This post will examine the major issues and their solution faced by salaried persons while job changing. Switching jobs at a time of a rapidly changing world is a common career decision in distinct industries and at distinct phases towards the professional journey, be it entry-level, mid-phase, or retirement. Behind such transitions are goals to rectify the work-life balance, financial prospects, and others.

A salaried one in India secures distinct basic income tax compliances to attain, some of them are furnishing the PAN information, filing ITR (Income Tax Returns), paying Advance Tax (if applicable), and so on. A person is required to take care of certain compliances at the time of altering an employer, the loss of which shall be directed to draw interest and penalties.

Important Things to Remember

- By the 31st a salaried person is to fill out the ITR form but in case one changes employer in the middle of the year, ensure that too has consolidated the income from both employers.

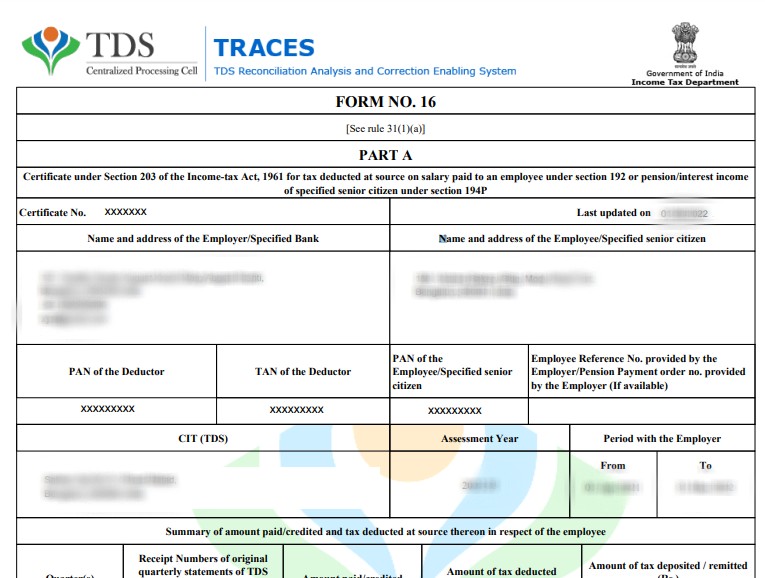

- Form 16 is a certificate that comprises information about the salary income made via the employee at the time of the fiscal year and the Taxes Deducted at Source (TDS) through the employer. 15th June of the assessment year is the last date for the employers to issue Form 16. In the case of the individual leaving a company in the middle, the employer is needed to furnish Form 16 for the interim duration. Ensure to collect Form 16 from both employers.

- When one joins a new company, he/she needs to fill out Form 12B. It is an income tax statement that includes information related to the salary received by an employee from his previous employer at the time of the financial year.

- A person who joins a company is needed to fill out Form 12BB. It is the statement of claims via an employee for the deduction of tax. For claiming tax advantages or rebates, the same form is required to be provided at the finish of the fiscal year. On the foundation of this form, the new employer shall be deducting TDS.

- Form 16 carries two parts, namely Part A and Part B. Part B comprises details of salary paid, other incomes, deductions allowed, tax payable, etc. Ensure to reveal all other incomes made in your Form 16.

Issues and Their Solutions for Salaried Persons

As mentioned below, we have discussed the issues and their solutions for salaried people when they switch jobs:

Double Claim of Basic Tax Exemption Limit

When your employer does not consider that the basic exemption limit is claimed through your previous employer, the same could directed to the penalties and the legal consequences. As availing the basic exemption limit twice leads to that you are underreporting your total income.

Facilitating it more, take for instance a person who switched jobs and his salary information is as follows-

| Details | Income from XYZ Ltd | Income from PQR Ltd | Actual income tax obligation |

|---|---|---|---|

| Salary income | INR 500000 (From Apr-Sept) | INR 700000 (From Oct-Mar) | INR 1200000 |

| Basic tax exemption limit | INR 250000 | INR 250000 | INR 250000 |

| Taxable income | INR 250000 | INR 450000 | INR 650000 |

| Income tax obligation | INR 0 | INR 10400 | INR 44200 |

Closure: In aforesaid when regarded individually then the income of the Rahul comes beneath the tax bracket of 5%. But the actual tax bracket where the income is counted is 20%. Then the same might draw interest.

Solution- To prevent such an issue Form 12BB is to be submitted so that you can obtain the data for the previously made salary along with the basic exemption limit availed.

Availing Standard Deduction Twice in a Year

The taxable income shall be diminished through the standard deduction that is the fixed amount, furnishing an easier method for the people to decrease their whole tax obligation. It is the most useful advantage for the salaried ones since it permits them to deduct a particular amount via their income before computing the taxes. However, availing of the standard deduction twice a year could lead to issues with the tax council.

Solution: To prevent the issue, submit Form 12BB to obtain the data for the previously made salary along with the basic exemption limit availed.

Claiming Twice Tax Deductions Under CHP VI A

You might end up owing tax even post availing the deductions, when the new employer has not considered that the old employer has already claimed deductions.

For example, let’s say you contributed Rs 1,50,000 to your EPF (Employee Provident Fund) at the time of the financial year. If both employers have deemed your contribution in EPF during filing the income tax return and claimed deduction under Sec 80C, it results in a double deduction and will be disallowed.

Solution: To prevent the issue submit Form 12BB so that you can obtain the data for the previously made salary and the basic exemption limit availed.

Difference B/W the Form 16 & 26AS

Here we have mentioned the two cases related to the major difference between form 16 and 26AS:

Case 1- Mismatch in TDS Components

Form 26AS is a statement that furnishes the information of any amount deducted as TDS or TCS from distinct income sources of the taxpayer. TDS must be similar to Form 16 and Form 26AS. But it might be effective that because of the mistake of the employer, there may be certain errors directing to the mismatch.

TDS is the process in which the employer deducts a specific amount via the employees’ salary to attain their tax obligation. The same ensures a steady inflow of taxes to the government as well as prevents tax evasion. Learning the TDS is important for completing the information in Form 16 and Form 26AS.

Solution: Inform the respective employer to file an amended TDS return and obtain the influential actions opted quickly.

Case 2- TDS not deducted by both employers

If the TDS is not deducted through both employers in any case then the same shall directed to non-compliance with the tax rules. The same could be directed to a more tax load when filing your ITR.

Solution: To prevent the circumstances, file the advance tax in four instalments in the fiscal year.

Closure: By complying with the aforesaid components, a salaried individual can make a smooth transition to a new employer at the time of preventing legal problems and issues related to finance.

Keep the Records of Financial Data

Maintaining track of your financial paperwork is similar to the roadmap for a smooth job change and remaining on the proper side of tax laws. It helps you report your income accurately for taxes, confirming you don’t miss out on any advantages. Take it as your financial history book; it comes in handy when the tax authorities ever want to review things.

Read Also: Don’t Misuse These 8 Income Tax Rules! Warning to Salaried

While, having organized records helps you plan your money better, comprehend your spending, and make smart financial decisions. If you switch jobs, keeping such records makes settling into the new job easier, it’s similar to a cheat sheet for your financial past.

Sample Format of TDS Form 16 Certificate