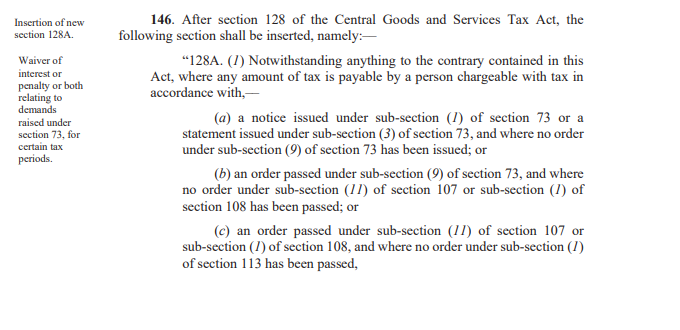

The Central Goods and Services Tax (CGST) Act has introduced a new section 128A, to decrease the tax loads and proposes relief for the assessees towards tax obligations made between July 1, 2017, and March 31, 2020.

This amendment permits people with tax obligations to settle their debts without facing extra interest or penalties, as long as they meet certain conditions.

Latest Update

- GSTN has issued guidance for taxpayers facing technical issues while submitting amnesty applications under Section 128A of the CGST Act. View more

- GSTN’s new advisory pertains to the withdrawal of appeals under the tax waiver scheme, in accordance with Section 128A of the CGST Act. View more

- GST Circular No. 248 addresses issues related to availing benefits under Section 128A of the CGST Act, 2017. Read Circular

- GST New Instruction No. 02/2025 for Section 128A. Read Eng PDF | Read Hindi PDF

- The GSTN has issued a new advisory for taxpayers regarding the filing of applications under the waiver scheme, as outlined in Section 128A. View More

- This advisory outlines the waiver scheme available for the taxpayer under Section 128A. View more

- The GST department has given an advisory on a new waiver scheme under GST section 128a. Read More

- CBIC has clarified various questions related to GST section 128A. Read Circular

What is the GST Amnesty Scheme U/S 128A?

As per the tax expert, the same proposes a one-time exemption of interest and penalties for specific cases raised under section 73 of the CGST Act. the cases that have wrong refunds are not covered. The taxpayers are required to deposit 100% of the tax demanded to claim the exemption, which makes it significant to compute if the matter comes under the qualified categories.

Last Date for Applying GST Amnesty Scheme U/S 128A

Under the circulars of the department, the due date for the standard amnesty applications is 31st March 2025 and it is the standard due date for both making the application and filing payment of tax disputed.

It is notified by GSTN in the advisory that the mere two forms GST SPL-01 and SPL-02, has been used to apply for it are now both available on the GST portal. The taxpayer to apply for the same scheme must withdraw any due plea, thereafter utilize either of these forms to apply, and then make 100% of the payment of GST tax demanded on or before March 31, 2025.

Which Sort of GST Notices are Eligible for the Amnesty Scheme U/S 128A?

Notices qualified for the same exemption are those where the demands related to regular non-fraudulent problems like clerical errors, filing return delays, short tax payments, and/ or excess claims of tax.

The major cause of these notices must be real mistakes or other interpretations of GST statutory provisions without any malafide intention. Also, the mere GST notices for the duration from 1 July 2017 to 31 March 2020 (both dates included) are qualified for advantages u/s 128A.

The amnesty scheme u/s 128A has been made to cover the demands asked u/s 73 which are related to the non-fraudulent cases. It comprises errors in filing returns or reporting transactions, delays in filing, and genuine matters that have short tax payment or excess GST ITC claims, specifically where the problem arrives from other interpretations of the evolving GST law.

GST Notice Under Section 74 for Fraud Cases Does Not Qualify for the GST Amnesty Scheme

It is significant to mark that this scheme does not extend to the matters of wrong refunds where a taxpayer may have claimed and obtained the refunds they were not qualified for.

Section 74 cases are not included in the extent of this amnesty scheme. Section 74 deals with the circumstances that have fraud, willful misrepresentation, or suppression of facts, which are regarded as serious violations.

Major Key Provisions Under GST Section 128A

The GST Section 128A contains some important provisions, which you can see below:

Application Scope

The relief comprises the amounts resulting from the notices furnished u/s 73, which is related to the non-payment or short tax payment, and orders passed u/s 107 and 108, which deal with the amendment of tax assessments and pleas respectively.

Read Also: Easy to Understand 21 Offences, Penalties and Appeals Under GST

Relief Provisions

The taxpayers to get the advantage should ensure that they pay the total amount left as mentioned in the pertinent notice or order. The modification specifies that if an appeal is in process for the tax amount, then the relief would not apply until the plea gets withdrawn via the taxpayer.

Forthcoming Proceedings

Under these updated provisions once the amount is settled all the pertinent proceedings would be regarded gets finished. Taxpayers should keep in mind that certain orders cannot be appealed after this settlement has been finalized.

Payment of Tax Without Penalty

The assessees may settle their obligations shown in a notice or order issued under distinct subsections of the CGST act without filing the interest or penalties. This is relevant if they complete the total payment by a date set by the government based on suggestions from the Goods and Services Tax (GST) Council.

Restrictions

The same provision does not apply to the matters that engage the false refunds. Additionally, any interest or penalty that has been paid will not be eligible for a refund, meaning taxpayers cannot gain from relief concerning previous payments.

Main Effect on Taxpayers

The same amendment does navigate towards furnishing relief to the businesses and the persons who faced hurdles to attain their tax liabilities in the tough economic conditions of the previous few years. Being able to pay off overdue taxes without penalties is expected to promote adherence to tax obligations and lessen the financial pressure on taxpayers.

The assessees are recommended to analyze their tax obligations for the particular duration and take benefit of the same opportunity to fill the left dues at the time of reducing the financial repercussions. To ensure compliance with the updated provisions it is crucial to stay updated towards the notification of the government regarding the due dates for the payments.

Closure: Section 128A in the CGST Act introduction marks a significant step for furnishing relief to the assessees loaded with older tax obligations. This amendment through removing the penalties and interest has the objective to streamline smoother compliance and assist the economic recovery in the surge of earlier challenges. To precisely navigate these updated provisions the taxpayers are motivated to consult with their tax advisors.