An updated advisory has been issued by the Goods and Services Tax Network ( GSTN ) on the new statement titled RCM Liability/ITC Statement on the Goods and Services Tax ( GST ) portal to assist the assessees in precisely reporting the Reverse Charge Mechanism ( RCM ) transactions.

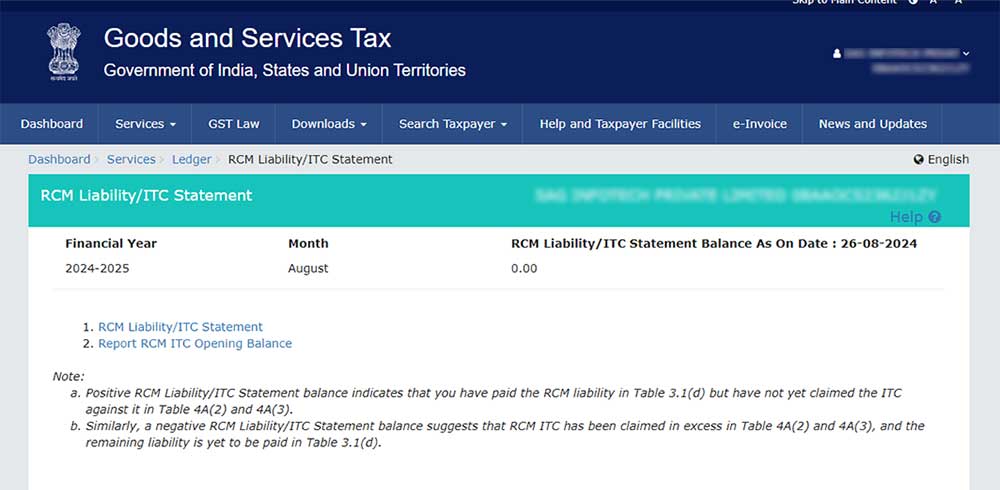

The same statement has the objective to improve the clarity and precision of RCM reporting via capturing the RCM obligation as mentioned in Table 3.1(d) of GSTR-3B, along with the corresponding Input Tax Credit (ITC) claimed in Table 4A(2) and 4A(3) of GSTR-3B for any provided return period.

