This is a news of happiness for all the business entities as the ministry of finance (MoF) has released them from service tax on certain services including passport and licence etc. Now the commercial institutions would not need to pay service tax on certain public services that are provided by the government and local authorities.

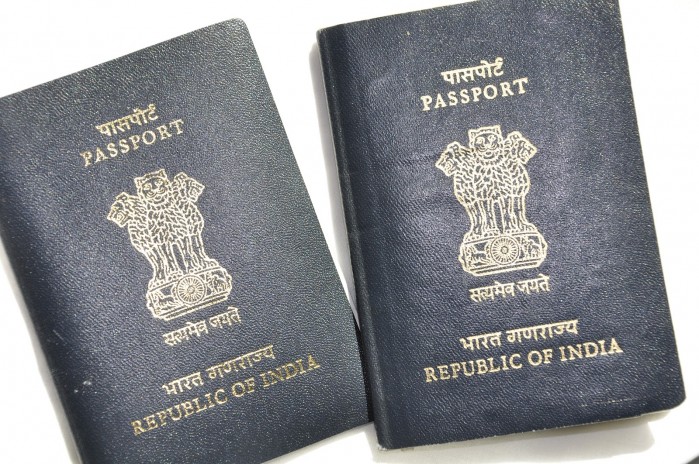

Although, the gross amount payable by the business entity does not exceed INR 5,000. According to the Finance Bill 2016, every business person, who having a turnover of Rs 10 lakhs had to pay 15 per cent service tax for government services from this fiscal year. But, the business entities and industry associations opposed the 2016 Finance Bill, therefore the MoF had issued a number of clarifications on April 13. According to the clarifications, the service tax would not give to issue passports, visa, driving licence, and birth or death certificate.

Apart from this, now the companies are also free from service tax to repay testing charge, security test, land use approval charge or any duty or any patently.

Bipin Sapra, indirect tax partner at EY said in his statement, “As per the provisions of the Finance Bill, such charges paid by telecom companies would have been subject to service tax, merely because the contractual terms had deferred the payment to subsequent years. This would have entailed a retrospective tax impact. The clarification issued by MoF puts at rest this controversy.”

He further added, “CENVAT credit on a ‘one-time charge’ on purchase of spectrum under auction can now be availed over a period of three years. Prior to the clarification, such CENVAT credit could be availed over the life of the spectrum, which is 20 years. This effectively led to loss of credit on net present value calculation.”

More Interestingly:

Tax Benefit on Home Loan Interest for FY 2016-17

Krishi Kalyan Cess at 0.5% Levy on all Taxable Services – Budget-2016