MGT 14 is obliged to be furnished through the company within the Registrar of Companies (ROC) under sections 94(1) and 117(1) of the Companies Act 2013 and the rules built in it.

Some of the companies do not require filing MGT-14 for a certain type of

resolutions, when those resolutions are part of their normal business.

This includes resolutions passed by the:

- Banking Company

- Non-Banking Finance Company registered with the RBI

- Housing Finance Company registered under the National Housing Bank Act 1987

Intention of Filing MGT 14 Form

Meetings of the board of directors or shareholders or creditors were conducted and the resolutions have been forwarded in the meetings. The resolutions have been furnished through ROC the company or liquidator as per the case and these resolutions get furnished in form MGT 14.

MGT 14 Board Resolutions to be Filed Under Section 117(3)

- Special Resolutions

- Resolutions have been accepted to be passed as special resolutions through all the members of the organisation.

- Any resolutions have been passed through the BOD with respect to the appointment /reappointment/renewal/distinction of the appointment courses of the managing director.

- The resolutions have been accepted to get passed through the particular majority or through a specific way via a class of members.

- The resolutions needed to fold up of the company as provided beneath section 59 of the insolvency and Bankruptcy Code 2016.

- Resolutions are declared beneath section 179(3).

MGT 14 Form List of Board Resolutions

Important resolutions furnished in MGT-14 are classified under 3 sections:

Annexure A Board Resolutions

Beneath Annexure A the mentioned way deal through the board resolutions requirement to be furnished:

- Investigation of the books of accounts and the other records of the subsidiary.

- Permission of building political enrichment.

- Doing investments or providing the loan or guarantee or security through the company.

- Relevant party transaction contract/agreement.

- Appointment of a whole-time key managerial personnel of a corporation.

- Appointment of an individual as managing director if he is the manager/managing director of another company.

- Permission of self-prospectus.

- Appointing/ re-appointing/renewing of appointment/variation of the terms of appointment of a managing director.

- Calling of the unpaid amount on the shares via the shareholders.

- Permission for the buy-back of securities as given beneath Section 68.

- Providing the securities (engaging debentures) in India/outside India.

- To borrow money.

- Permission of the Board’s report and financial statements.

- Extension of the business of the organisation.

- To accept amalgamation, alliance, or reconstruction.

- Taking a stake in the company or obtaining a controlling stake in a different company.

Read Also: E-filing Annual Return MGT 7 & 7A Form Via Gen Complaw Software

Annexure B Special Resolutions

Beneath Annexure B the mentioned objectives deal with through the appropriate resolutions required to get furnished:

- Addition of the law of entrenchment in the Articles of Association through the company.

- Revisions of an enrolled office from one city to different in the same state.

- Change of Memorandum of Association.

- Revolution in the thing towards the money borrowed is unutilized.

- Change of Articles of Association.

- Change towards the contract or things in the prospectus.

- Providing the depository receipts to outside nations.

- Modification of shareholder rights.

- Providing the sweat equity shares.

- Issuance of employee stock options.

- A private offer of securities.

- Issuance of debentures or loans holding an option for conversion to shares.

- Decrease of share capital.

- Buying or subscribing to the fully paid shares for the advantage of employees.

- Buyback of shares.

- Excluding the registered offices maintaining the registers at different locations in India.

- Elimination of auditor prior to the expiry of the term.

- Appointment of exceeding the 15 directors.

- Reappointment of Independent Director.

- Limiting the number of directorships of a director.

- Selling, leasing or otherwise disposing of the whole or substantially the whole of the undertaking of the company or towards the company owns exceeding the one undertaking of complete or substantially the complete of any of these undertakings.

- Investing differently in trust securities, the amount of compensation received through the result of an amalgamation or alliance.

- Borrowing the money in which the money is to be borrowed and the money previously borrowed through the company shall be more than the average of its paid-up capital along with the free reserves other than the temporary loans received from the company’s bankers in the normal business.

- Give the time for the repayment of the debt left from the director.

- Scheme for furnishing the loans to directors.

- Loan and investment through the company who have more than 60% of the paid-up share capital, free reserves, and securities premium account or 100% of the free reserves and securities premium account, whichever is higher.

- Appointment of a director, i.e. a managing director/whole-time director/manager exceeding the age of 70 years.

- Company operations needed to be examined.

- Application to the registrar for the prevention of the name from the registrar.

- Scheme concerning the amalgamation of the sick organisations through the other companies.

- Winding up of the company through the bench.

- Voluntary winding up of the company.

- To furnish the liquidator through the powers to accept the shares etc as per the acknowledgement of the property sale.

- Permission for the arrangement amid the company that seems to be wound up and its creditors to be binding.

- Sanctioning the company liquidator to practice the specific powers.

- Disposal of the books and paper of the company when the organisation gets fully wound up and is directed to be dissolved.

Annexure C Ordinary Resolutions

Beneath Annexure C the mentioned things deal with through the normal resolutions required to furnish:

- The company can amend its name post to obtain the objectives from the registrar if it revealed that the name was applied to or by filing the wrong details.

- The company revised its name post to obtain the commands from the central governments if the name or trademark is similar to the previous name of the organisation or enrolled trademark.

- Receiving deposits from the public.

- Representation of Corporations at the meeting of organisations.

- Representation at any meeting of creditors.

- Opting for an individual other than the retiring auditor as a legal officer.

- Eliminating the director prior to the expiry of the period of his office.

- Delegation of powers through the board as categories beneath section 179(3) clauses(d) to (f).

- Permission to enter into non-cash transactions to a director of the company/holding/subsidiary/associate company.

- Appointment of a managing director/whole-time director/manager.

