The GSTN added a 6% tax rate in the item details section of all the tables of the form GSTR 1, excluding HSN table 12 on the GST portal.

A new tax rate of 6% IGST or 3% CGST including 3% SGST has been made on specific goods vide Notification No. 02/2022 on 31st March 2022. The technical team was working on the GST portal to engage the same rate in GSTR-1. Towards HSN table 12 of form GSTR-1, a 6% tax rate would get added.

Because of the late addition of the utility on the portal, in the former month, the GST portal would arrive with the temporary solution and is been provided with an advisory with respect to the temporary measure towards furnishing the GSTR-1 by the composition assessees.

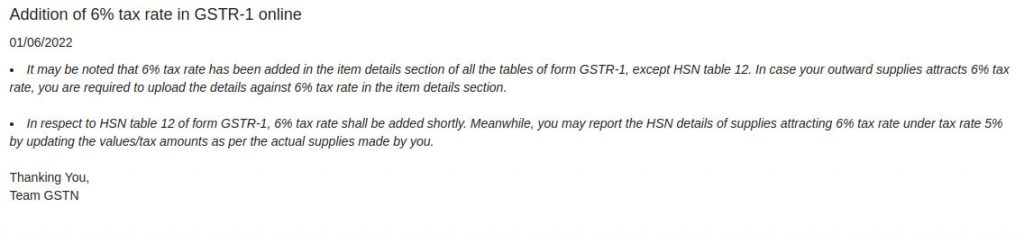

Below is the screenshot which is placed by GSTN on Portal

As Earlier Discussed Amendments Below

As a temporary measure, the assessee who needs to report the goods at the rate might do via reporting the entries in the 5% heading and then manually rising the system calculated tax amount of 6%. The same could be performed by entering the value in the taxable value column subsequent to the 5% tax rate and then rising the system, calculating the tax amount to 6% IGST or 3% CGST and 3% SGST in the ‘Amount of Tax’ column beneath the applicable Table, namely B2B, B2C or Export, as suitable.

The same ensures that the correct tax amount appears on the GSTR-1. However, the same rate would be published soon on the GST portal.