The Madras High Court in the matter of Tvl. Norton Granites & Properties Private Ltd. v. Assistant Commissioner (ST), dismissed the petitioner’s claim for a GST refund. The petitioner, Tvl. Norton Granites is involved in the KG Foundation for construction services and levied a GST of 18%.

The applicant assuming the applicable GST rate was 5% asked for a refund application mentioning that the mere KG foundation as the enrolled service provider was qualified to file for the refund. A writ petition has been filed via the applicant which the court has dismissed.

It was clarified by the court that as per the GST framework the service provider, not the recipient is obligated to collect and file the tax on a forward charge basis, which makes the KG Foundation the proper claimant. The decision of the court supported that the recipient of services does not own the legal standing to apply for a refund on the taxes filed via the service provider. Hence the writ petition was dismissed.

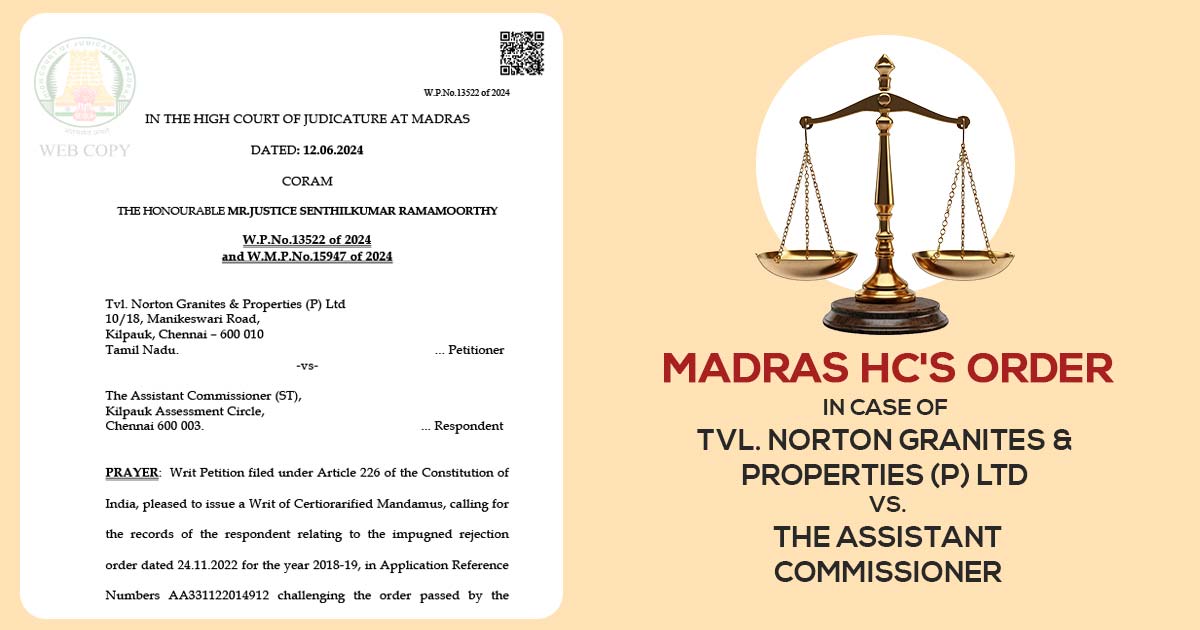

Introduction: The Hon’ble Madras High Court in the case of Tvl. Norton Granites & Properties Private Ltd. v. Assistant Commissioner (ST) [Writ Petition No. 13522 of 2024 dated June 12, 2024], ruled that the refund application for excess tax filed should be furnished via the registered service provider, not through the recipient of services. Since M/s KG Foundation was the registered entity, the direct refund claim of the taxpayer was considered invalid. Therefore, the writ petition was dismissed.

Key Facts

M/s. Tvl. Norton Granites & Properties Private Ltd. (“the Petitioner”), had entered into an agreement for development/sale with KG Foundation Private Limited. As per the agreement, KG Foundation furnished construction services and collected GST at 18% from the Petitioner. The GST rate for the services should have been 5%, the Petitioner contended and thus, filed an application of refund for the surplus GST paid.

The refund application was rejected by the assistant commissioner (ST) (“the Respondent”) via an order on November 24, 2022 (“the Impugned Order”) for the assessment period 2018-19, mentioning that merely KG Foundation was enrolled service provider has the power to furnish the refund claim.

The applicant dissatisfied with the impugned order furnishes the present writ petition to the Hon’ble Madras High Court.

Core Issue

Is it feasible for a recipient of a service to file a GST refund application?

Held:

The Hon’ble Madras High Court in Writ Petition No. 13522 of 2024 held as under:

It said that the GST on construction services was imposed on a forward charge basis, which means the service provider is obligated for tax collection. Subsequently, the refund application must be furnished via KG Foundation, the registered service provider instead of the recipient of the services. The writ petition was dismissed.

Our Observations

Section 54 of the CGST Act discusses “Recovery of tax”. Section 54(1) of the CGST Act cites that any individual who claims for the refund of any tax along with interest, if any, paid on these taxes or any additional amount filed via him, may make an application before the expiry of 2 years from the pertinent date in these form and way as might be specified, furnished that an enrolled individual who claims for the refund of any balance in the electronic credit ledger as per the provisions of section 49(6) of the CGST Act, may claim these refund in a way as might be specified.

Also, Section 77 of the CGST Act cited “Tax wrongfully collected and paid to Central Government or State Government”. It mentions that a registered individual who has filed the Central tax and State tax or, according to the case, the central tax and the Union territory tax on a transaction deemed by him to be an intra-state supply, which is next held to be an inter-state supply would get refunded the tax amount so filed in a way within the mentioned conditions.

Also, a registered individual who filed the integrated tax on a transaction regarded via him to be an inter-state supply, which is ruled to be an intra-state supply would not be needed to file any interest on the amount of the central tax and state tax or, as per the case, the central tax and union territory tax subjected to get paid.

| Case Title | Tvl. Norton Granites & Properties (P) Ltd vs. the Assistant Commissioner (ST) |

| Citation | W. P.N o.13522 of 2024 and W.M.P.No.15947 of 2024 |

| Date | 12.06.2024 |

| For Petitioner | Mr.R.Sivakumar |

| For Respondents | Mr.T.N.C.Kaushik |

| Madras High Court | Read Order |