The Madras High Court in a ruling established a 150% penalty levied u/s 16(2)(d) of the Tamil Nadu General Sales Tax Act, 1959 (TNGST Act) for sales/purchases suppression despite removing speculative additions.

The petitioner, Ruckmani Electricals, is a registered dealer under the Tamil Nadu General Sales Tax Act, 1959 (TNGST Act). On 13.12.2000, an inspection was performed on the applicant’s premises, and distinct discrepancies were discovered.

An assessment order was passed on 30.09.2002, after hearing from the taxpayer for the duration of 2000-2001. The assessing authority added Rs 41,356 for the purchase suppression of aluminium winding wires, including a 15% freight and Gross Profit.

The additions for the probable omissions for the earlier durations were incurred, parallel to the suppression in sales and second sales of electrical goods. U/s 16(2)(d) of the TNGST Act a penalty rate of 150% was levied for the purchase/sales suppression.

On appeal, the first appellate authority (FAA) on 14.11.2002 permitted the plea. Revenue appealed the order of FAA to the Tamil Nadu Sales Tax Appellate Tribunal (STAT) reversed the first appellate authority order permitting the State appeal.

Dissatisfied with the decision of the tribunal, the taxpayer contested the STAT order to the Madras High Court claiming that the additions incurred for the suppression of sales and purchases were unwarranted since the amounts had been accounted before in the closing balance of the former AY (1999-2000). The applicant’s counsel shows a single-page trading account as proof to assist the same claim.

The revenue counsel opposite to that claimed that additional proof (trading account) furnished via the applicant was not being produced in the inspection or the assessment proceedings and must not be accepted at the same phase.

It was noted by the bench Justice Anita Sumanth and Justice G. Arul Murugan that the trading account was produced merely in the appellate proceedings and was not specified in the inspection or assessment. Therefore the court carried the decision of the tribunal to deny the additional proof as no reasonable justification was there for its late submission.

Also Read: Madras HC Quashes 300% GST Penalty for Belated Tax Returns, Instructs to Place a New Order

The court while affirming the additions incurred for the suppression of purchase/sales discovered that the two equal-time additions incurred via the assessing authority were based on speculation and were not supported by any tangible proof. The court in the lack of fresh proof removed the additional estimates.

U/s 16(2)(d) of the TNGST Act the penalty levied for the suppression was carried since no fault has been discovered by the court in the original penalty decision.

Subsequently, it was carried by the court that the additions made for the purchase and sales suppression and penalty however removed the speculative double additions incurred via the assessing authority. The writ petition was disposed of and the related miscellaneous plea was shut.

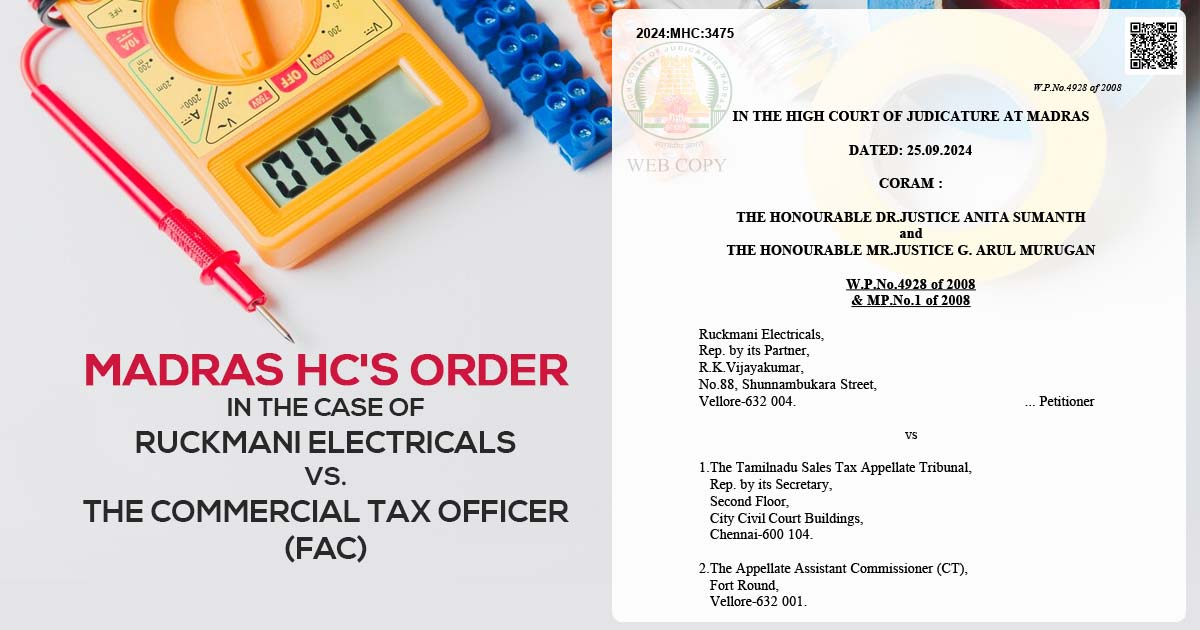

| Case Title | Ruckmani Electricals vs. The Commercial Tax Officer (FAC) |

| Citation | W.P.No.4928 of 2008 & MP.No.1 of 2008 |

| Date | 25.09.2024 |

| For Petitioner | Mr.S.Kaarthick, and Mr.K.Soundararajan |

| For Respondents | Mr.G.Nanmaran |

| Madras High Court | Read Order |