The Patna High Court ordered the State GST Department to return the money, along with 9% simple interest and Rs. 10,000 in costs, after invalidating an illegal tax recovery made under the Goods and Services Tax (GST) regime.

The division bench, consisting of Justices Rajeev Ranjan Prasad and Ashok Kumar Pandey, after witnessing that the authorities had breached their previous order, imposed show-cause notices before the Appellate Authority and the Assistant Commissioner.

They were asked to defend themselves against being held personally accountable for filing interest and legal fees resulting from their willful disregard for the court’s order, as well as why contempt proceedings must not be brought against them. Both officers provided certain apologies and show-cause replies in return.

Under the Goods and Services Tax (GST) regime, the two orders made were contested via the applicant M/s Great Eastern Hire Purchase Private Limited, a Patna-based private entity registered under the GST. The Assistant Commissioner of State Tax, Gandhi Maidan Circle, Patna, issued the first ruling, and the Additional Commissioner of State Tax (Appeals), Patna West Division, issued the second appellate order.

As per the applicant, such orders that dealt with a GST tax demand and recovery procedure were illegal, capricious, and given against the law as specified by a previous High Court ruling in the matter of SIS Cash Services Pvt Ltd vs. Union of India (CWJC No. 6514 of 2021).

Appellate Authority inadvertently refused their appeal as per the government’s amnesty scheme (Notification No. 53/2023 dated 02.11.2023), the applicant said, citing that the scheme did not have the orders issued u/s 62, and that the Assistant Commissioner had inaccurately invoked provisions of Section 62 of the CGST/BGST Act to start recovery without following due process.

The applicant, the Court’s binding precedent in the SIS Cash Services case, which provided direction on such topics under sections 62, 73, and 74 of the GST Act, was breached via the refusal of amnesty benefits and the execution of recovery orders.

Read Also: Self-ascertainment Recovery Under GST Section 74 Violates Article 265

The Appellate Authority claimed that the applicant did not inform him of the precedent in the appeal proceedings, and the Assistant Commissioner claimed that about the SIS Cash Services case she was unaware as it had not been brought to her attention during the period when the order was issued.

For the lack of a formal explanation, the court has raised concerns and said that the submission of the assistant commissioner was not furnished via affidavit. But the court accepted their responses and decided not to seek a contempt action as the applicant did not challenge these representations.

It was decided by the court that the recovery was illegal and that the authorities’ acts had directed litigation for the applicant. The High Court ordered the State of Bihar to return the money that was recovered, along with a 9% simple interest annually from the date of seizure to the refund date. The applicant must file Rs 10,000 as litigation costs.

If the State Government wants, then it is qualified to recover such amounts from the irresponsible officers, the court mentioned.

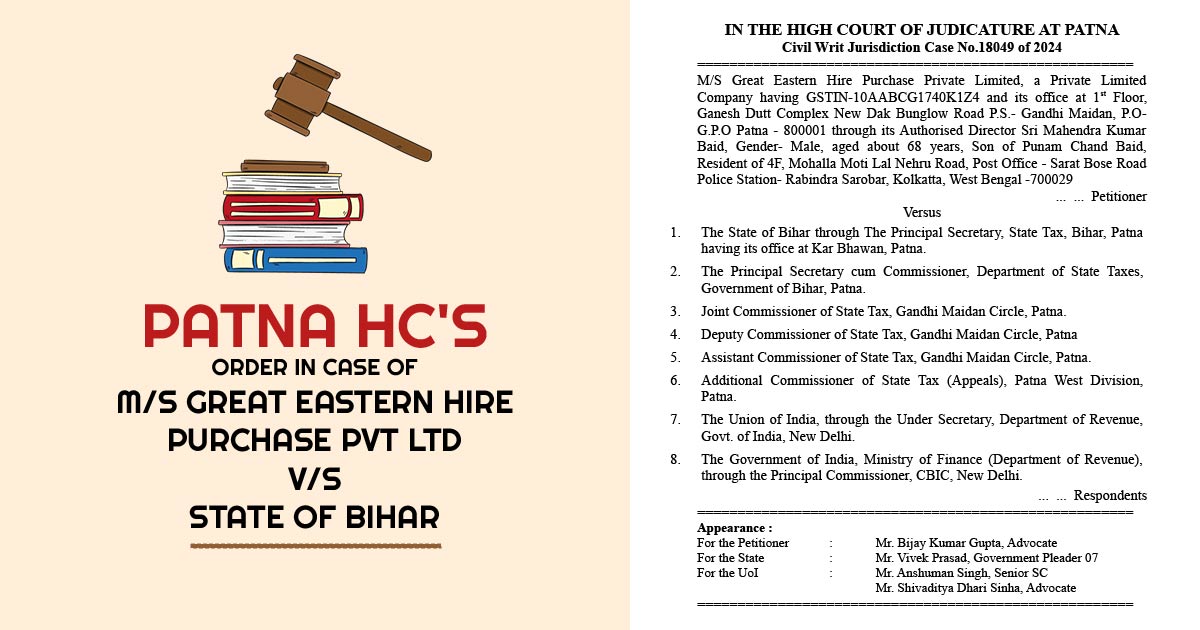

| Case Title | M/S Great Eastern Hire Purchase Pvt Ltd vs. State of Bihar |

| Case No. | Civil Writ Jurisdiction Case No.18049 of 2024 |

| For Petitioner | Mr. Bijay Kumar Gupta |

| For Respondent | Mr. Vivek Prasad |

| For the UoI | Mr. Anshuman Singh, Mr. Shivaditya Dhari Sinha |

| Patna High Court | Read Order |