing officer on 30 August 2022 levying the penalty u/s 271(1)(b) of the Income Tax Act, 1961, for the Assessment Year 2014-15.

The representative of the appellant, Sakshi Gopal Agrawal, has filed a letter on 13th January 2025 citing that he had opted for the Vivad Se Vishwas Scheme, 2024, to settle the dispute. A record of “Form-1” filed under Rule 4 of the Direct Tax Vivad Se Vishwas Rules, 2024. It urged to seek adjournment, mentioning that “Form-2” was not being issued till now under the scheme.

Recommended: Gujarat HC Upholds Assessee’s Right to Interest on Refund Under Vivad se Vishwas Scheme

The representative of the revenue, Anubhaa Tah Goel, does not raise any objection to the withdrawal of the appeal under the appellant’s choice to proceed under the settlement scheme.

The Bench, comprising Judicial Member Ravish Sood and Accountant Member Arun Khodpia, held that as the appellant had begun the process of settling the tax dispute via the Direct Tax Vivad Se Vishwas Scheme hence the appeal does not need any adjudication as per merits.

It cited that if the designated authority does not pass a final settlement order in Form-4, then the appellant has the privilege to seek restoration of the appeal.

Hence, the tribunal dismissed the appeal as withdrawn.

| Case Title | Shri Rakesh Kumar vs. Income Tax Officer |

| Case No. | ITA No. 495/RPR/2024 |

| Appellant by | None |

| Respondent by | Smt. Anubhaa Tah Goel |

| Raipur ITAT | Read Order |