The Commissioner of Income Tax(Appeals)[CIT(A)] order, has been set aside by the Pune Bench of Income Tax Appellate Tribunal (ITAT) which had dismissed the appeal u/s 249(4) of Income Tax Act,1961 for non-payment of advance tax, considering the taxpayers’ senior citizen status and health issues.

The taxpayer Hingora Ali Mohd Vali Mohd, plea was dismissed via the CIT(A) u/s 249(4) for non-payment of advance tax. The paper book demonstrated that the taxpayer had filed Rs 4,000 as an advance tax dated 30.12.2016 and Rs 1,750 as a self-assessment tax on 07.08.2017, with challans on record.

For the fiscal year, the advance tax was grounded on the approximated income and is required to be filed within that year. Different HC rulings state that these estimates cannot be precise which is why the provisions for the interest on any shortfall or excess payment.

The taxpayer does not submit the income tax return directing to an assessment order u/s 144 dated 27.12.2019. U/s 249(4)(b), the matter falls but the proviso permitted the CIT(A) to consider the plea for the true reasons. The taxpayer being a senior citizen and not well in the duration has approximated and filed the advance tax but there was a shortfall which was subsequently filed.

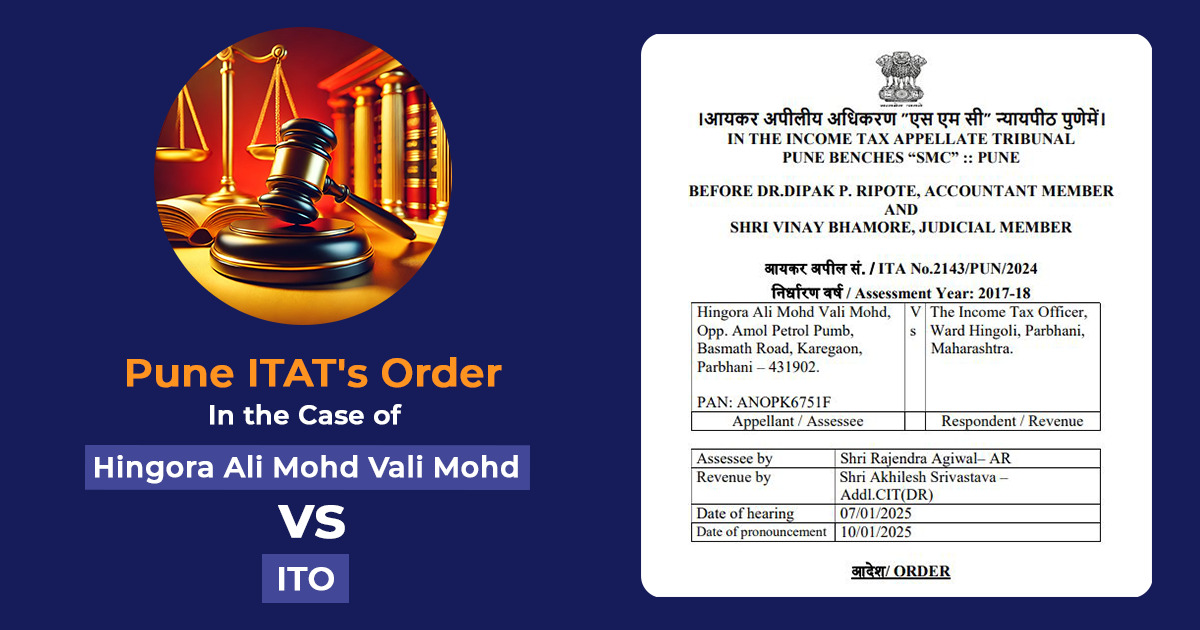

The two-member bench Vinay Bhamore (Judicial Member) and Dr Dipak P.Ripote(Accountant Member) on considering these factors, the order of CIT(A) was set aside, directing a fresh decision on merits after permitting the taxpayer to present necessary documents.

Consequently, the plea furnished via the taxpayer was authorized for statistical objectives.

| Case Title | Hingora Ali Mohd Vali Mohd vs. ITO |

| Citation | ITA No.2143/PUN/2024 |

| Date | 10.01.2025 |

| Assessee by | Shri Rajendra Agiwal |

| Department by | Shri Akhilesh Srivastava |

| Pune ITAT | Read Order |