- Adjournment post recognizing the report of the Company Liquidator.

- Voluntary winding up of the business due to expiry period of its term or on the occurrence of any situation towards which the articles provide that the organizations should be dissolved.

- Starting in the contract with the relevant party towards the companies who pose prescribed paid-up capital or the amount of the transactions more than the prescribed amount.

Recommended: Due Dates of Filing ROC Annual Return for FY 2020-21

MGT 14 Form Penalty Under Section 117

Failure to furnish the resolution or the agreement beneath sub-section (1) of section 117 before the expiration of the period given beneath section 403 through the other fee, the penalty will be stated as mentioned below:

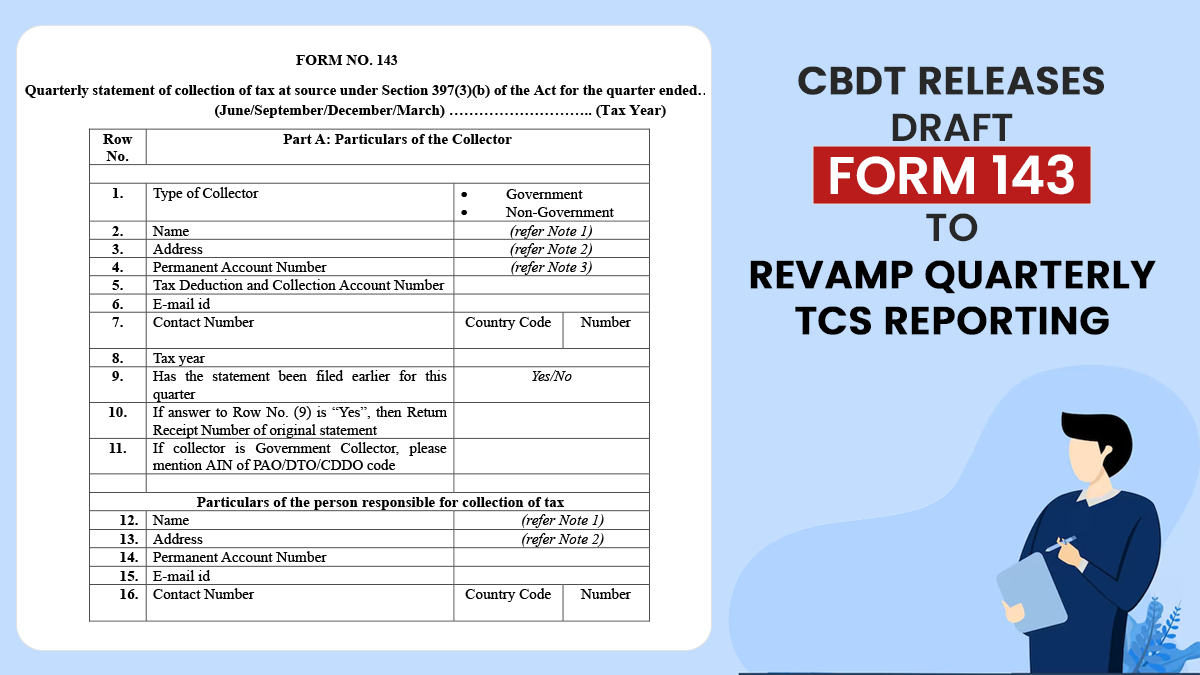

| Defaulting Party | Penalty |

|---|---|

| Company | Initial liability of Rs 10,000 & in case of continuing failure, with a further penalty of Rs 100 for each day after the first during which such failure continues, subject to a maximum of Rs 2,00,000. |

| Every Officer in Default (Including the Liquidator of the Company) | Initial liability of Rs 10,000 & in case of continuing failure with a further penalty of Rs 100 for each day after the first during which such failure continues, subject to a maximum of Rs 50,000. |

Due Date for Filing MGT 14 Form

A copy of every resolution or any agreement, in respect of matters specified in Section 117 (3), shall be filed with the registrar within 30 days of passing such resolution or entering in an agreement.

Result of Failure to File MGT 14 in 300 Days From the notice of Resolution

Inside the case, the company shall be unable to furnish e-form MGT 14. Since MGT 14 needs the information of SRN of INC-28 and INC-28 could be furnished only post to obtain the order of condonation. The condonation power is in the hands of the MCA. For condonation of delay, below are the mentioned steps:

- The company needs to file form CG 1 with MCA for condonation in the late furnishing of e-form MGT 14.

- MCA imposes the penalty in the condonation order and the company is subjected to the payment of the same penalty.

- Post to obtaining the order and the payment of the penalty, the company will furnish a copy of the order and the penalty receipt in form INC-28 along with ROC software.

- The company after that furnishes e-form MGT 14 by stating SRN of INC-28.

MGT 14 Filing Fee in Case of the Company Share Capital

| Nominal Share Capital | Fee Applicable |

|---|---|

| Less than 1,00,000 | Rupees 200 |

| 1,00,000 to 4,99,999 | Rupees 300 |

| 5,00,000 to 24,99,999 | Rupees 400 |

| 25,00,000 to 99,99,999 | Rupees 500 |

| 1,00,00,000 or more | Rupees 200 |

Additional Fees in Case of Delay in Filing of Webform

| Period of Delay | Additional Fees Applicable |

|---|---|

| Up to 30 days | 2 Times of normal fees filing |

| More than 30 days and up to 60 days | 4 Times of normal fees filing |

| More than 60 days and up to 90 days | 6 Times of normal fees filing |

| More than 90 days and up to 180 days | 10 Times of normal fees filing |

| More than 180 days | 12 Times of normal fees filing |

Is mgt -14mandatory for pvt co in respect of adoption of financial statements at agm