It was carried by the Mumbai Bench of Income Tax Appellate Tribunal (ITAT) that the disallowance of ₹1.07 Crore for non-deduction of Tax Deducted at Source (TDS) on reimbursements u/s 40(a)(ia) of Income Tax Act,1961 was not justified as of the tax compliance.

The applicant Crisil Limited had been assessed under section 143(3) with an addition of Rs. 1,07,51,004 u/s 40(a)(ia) for non-deduction of tax on reimbursements. The Commissioner of Income Tax (Appeals)[CIT(A)] in the first appeal, had deleted the disallowance, but the Revenue appealed to the Tribunal, which restored the case for verification in its 12/02/2019 order.

The taxpayer in its answer to the notice has claimed that the reimbursements were for the common expenses without markup therefore no tax was needed. As the taxpayer has comprised these receipts in its income and filed tax therefore it was not in default u/s 201 rendering the disallowance invalid.

The disallowance of Rs. 74,57,621 has been confirmed by the assessing officer without considering the submission of the taxpayer or furnishing a hearing. The AP has removed the disallowance of Rs 32,93,383 which was for the reimbursement of costs in which no TDS is applicable as asked via the tribunal.

The addition of the AO has been carried by the CIT(A) and surged the same via disallowing Rs 32,93,383 without furnishing the taxpayer a chance to get heard. It was mentioned by the CIT(A) that the TDS must be deducted on reimbursements to a parent company however overlooked Form 26A of the appellant depicts that the taxpayer has reported the income before. Hence under section 40(a)(ia) no disallowance was justified. Indeed CIT(A) does not elaborate on why specific business costs were regarded as payments like income.

After reviewing the facts and evidence, The two-member bench comprising Amit Shukla (Judicial Member) and Renu Jauhri(Accountant Member) discovered that the disallowance of Rs 1,07,51,004 was made in three parts: Rs. 32,93,383/- for reimbursements where TDS did not apply, Rs. 10,03,947/- for the service tax component, and Rs. 64,53,674/- for other reimbursements. It concluded that the cost of Rs 32,93,383 like s bank charges and electricity, were for business purposes and did not need TDS.

Under the Central Board of Direct Taxes (CBDT) Circular No. 1 of 2014 the service tax component was not within Tax Deducted at Source (TDS). For the balance reimbursement of Rs 64,53,674, it was marked by the tribunal that the taxpayer has declared the income, filed the tax, and furnished the return as validated by Form 26A.

Hence the tribunal carried that no disallowance u/s 40(a)(ia) was directed and deleted all disallowances kept by the CIT (A).

The taxpayer’s appeal was permitted.

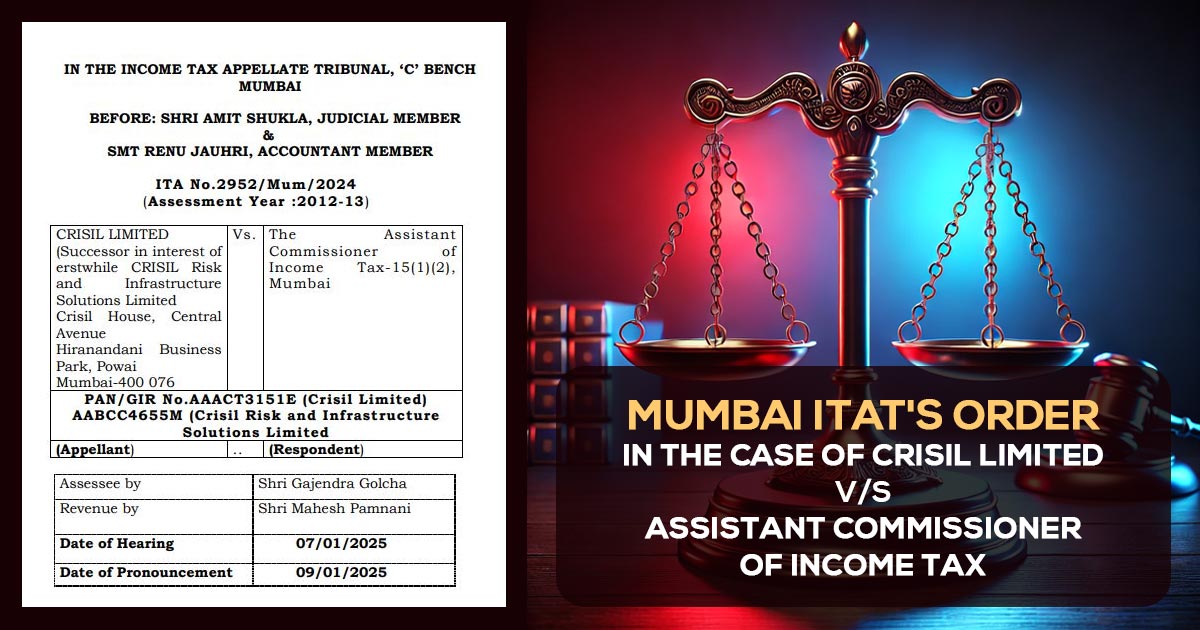

| Case Title | Crisil Limited vs. Assistant Commissioner of Income Tax |

| Citation | ITA No.2952/Mum/2024 |

| Date | 09.01.2025 |

| Assessee by | Shri Gajendra Golcha |

| Revenue by | Shri Mahesh Pamnani |

| Mumbai ITAT | Read Order |