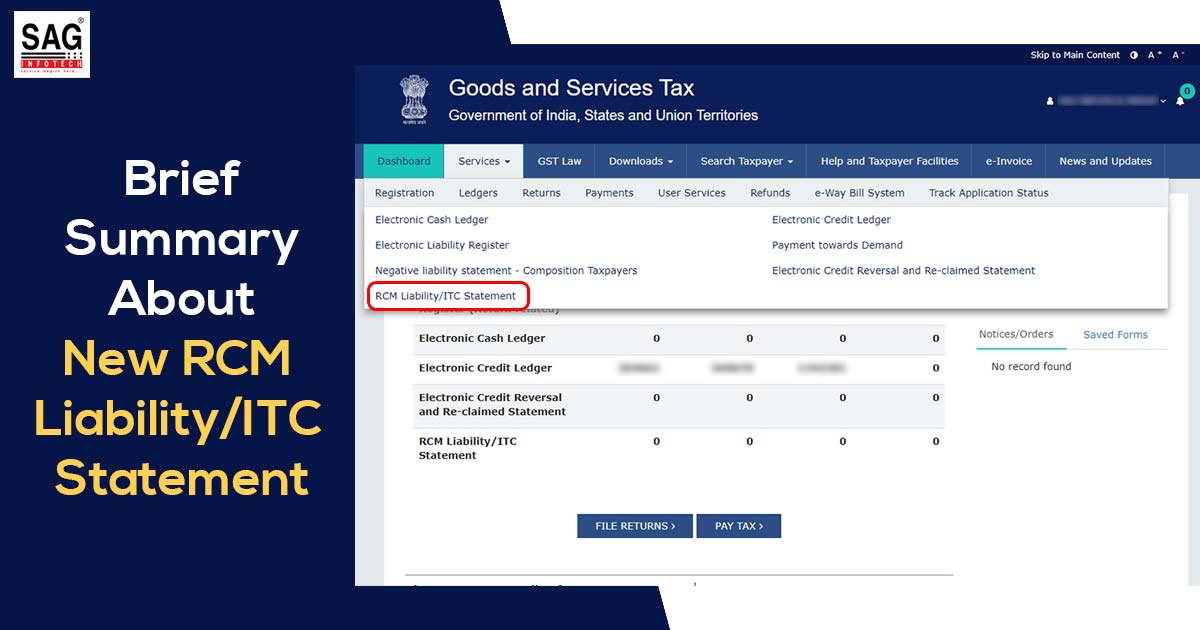

New RCM Liability/ITC Statement Options

- RCM Liability/ITC Statement

- Report RCM ITC Opening Balance

Option 1: RCM Liability/ITC Statement

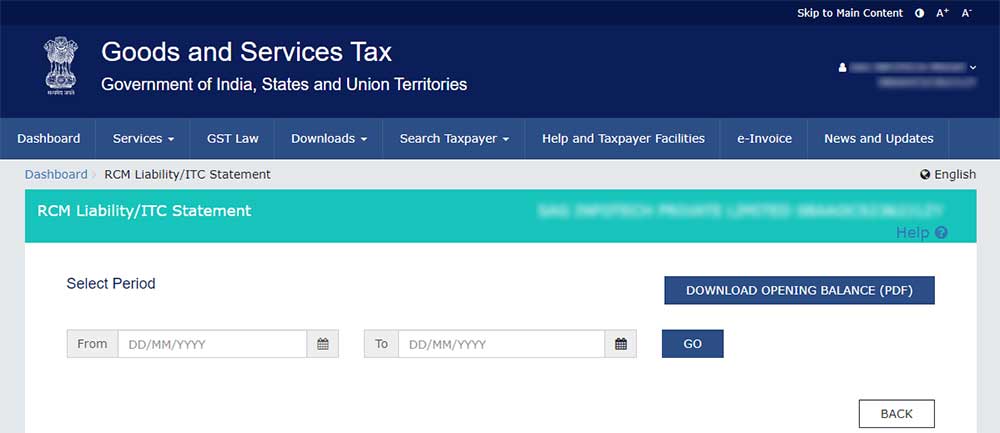

From the tax period of August 2024, the same new tool is designated to be applicable for monthly filers and from the July-September 2024 quarter for quarterly filers. Taxpayers can access the RCM Liability/ITC Statement via the navigation path: Services >> Ledger >> RCM Liability/ITC Statement.

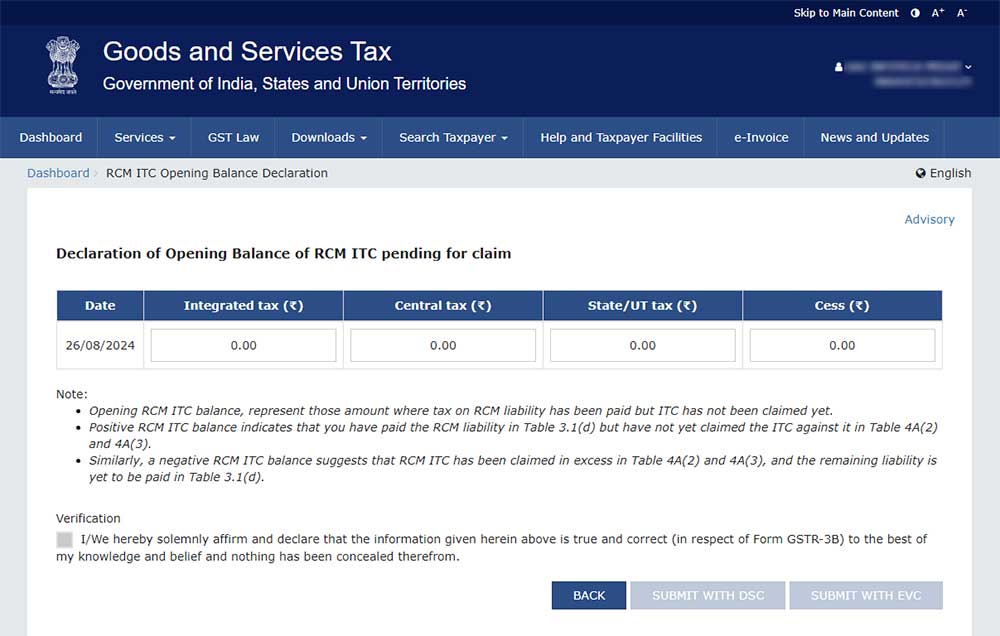

Option 2: RCM ITC Opening Balance Declaration

- The taxpayers who had filed the excess RCM liabilities however not claim the related ITC will required to fill in a positive value for the excess paid RCM ITC as an opening balance.

- If the assessee had claimed the excess RCM ITC but does not declare the related obligation they are needed to report a negative value for the excess claimed ITC as RCM in an opening balance.

- For assessees reclaiming RCM ITC that was previously reversed, the reclaimable ITC can be reported in Table 4(A)(5) of GSTR-3B. Such reversals should not be reported as RCM ITC opening balances.

Read the below-mentioned advisory before reporting the RCM ITC opening balance:

- It is important for the assessees to report their RCM ITC balance that had not been already claimed in 4A(2) & 4A(3).

- The assessee may report their opening balance until 31st October 2024. Post to this date the option to report the opening balance will be eliminated and the same shall be carried that the assessee has no RCM ITC reversal balance to report.

- Till 30th November 2024, the assessee may revise their opening balance. Any reported balance post to this date will be regarded as final and cannot be revised.

- After November 30, 2024, the updated value will be frozen with no additional amendments allowed. This RCM ITC value will also be shared with the Jurisdictional Tax Officer for review.

- The assessees are recommended to practice due diligence while reporting or revising the RCM ITC opening balance.

- The opening balance that has been reported or revised via the assesse would get credited to the RCM Liability/ITC Statement. This statement will be utilized to validate the taxpayer’s RCM ITC claimed amount in Table 4A(2) & 4A(3) and RCM Liability paid in Table 3.1(d) of form GSTR-3B.

Note: The taxpayers must not use the same functionality if they hold any RCM ITC balance that is qualified for a claim.

Reconciliation and Deadlines: Monthly Filers and Quarterly Filers

- Till the July 2024 return period, the opening balance should be reported by considering RCM ITC.

- Quarterly Filers: Report the opening balance up to Q1 of FY 2024-25, considering RCM ITC till the April-June 2024 return period.

Deadline to Reporting Opening Balance

October 31, 2024, is the due date for declaring the opening balance. The taxpayers have the chance to revise any errors in their declared opening balance till November 30, 2024, with up to three chances furnished for rectification. The GSTN has shown that the revision facility will be stopped post-November 30, 2024.